Developing Indices System - Indices Strategies

When creating your own system or strategy, there are a few factors & aspects to keep in mind. Your strategy needs to be able to spot new trends, while at the same time making sure you don't to get faked out/whipsaws. The real trick is, once you have come up with a system which works for you, stick to it. Being disciplined will help you as a trader a lot in becoming successful.

Before Stock Index on a live/real account, you have to figure out what index strategy works for you. It's good to know in what time-frame you are going to be working in, & how much you are willing to risk once you begin. All these should be factored in, and should be written within your Indices plan. A good place to test this would be on a free practice trade account. This is where you test your strategies risk-free without investing/depositing money to figure out which strategy is best fitted for you.

So, now how can a trader like you develop a "good trading system" or "best trading strategy"?

To create a good currency strategy the first thing to do is to define your objective or goal:

This sample outlines a target and steps to reach it.

Goals

1. Identify a new trend

The moving average crossover strategy spots new trends often. Enter long or short trades when two averages cross each other.

2. Confirm the new trend

Relative Strength Index(RSI) & Stochastic Oscillator are the most oftenly used indicators to confirm a trend.

Indicator-based

Best type of a method/technique is one that is indicator-based. You will find it straightforward to generate the signals & thus less error-prone on your part & this will help you as a trader to avoid market whipsaw signals.

Our objectives include several key aspects when we develop a trading methodology:

- Find entry points as early as possible.

- Find exit points securing maximum gains.

- Avoid fake entry & exit trading signals.

- Proper Money Management Principles

Accomplishing these 4 goals will result in aprofitable strategy that works.

The last piece of info needed, is making a decision how aggressive you are going to be when entering and exiting and getting out of a trade. Those who more aggressive would not wait until the chart candle closes & would enter as soon as their indicators match up. But most would wait until the chart candlestick of the timeframe they're using has closed, to have more stable trading signal when entering the market.

To get profits out of the fx market you as a trader need to build your own profitable system: You need to have your own strategy that will help you as a trader achieve your goals. Sometimes the best trading systems are the ones that you create on your own. No need for you to keep searching for the best Indices systems or for strategies which work, this website provides you with all the trading tools required to help you as a trader and guide you on how to make your own trading systems.

The foreign money machine instance above is made from four indicators in total, all of those generate trade signals the use of distinct strategies, MA will generate signals the use of the crossover approach proven, RSI, Stochastic & MACD use exclusive evaluation to generate the lengthy and quick alerts just as is displayed and illustrated within the above instance. a way to generate those indicators is defined within the subsequent topic (on the sidebar navigation research lessons menu beneath key concepts).

Developing proprietary Indices trading systems presents a challenge for novices due to their limited comprehension of the foreign exchange landscape. Nevertheless, this platform will outline a simple, seven-step process for crafting your own free analytical system. Ultimately, the most effective approach is the one you devise independently and master through application in the forex market.

Main advantage of making your own free trading systems is that you'll know how to earn profits by yourself and not rely on other peoples efforts.

In the next tutorial located on the side-bar navigation learn lessons menu below the key concepts will show and describe to you how to create a system like that one above, write it's rules & how to back test it on a practice trade account before using it on a live/real account.

4 Examples of Free Systems

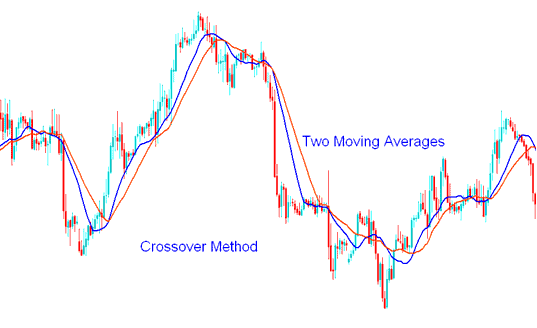

Example 1: The Moving Average Cross-over Method

The cross over method uses 2 moving averages to generate signals. The first Moving Average MA uses a shorter period and the second is a longer period.

Crossover Method- Indices System

This above method/technique is referred to as the MA crossover trading strategy method/technique because signals are derived and generated when 2 averages cross above or below each other.

