Techniques of Setting Stop Loss In Forex

Traders in a system need math formulas to set stop loss spots.

Traders can also set a stop loss based on the indicators that traders use to set their stop loss orders. Some indicators use math to figure out where to set the stop loss order in order to have the best exit point for open trades. These forex indicators can serve as the foundation for setting these stop loss orders.

Other traders also set these stop loss orders based on a set risk to reward ratio. This way of setting orders uses certain math formulas. For instance, a trader might use a stoploss order of 50 pips if the trade could earn 100 pips in profit, making it a 2:1 risk reward ratio.

Alternatively, some individuals simply utilize a fixed percentage of their total account funds to determine the placement of these stop loss orders.

To effectively set a stop-loss order, it is advisable to employ one of the following established strategies:

1. Percent of equity balance

This metric is determined by the percentage of the trading account's balance that the individual trader is prepared to risk on a single trade.

If a trader risks 2% of their account, they set the stop loss based on position size. This applies to both buy and sell trades in forex.

Example:

If a trader has got a $100,000 account and is willing to risk 2 %

- If the trader buys 1 lot

1 pip = $10 dollars

Then setting stop loss order at 2%

2 % is $2,000

2000 /10 = 200 pips

Stop Loss = 200 pips

- If the trader buys 2 contracts

1 pip = $20

Then setting stop loss order at 2 %

2 % is $2,000 dollars

2000 /20 = 100 pips

Stop loss = 100 pips

- If the trader buys 4 contracts

1 pip = $40

Then setting stop loss at 2 %

2 % is $2,000 dollars

2000 /40 = 50 pips

Stop loss = 50 pips

2. Setting Stop Loss using Support & Resistance Areas

An alternative method to set stop-loss orders involves using support and resistance levels identified on forex charts.

Given that stoploss orders tend to congregate at these support & resistance levels key points, when one of these levels is touched by the forex price, many other stop losses are set off, like dominos. Stop loss orders tend to crowd just above/below the resistance/support levels, respectively.

A support or resistance zone is intended to act as a ceiling or floor to price movement, preventing forex prices from moving past these levels: this is precisely why these support and resistance markers are utilized for setting stop losses. Should this barrier be overcome, the forex price movement may advance in the opposite direction of the original trade trend: however, if these barriers (support and resistance areas) remain unbroken, the price is expected to persist in its intended market trajectory.

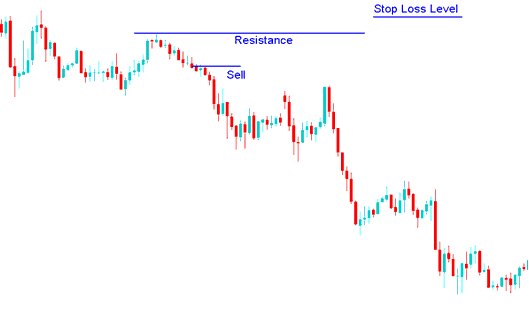

Set Stop Loss at Resistance Levels for Your Trades

Set Forex Stop Loss Above Resistance to Guard Your Position

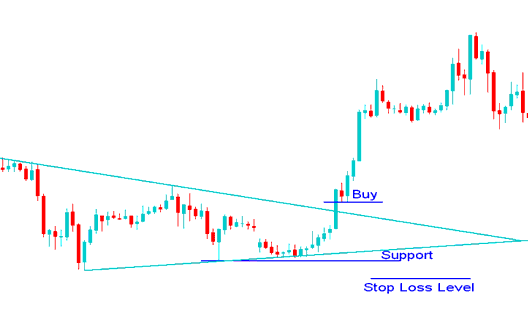

Set Stop Loss at Support Level - Place Stop Loss Orders Using Support Zones

Set Forex Stop Loss Below Support Line

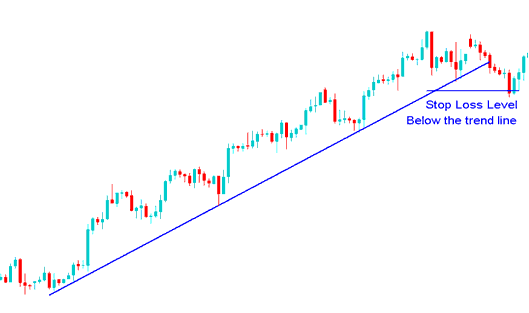

3. Forex Trend-Lines

A trendline can be used to set stop losses, where the stop loss order is placed just below the trendline. As long as the trend line holds, the trader can keep making profits while also setting this stop loss order, which will protect their profit if the trendline is broken.

Place Stop Loss Below the Trendline for Forex Trades.

Examples of where to set this stop loss order using forex trend lines.

Explore Extra Lessons, Tutorials, and Topics