Draw Down & Maximum Draw Down in FX Trading

In business and trading, you must learn to manage risks to earn a profit. Online, a trader needs to understand how to manage those risks. A trader should know what the trading risks are. Once they understand the risks involved, they can develop tools to mitigate them. To profit from trading, you need to learn about money management strategies discussed on educational websites.

In trading, the risks that must be managed include potential trading losses. Adhering to money management rules will not only safeguard your trading account but also contribute to long-term profitability.

Draw Down

As traders, the biggest risk is drawdown - that's the total amount you lose on a single currency trade.

If you start with $10,000 and lose $500 on a trade, your drawdown is $500 divided by $10,000, which equals a 5% drawdown.

Maximum Draw Down

Drawdown is the total loss on your account before profits start. Say you have $10,000. You lose $1,500 on five bad trades. Then you gain $4,000 on ten good ones. Drawdown is $1,500 out of $10,000, or 15 percent max.

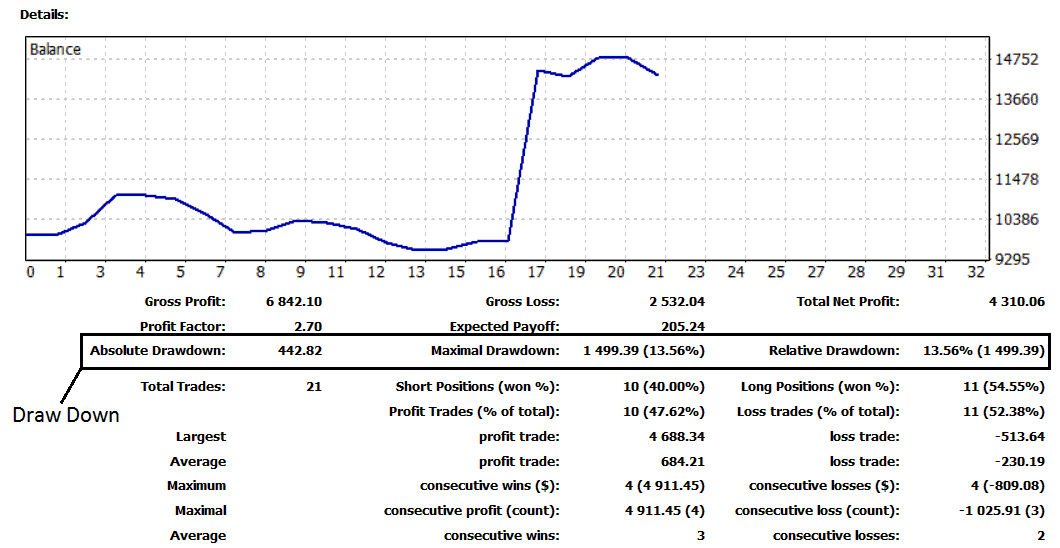

Draw Down is $442.82 (4.4%)

Maximum Draw Down is $1,499.39 dollars (13.56 percent)

To know how to generate the above reports using MT4 platform: Generate Reports on MT4 Guide Lesson

Money Management in FX Trading

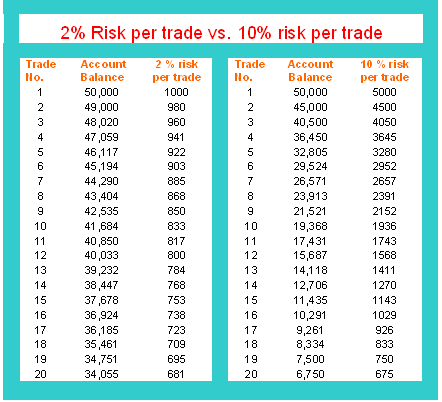

The subsequent demonstration illustrates the difference between committing a minor percentage of your capital versus risking a much larger percentage. Sound investment protocols dictate that you should never risk exceeding 2 percent of your total account equity on any single trade.

Percentage Risk Method

2 percent and 10 percent Risk Rule

There's a huge difference between risking just 2% of your equity and risking 10% on a single trade.

