What's Inverse Head and Shoulders Chart Setups in Forex?

How Do You Identify a Reverse/Inverse Head and Shoulders Trading Pattern in Forex?

The Premier Lesson on Chart Patterns for Novices - Identifying and Trading the Inverse Head and Shoulders Chart Setup

Patterns for Intraday Trading - Trade Patterns Cheat Sheet

This tutorial on inverse head and shoulders patterns offers insights into identifying chart patterns necessary for successful trading strategies. Recognizing these patterns is crucial for navigating forex markets effectively.

Reverse Head and Shoulders price patterns frequently appear on charts. This chart pattern analysis guide outlines how to effectively trade and analyze these patterns.

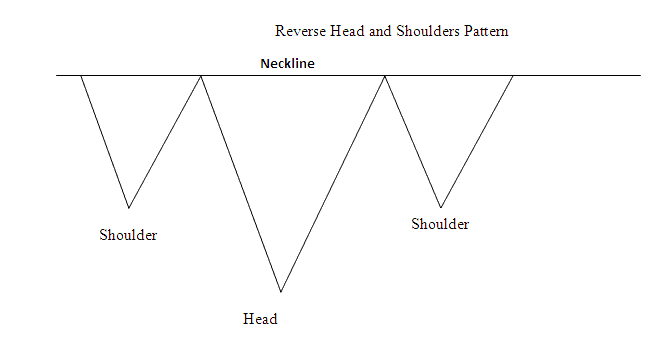

Reverse Head and Shoulders Chart Setup

The Reverse Head and Shoulders Chart setup is a reversal pattern that emerges after a prolonged downtrend. This pattern resembles an inverted head-and-shoulders formation, indicating potential trend reversal.

The Reverse Head and Shoulders chart pattern becomes complete when the price breaks above the neckline, which is determined by joining the two peaks between the reverse shoulders.

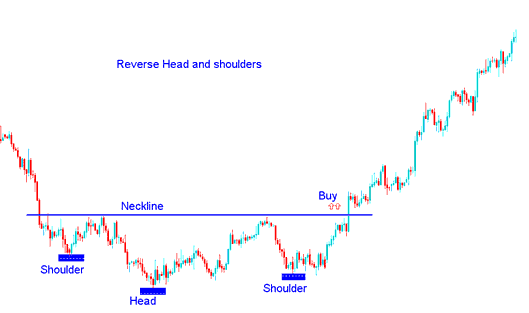

To go long buyers set their buy stop orders just above neckline.

Summary:

- This Inverse Head and Shoulders Chart Pattern forms after an extended move downwards

- This Inverse Head and Shoulders Chart Pattern formation indicates that there'll be a reversal in market

- This Inverse Head and Shoulders Chart Setup formation resembles up-side-down, thus the title Reverse.

- We buy when the price breaks above the neck-line: see the trading chart below for an explanation.

Reverse Head and Shoulders Setup - What is Reverse Head and Shoulders Setups in Forex?

Example of Reverse Head and Shoulder Chart Setup on a Trading Chart

Identifying an Inverse Head and Shoulders Pattern - A Guide to Spotting This Reversal Chart Setup in Forex Trading.

Get More Lessons:

- Bollinger Percent B Forex Technical Analysis

- Index Trading Strategy Dow Jones

- Automatic Forex Trading Program Program Getting Started

- How to Find and Get SWI 20 in MT4 PC

- What Time is The Asian Session of FX?

- USD vs DKK Chart

- What's FX Technical Indicators Listing?

- How Do I Place a New Forex Order Using the MT4 iPad App?