The Elliott Wave Forex Trading Theory

Elliott Wave Theory/Principle represents a type of technical chart analysis utilized by traders and other investors to anticipate future trends in financial and currency markets. This is achieved by identifying peaks and troughs in investor sentiment and price action, along with other collective behaviors. This theoretical model suggests that the collective psychology of humans develops and forms natural patterns over time, manifested through buying and selling decisions reflected in market prices.

This form of technical evaluation originated with Ralph Nelson Elliott, predicated on the observation that many natural occurrences manifest in recurring five-wave sequences. These observable patterns are also applied in market analysis to interpret and anticipate the movements of financial trends.

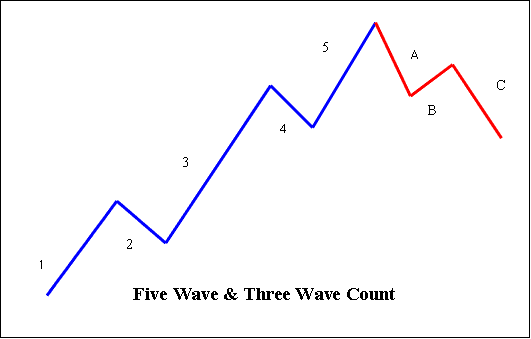

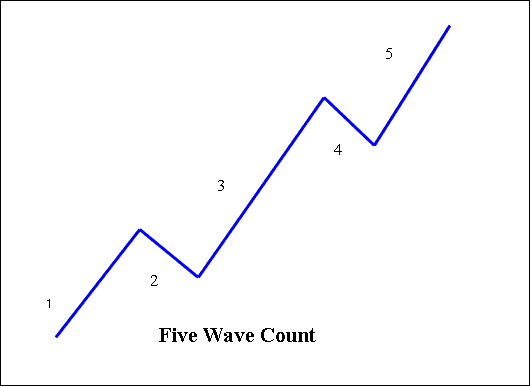

In forex, this theory sees prices form five waves. Three push up as waves 1, 3, and 5. Two pull back as 2 and 4. Together, the ups and downs build the five-wave Elliott pattern.

The trading theory posits that every upward surge composed of five waves will subsequently be succeeded by a downward correction comprising three waves. This down move, however, is designated using letters A, B, and C instead of numbering, to distinguish it clearly from the five waves constituting the preceding upward movement.

5 and 3 Wave Pattern

A primary trend is generally composed of five distinct movements, whereas market retracements typically involve three movements.

Five setup (dominant trend) - uses 1, 2, 3, 4, 5

3 setup (corrective trend) - uses A, B, and C points

This article discusses trading in online currency exchange markets guided by the Elliott Wave Theory as a fundamental element for analyzing currency pairs. This trading approach relies on scrutinizing price charts. Technical analysts leverage this theory to observe emerging trends, identify waves, and predict future price movements.

By meticulously examining these chart formations and applying the principles of Elliott Wave Theory, traders gain the ability to determine optimal entry and exit points through the identification of price inflection zones.

One of the most straightforward environments to observe this principle in action is within the financial markets, where shifts in market participant sentiment are numerically recorded through price fluctuations. If a forex trader possesses the ability to recognize recurrent price patterns and accurately position those patterns relative to Elliott wave counts, the trader can then forecast potential future price directions.

Rules for Elliott Wave Count

Market patterns from this theory set rules for valid counts. Follow these guidelines to check them.

- Wave 2 shouldn't go below the starting of Part 1.

- Wave 3 should be the biggest among Part 1, 3 & 5.

- Wave 4 shouldn't over-lap with Part 1.

Five setup (dominant trend)

Wave one in a new bull market hides at first. News stays mostly bad. The old downtrend seems firm. Analysts keep cutting their forecasts. The new upmove looks weak. Trader moods remain sour. Market fear runs high. Volume picks up a little as prices climb, but not enough to notice.

2: This second wave corrects the first but is prohibited from progressing beyond the starting point of wave one. Typically, prevailing news remains negative. As prices retest the previous low, bearish sentiment rapidly intensifies, and the pervasive "crowd" mindset reinforces the ongoing bear market. However, subtle positive indicators emerge for astute observers: the volume during wave 2 should be lower than during wave 1, and prices generally do not retrace beyond 61.80% of the gains made in wave one. The ultimate low reached will be higher than the prior low, creating a higher low formation.

3: Typically, this represents the most significant and forceful upward movement, surpassing both 1 and 5. The news has turned favorable, prompting fundamental analysts to start raising their projections. Prices climb rapidly, and market corrections tend to be brief and shallow. Those hoping to enter during a pullback might find they miss the opportunity. When phase 3 begins, the reports may still hold a slightly negative tone, with many traders maintaining a pessimistic outlook: however, by the midpoint of part 3, the majority will often recognize and agree that the prevailing market sentiment has shifted to a positive one. Wave three will surpass the peak established by wave 1.

4: This is often and clearly a correction. Prices might stay sideways for a long time, and 4 often retraces less than 38.20% of 3. The volume is much lower than it was in wave three. This is a good time to buy on a pullback if you know what is coming for a Part 5. Still, this 4 is often annoying because it does not make much progress in the bigger upward trend.

5: This is the last part of the main trend. Almost all news is good, and everyone thinks prices will go up. Sadly, a lot of regular traders buy in at this time, right before the price hits the highest point. Often, the amount of trading is less in 5 than in wave three, and a lot of momentum indicators start to look different (prices reach a new high, but the indicators don't). At the end of a big market increase, people who bet against it might get made fun of for trying to guess when the market will peak.

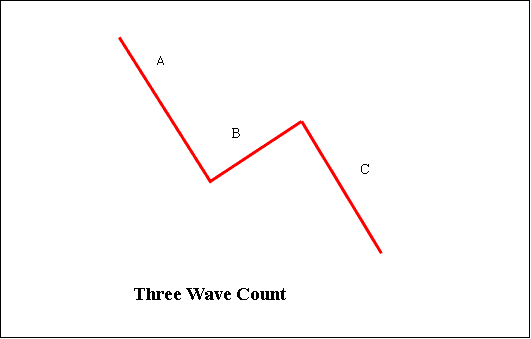

3 Pattern (Corrective Trend)

Corrections prove tougher to spot than main impulse waves. In wave A of a falling market, economic data stays mostly upbeat. Analysts often view the decline as a pullback in an ongoing bull run. Signs of wave A include higher volume, growing actual and expected volatility, and likely more open interest in short sales.

B: Prices reverse & move slightly/a little higher, which many interpret as a resumption of the now long gone bullish market trend. Those familiar with classical analysis might see the peak as a right shoulder of head and shoulders reversal trading pattern. The volume during B should be lower and lesser than in A. By this point, fundamentals are probably no longer improving, but they most probably haven't yet turned negative.

C: Prices quickly go lower. Volume increases, and by the third part of C, almost everyone knows there is a strong bearish trend. C is usually as big as A and often goes to 1.618 Fibonacci expansion level beyond A lowest point.

Explore More Classes and Lessons:

- Gold Maximum XAUUSD Leverage & Used XAU/USD Leverage

- What is Margin Requirement per 1 Lot/Contract of SWI 20 Index?

- Putting Arrows in XAU USD Charts on MetaTrader 4 Platform

- What are Linear Regression Slope Buy and Sell FX Trade Signals?

- How to Create a Trading System?

- What is DowJones30 Index Trade Chart?

- Best Combination of Trading Indicators Course Trade Forex

- How to Open Terminal Window MT4 Software

- How to Add Hang Seng 50 in MT5 PC