Let's say you experienced a losing streak and lost 20 trades in a row: if you risked 10% on each trade, starting with $50,000, you would end up with only $6,750. Your equity would have decreased by more than 87.50%.

If you had risked only 2%, you would still retain $34,055, which represents a 32% equity loss. This underscores the importance of following the 2% risk management method.

Risking 2% beats risking 10% because after 20 bad trades, you'd keep $34,055.

Conversely, risking 10% would leave you with only $32,805 following just 5 consecutive losing trades, a lesser amount than what would remain if you risked only 2% of your capital and experienced all 20 trade losses.

The point is that you want to setup your trading rules so that as when you do have a loss making period downtime, you will still have enough trading capital to trade next time.

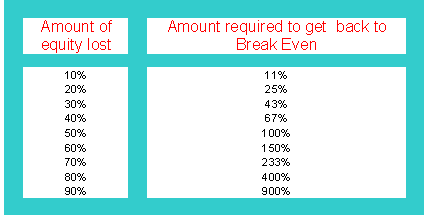

After losing 87.50% of your funds, you need 640% gains to break even again.

If you were to lose 32 percent of your trading money, you would need to gain 47% to return to where you started. As shown in the examples, reaching 47% profit is much easier than achieving a 640% gain.

The chart below displays the profit percentage needed to recover your losses if you lost a certain portion of your trading money.

Concept of Break Even

Account Equity and Break-Even

At 50% drawdown, you need 100% gains to break even. Fewer than 5% of traders worldwide pull that off.

At 80% drawdown, traders must multiply equity by four to recover the start balance. This returns to break-even, your original deposit.

The more you lose, the harder it's to make it back to your initial account size.

This is the reason/explanation why as a currency trader you should do everything you can to PROTECT your equity. Do not accept to lose more than 2 percent of your trading equity on any 1 single trade position.

Effective money management involves risking only a small percentage of your trading capital per transaction. Doing so helps endure losing streaks and minimizes significant drawdowns on your account.

Traders employ stop-loss orders in FX trading, which are placed in order and with the purpose of minimizing losses. Managing hazards necessitates setting a stop-loss order after placing an order.

Effective Money Management

Effective management of risk necessitates control over all exposures present in the trading market. A trader must establish a defined risk management framework and corresponding strategy. Engaging in Forex or any other venture invariably involves making choices that carry some degree of risk. All facets must be assessed to keep potential losses minimal, incorporating the advice provided in this guide.

Ask yourself? Some Tips

1. Are the potential hazards associated with your trading endeavors identified, what forms do these risks manifest as, and have clear understandings and plans been established to address them? All identified risks must be incorporated into your strategy plan.

2. Do you systematically evaluate the trading risks you face? - Do you maintain a formal trading plan? - Have you thoroughly reviewed the guidance material provided extensively on this Website?

3. Are you, as a trader, fully aware of the maximum possible level of risk associated with every trade transaction you initiate for each position you open?

4. Are choices made using good, up-to-date information and a plan, or not? Have you learned about systems on this website's tutorial lessons?

5. Are the risks big relative to the turnover of your invested capital and what impact could they have on your trading profit margins and your margin requirements?

6. How long do the trading dangers of your trading actions last? - Do you keep trades open for a long time or a short time? What kind of trader are you?

7. Are exposures of your market trading activities a one-off or are they recurring?

8. Do you know ways to cut risks as a trader? What happens if you skip those steps? How does it affect your gains?

Check if your trading rules cover profits well. Make sure you can hold onto gains as a trader.

Study More Topics & Guides:

- Linear Regression Acceleration Buy Sell Signal

- Here's a guide and tutorial for NETH25 trading strategies - plus how to download them.

- Open a Live Forex Account with No Deposit

- Bollinger Band Patterns: Spotting Continuation Signals in Indices

- What is Reverse/Inverse Head and Shoulders Setups in?

- Using the Alligator Indicator in MetaTrader 4

- Explaining the Various Types and Categories of Forex Accounts Available

- EURHKD Trading Hours from Open to Close

- Comprehensive Guide to FX Lessons

- Listing Online MT4 Brokers that Support XAU/USD Trading