Momentum Trends - Various Types of Market Technical Analysis

What's a Momentum Trend?

A momentum trend is one which has more strength than prior one, it can be plotted using a much steeper trend line than the one that was in play before. When a new line forms that's much steeper than a earlier one we say that the trend has gained extra strength and becomes much stronger. These types of setups requires a different type of market analysis.

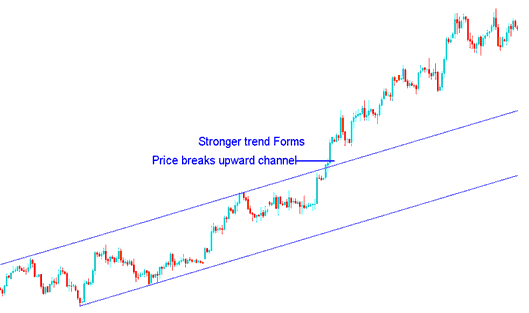

In the example illustration shown below: Also when price is moving upwards within a trading channel, if price breaks the up channel a stronger trend is initiated such as shown & illustrated in the illustration below. If as a trader your chart breaks an up trend line to the up-side in an upwards direction moving market like the one below, Don't Try to Sell, Buy More Contracts, Remember this tip it can help make you a lot of money just like the way it did in trading analysis below.

Breakout Above Channel Boundaries - Signifies Increased Buying Power in the Ascent

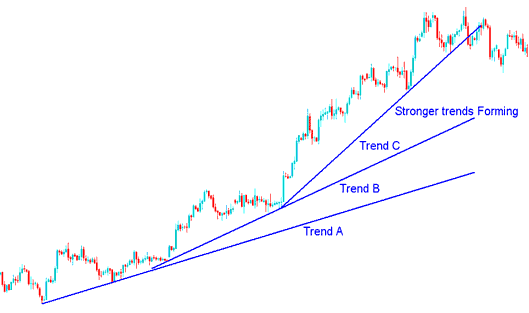

By using the same example analyses as before, we can also see how the new, steeper trend lines started, showing the currency was picking up speed.

This is represented and illustrated by the steeper trendlines that emerge as the price progresses.

A new trend usually has more momentum than the previous one, and you'll see this with the steeper setup of the trendline.

This forms trend B & C just as displayed and shown in the diagram below depicted using the MT4 analysis software, The force added a new steeper line as plotted on this chart.

This is shown in the example below by the three lines A, B and C showing formation of stronger trends as the market continues to gather strength.

Price Gaining More Strength

Conversely, should the steepest trend line be breached, it is highly probable that other established trend lines will also fail. The recommended action is to secure profits once this most aggressive trend line is broken.

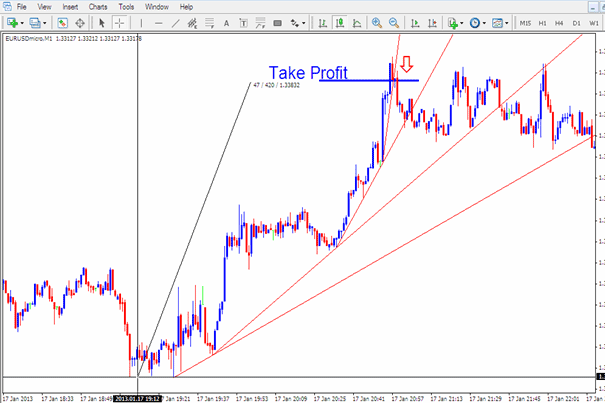

Short-term traders like day traders, intraday traders, or scalpers can use this strategy too. It often forms on 5-minute or 15-minute charts. Use parabolic trend lines to set take-profit levels. Take profit right when the steepest trend line breaks.

How Do You Trade These

Momentum trendlines serve as valuable analytical instruments for preemptively securing profits before other market participants. This momentum configuration frequently materializes on the 1-minute, 5-minute, and 15-minute charts, making it suitable for scalpers and day traders. For intraday trading, which is the more frequent activity, the 15-minute chart is generally superior, sometimes the 5-minute chart is used. For instance, after entering a short-term transaction (buy or sell) and the market moves in your favor, if you recognize this pattern, it is best to exit when the steepest trendline is breached and realize your profit at that point.

