Educational Resources and Tutorial Programs for Aspiring Beginner Traders

This collection consolidates all necessary training modules that one must grasp prior to engaging in market trading: they are structured starting with fundamental concepts, advancing to analysis, and concluding with crucial principles. Commencing without mastering all of these means you risk overlooking the single concept impactful enough to boost your gains.

Beginner trading courses are categorized into three core guides: FX Basics – Introduction to Forex Trading, Analysis – Forex Trading Techniques for New Traders, and Key Concepts – Foundational Forex Knowledge for Starters.

1. Learn Basics - Learn Trading Online Basics

- How to Start Forex

- Instructions for Opening a Demo Trading Account

- How to Sign Up Real Account

- Regulated FX Trading Broker

- Introduction Topics

- Market

- Market Participants

- What to Know

- Major FX Pairs

- FX Pair Names

- Forex Market vs Stocks

- Reading Currency Quotes

- Lots, Contracts, Spread

- Buy Long & Sell Short

- Types of Trade Accounts

- Practice Sessions for Currency Trading on a Demo Account

- Islamic Trading Accounts

- How to Trade Currencies

- News Trading Strategy

- News Strategy Summary

- Fundamental Analysis

- Fundamental News Reports

- Fundamental Reports

- Currency Softwares

- Phone Softwares

- Best Platform

- Currency Softwares

- Save Platform Workspace

2. Analysis - Learn Analysis

- Analysis Training

- Analysis Basics

- Price Action 1 2 3 Strategy

- Pin Bar Price Action

- Elliott Wave Principle/Theory

- Types of Charts

- Types of Orders

- Setting and Placing a Limit Order

- Setting and Placing a Stop Order

- Pivot Point Indicator

- Intraday Trading Pivot Point

- Japanese Candles

- Marubozu & Doji

- Spinning Tops

- Reversal Candlesticks

- Understanding the Inverted Hammer Candle Pattern Alongside the Shooting Star Candle Formation

- Piercing Line Candle Pattern & Dark Cloud Candle Setup

- Morning Star Candlesticks and Evening Star Candlestick

- Support Resistance Levels

- Drawing Support & Resistance

- What is Trend-line

- Upwards TrendLine

- Downwards Trend-line

- FX Trendline Break

- Momentum Trends

- Setups

- Continuation Chart Pattern Configurations

- Consolidation Chart Setup Patterns

- Double Tops and Double Bottom Setups

- Head and Shoulders Patterns

- Forex Trading Fib Retracement Levels

- Drawing Fibonacci Retracement

- Forex Trading: Fibonacci Extension Levels

- Drawing Fibonacci Expansion

- Expansion & Retracement Exercises

- Divergence Trading Setups

- Classic Divergence

- Hidden Divergence Trade Setup

- Divergence Summary

3. Key Concepts - Learn Online Topics

- What's Leverage

- Leverage and Margin Example

- Leverage Margin Explain

- Stop Loss Orders

- Methods of Setting StopLoss

- Indicators for Setting Stops Loss

- StopLoss Summary

- Capital Management Principles

- Money Management Methods

- Multiple Timeframes Analysis

- Market Hours

- Best Market Trading Hours

- When Not to Trade

- Types of Traders

- Setting a Schedule

- 3 Market Trade Sessions

- What is System

- Making a Strategy Template

- Writing System Rules

- Generating Signals

- Making System Tips

- Writing a Trade Journal

- Market Psychology

- Emotions in Market

- Market Psychology Principles & Guidelines

- Market Psychology

- Carry Example

- Aspects and Factors of Carry Strategy

- US Dollar Index - USDX

- Currency Market Tips

- Writing a Plan Template

- Account Equity Management

- Capital Management Tips

Learn Free Guides - Learn To Trade Free Training Lessons

This part of the website for learning goes over each part of the lessons that are explained in the Learn section of this website for new traders. These lessons have been put in order from the simple beginning lessons to the more complex lessons. Also, each topic has a number, so you can see which lessons you have finished, giving you the simplest way to learn about Forex trading. The lessons give a full explanation of how to learn online trading, where all the needed courses have been gathered in a single place.

These trading lessons give you the skills to trade currencies. Check the strategies wiki and indicators wiki too. After these tutorials, you can move to:

Technical indicators are the maximum oftenly used equipment in terms of forex evaluation & no lesson may be healthy and entire with out discussing signs, The evaluation segment will provide an explanation for to newbie buyers a way to generate purchase & promote signals the usage of those tools. you could learn how to change the market with those trading indicators and additionally how to integrate the indicators to create a FX gadget which you as a FX trader can transact with.

Ensure you complete every learning module: do not skip any. Furthermore, establish and sign up for a complimentary practice demo trading account and utilize it for practice while you are acquiring Forex trading knowledge and throughout the duration required to read and finish the preceding instructional materials. A practice account offers a valuable means to rehearse trading within the live market using simulated funds, thereby aiding your Forex learning process.

It might take you a while to understand certain trading concepts, and the entire training course on this website will take you about one to two months to finish. During this period, you, as a trader, should be studying and simultaneously putting your trading skills to use in a practice. A practice trading account is comparable to the real account you will be using to trade with your currency broker when you deposit and invest actual money.

What should you expect from an online training lesson as a new trader?

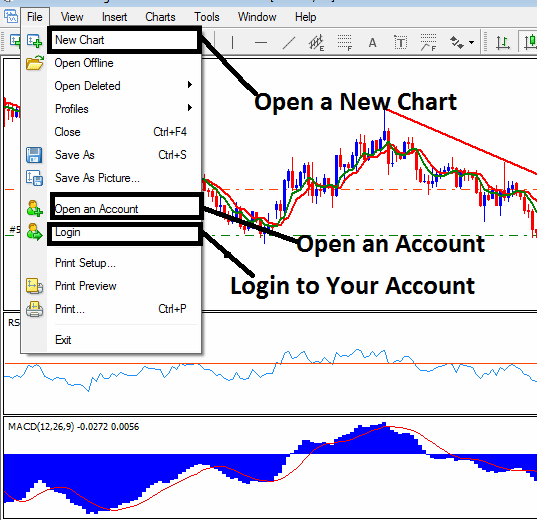

- Learn How to Trade for Beginner Traders Guide - MetaTrader 4 Platform Software Intro

Each tutorial comes packed with real examples, so you can actually see how these concepts work in action.

If you are looking and searching for a free trading training course, the above tutorials & articles provide all the information needed to begin trading, you as a forex trader can also visit the other sections of this web site to learn the strategies used by experts and trading analysis of all indicators and how to use them to generate buy and sell signals.

Check indicator guides and trade plans on this site. Find them in data spots at the top menu or side menu.

Obtain Further Programs & Instructional Material:

- Best Top 10 XAU USD Platforms for Beginner Traders in XAU USD

- What is USDPLN Spread?

- MetaTrader 4 Charts Options Settings on Tools Menu in MetaTrader 4 Software Platform

- Reasons Why Traders Opt for and Select STP Brokers.

- Bollinger Percent B or Bollinger %b MetaTrader 4 Indicator

- Steps Required to Add the AUDCAD Chart to the MT4 Platform

- Stochastic MACD RSI Index Trade Strategy

- MACD Technical Analysis Buy and Sell FX Trade Signals Generation

- How Do I Draw Trend lines and Channels in Forex Charts?

- List of FTSE Strategy