Multiple Time-frame Analysis - Multiple Time-frame Analysis

Multiple timeframe analysis in forex means using two charts. A short one handles trades: a long one checks trend direction.

Always trade with the trend. In multi-timeframe analysis, the higher chart sets the long-term direction.

If the long term market trend direction supports the direction of smaller chart time frame then the probability of being profitable is greatly/significantly increased. This is because even if you make a mistake when opening your trade the long term trend eventually will save you. Also if you trade with direction of the price trend, then mostly likely you will be on the winning side, this is what this multiple chart time frame analysis is all about.

Remember this common saying that many investors in the Forex and stock markets say: "Go with the trend because it is helpful" - never bet against the current price direction.

There are 4 different types of traders - all these different types of traders use different charts to trade such as shown below.

Examples of how trader types use multiple time frame analysis.

Scalpers

This cohort of traders maintains their positions for only brief durations, often mere minutes. Scalpers rigorously avoid holding any FX trade beyond a ten-minute timeframe, aiming to secure small profit increments of 5 to 20 pips.

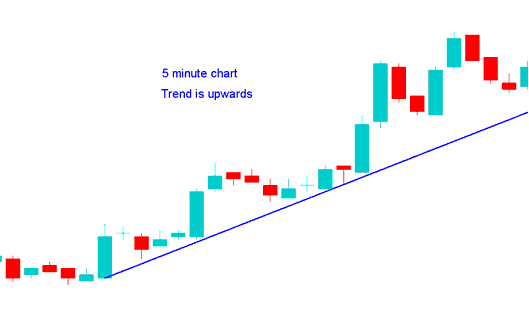

A scalper using a 1-minute chart aims to execute a long position and first checks the 5-minute chart, which resembles the one illustrated. If the 5-minute chart indicates an upward trend, the scalper may proceed with a buy decision based on this multi-timeframe analysis.

Day Traders

These traders keep positions open for just a few hours, up to a full day. Their goal is to grab 30 to 100 pips.

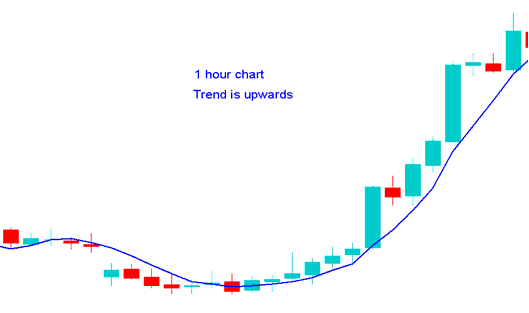

A day trader using a 15-minute chart wants to buy, so they check a 1-hour chart, which looks like the one below: because the 1-hour chart shows the price is going up, the day trader decides it's okay to buy after this analysis using different chart times.

Swing Traders

The transactions of this group of traders are held for a few days to a week. with the primary goal of gaining a significant number of pips, between 100 and 400.

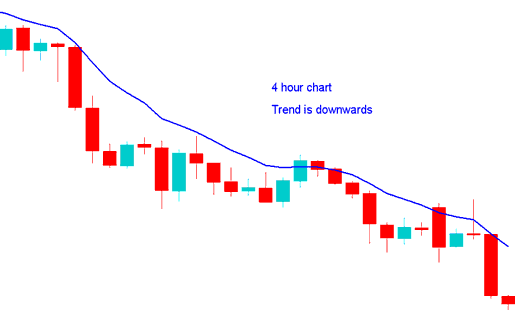

Say you're a swing trader using the H1 chart and thinking about a short trade. You check the 4-hour chart, and it looks like the trend is heading down, just like the illustration below. Based on this multiple time frame analysis, you decide it's a good time to sell.

Position traders

These traders and investors keep their trades going for weeks or months, mainly trying to get a large profit of 300 - 1000 pips.

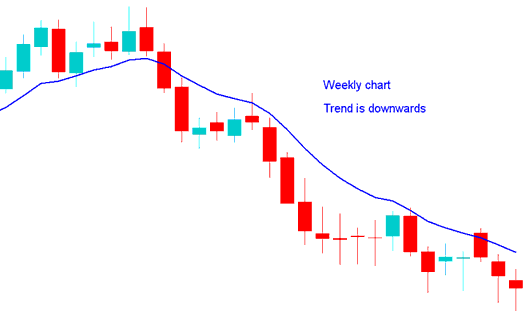

A position trader using a daily time frame intends to short and cross-references this with a weekly chart. Observing a downward trend in the weekly chart, as outlined below, confirms that selling based on this multi-timeframe analysis is an appropriate decision.

Spot a Trend: Use This Simple Method

One can use a system which has 3 indicators - Moving Average Cross-over System, RSI & MACD and use simple rules for these indicator to define the trend. The rules of the system used to define a trend are:

Upwards Trend

Both MAs Moving Averages Moving Up

RSI above 50 Mark

MACD Above Center-Line

Downwards Trend

Both MAs Moving Averages Moving Down

RSI below 50 Mark

MACD Below Center-Line

Get more on this trade system. Read the tutorial on generating signals with a method.

Learn More Tutorials & Topics:

- Where to Download the MT4 Trading Platform Specifically for Gold

- William % R Indicator in MetaTrader 5

- Overview of Stock Index Trading Systems Tailored for Beginner Traders

- No-Nonsense Guide to Bollinger Band Buy and Sell Signals

- Continuation patterns: Examples of ascending triangles and descending triangles

- How do you add the Keltner Bands indicator to a chart?