Technical Analysis Example

In this example, we will use a minutes chart to draw for a short time: when things looked like they do below, it was a good time to take a profit.

Trading the Momentum Market Moves

In the example above, a person trading to buy would have waited until the steepest trendline was broken, then closed the trade and taken the profit at that point, making a profit of 42 pips on this buy trade. A trader would have left the trade at the best time, avoiding the unstable market that followed.

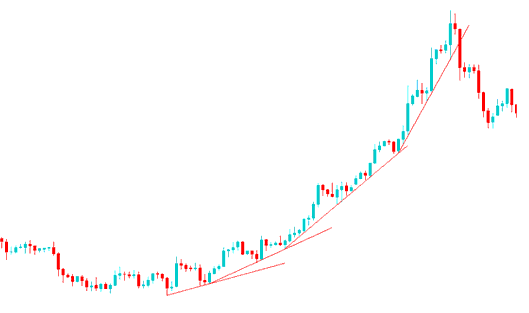

Parabolic Trends - What is it?

Occasionally, the market enters a parabolic phase, characterized by an onset of frantic purchasing that drives prices straight upward. During such a parabolic ascent, sellers are virtually nonexistent, creating a buying void. When this occurs, participants rush to enter the market irrespective of price, driven by the fear of missing out. This movement generates the most significant price shifts in the briefest timeframes, leading traders to place buy orders in this specific configuration.

For this specific movement, the optimal strategy is to maintain buying: technical analysis is unnecessary, simply continue purchasing.

This market trajectory can persist for extended durations, potentially spanning up to two years: during this window, the strategy dictates consistently taking long positions, provided the support indicated by the weekly and monthly trendlines remains intact.

When a stock or currency hits its peak, it often marks the end of the move. Prices rarely return to that high for a long time. If the steepest trendline breaks at that point, see it as a trend reversal. Step away from the market. Take your profits and plan your next step.

The same occurs in a downtrend with panic sales and a sharp price drop. This hits hard in recessions.

Greater inclination in a trend line correlates with reduced reliability. Once the steepest line within a trend is breached, exiting the trade is the advisable course of action. The illustration below depicts a parabolic formation in oil, while another instance involves XAUUSD exhibiting a similar pattern on weekly or monthly charts shortly following the breakdown of a highly aggressive trend line seen in oil charting.

As a trader encountering a sharp, parabolic upward trend, the recommendation is to continuously enter buy orders. This strategy offers a high probability of profiting from the prevailing market direction, requiring no complex analysis beyond tracking trendlines. The crucial element is to exit the trade promptly once the steepest trendline is crossed, as reversals in this setup can occur with extreme speed, demanding swift action. Ensure you exit the trade at the precise appropriate level, mirroring the illustration provided previously.

For example, the chart movement above shows crude oil: the FX traders pushed the price of oil from $70 to $150 over several months, and at the market's peak, some people who called themselves analysts were so optimistic that they predicted crude oil would reach $200. These analysts didn't understand something called Vacuum buying, in market trading analysis, as long as the trendlines held, the market price trend was upward, but even after the first steep trendline broke, the analysts kept saying the price would reach $200. After the steepest trend line broke, it took less than two weeks for the price of oil to drop back to $50: at one point, it was even $35. This is parabolic analysis: now you understand.

Good examples of this pattern on charts is the week and month price charts for Gold and Crude Oil, these trade charts can be found on MetaTrader 4 software depending on your broker.

Explore More Topics and Courses:

- EA XAU/USD Bots Free Download

- Aroon FX Trading: Buy and Sell Signals

- How Do I Draw Upward FX Channel on MT5 Platform?

- DJ30 Pips Calculation for DJ 30 Index

- What Do Chandes Trendscore FX Signals for Buying and Selling Mean?

- What's Index Forex Trading?

- What are Alligator Buy and Sell Forex Signals?

- Instructions for Loading NKY 225 on MT5 Desktop

- Gold Analysis Using Gold Analysis Indicators and Gold Strategy

- Analysis of the Gann XAU USD Trend Oscillator Gold Indicator on XAU USD Charts