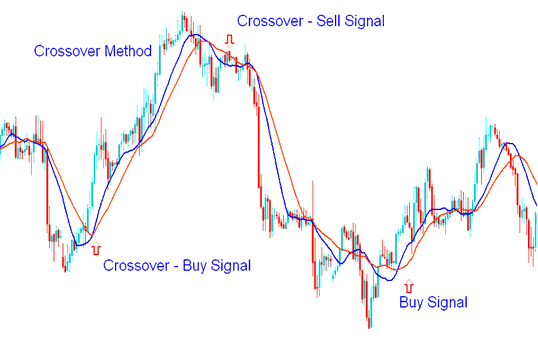

Indices System Example - Short & Long signal Generated

A buy signal - or a long trade - pops up when the shorter moving average crosses above the longer one (both moving averages trending up).

A short sell signal appears when the short moving average dips below the long one. Both averages move down.

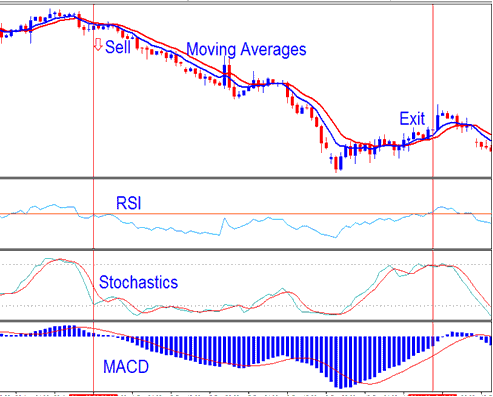

Example 2: Stochastics System

Stochastics can be combined together with other indicators to form a trade system.

- RSI

- MACD

- Moving Averages

Trading Systems Example

Short Signal or Sell Signal - Index Trading System

How the short signal was generated

From our rules the short signal is derived & generated when:

- Both MAs MAs are heading down

- RSI is below 50

- Stochastic moving downwards

- MACD moving downwards below centerline

The short signal came when all index rules matched. Exit when an opposite signal appears.

A key benefit of combining various technical indicators is minimizing false signals and improving accuracy by cross-verifying trading setups for more reliable entries.

- Stochastic - momentum oscillator

- RSI - momentum oscillator

- Moving Averages - trend following indicator

- MACD - trend following indicator

This strategy can be employed as a scalping trading system when utilizing minute trading charts, or as a day trading system when hourly trading charts are applied.

Example 3: Trade System Stock Index Example

This trade system is fully illustrated within the Index plan on the Index plan tutorial on this website under the Indices key concepts tutorials located on the right navigation menu.

Chart Time-frame

H1 chart

Indicators that identify a new trend

Moving Average MA Crossover

Indicators that validate the trend

RSI

STOCHASTIC OSCILLATOR

Long Entry

1. Both MA(moving averages) pointing upwards

2. RSI above 50

3. Both stochastics heading up

Short Entry

1. Both MA Moving Average pointing down

2. RSI is below 50

3. Both stochastic lines going down

Exit

1. Moving Average gives and generates in the opposite market trend signal

2. RSI Often Signals Against the Trend

Risk Management

StopLoss - 35 pips

Take Profit - 70 pips

Reward : Risk 2:1

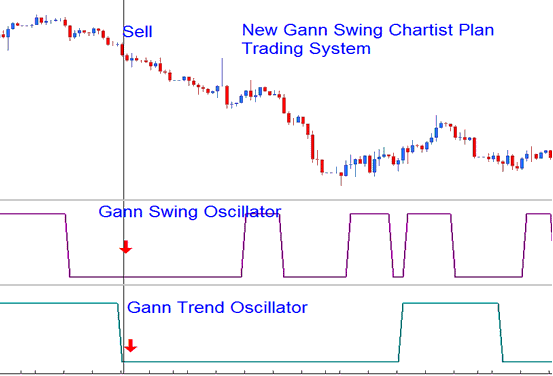

Example 4: New Gann Swing Chartist Plan

The Gann Swing Oscillator should be used with the Gann HiLo Activator and Gann Trend to create a full strategy, often called the 'New Gann Swing Chartist Trading Plan.' Within this method, the Gann Swing Oscillator Trading helps to find market swings for trading only within the current trend, as shown by the Gann Trend.

Below is the exemplification of the New Gann Swing Chartist Plan

The Gann Chartist Plan - Index Trading Systems

More Tutorials and Topics:

- How Can I Add OBV Technical Indicator on Chart?

- How Do You Analyze GER 30 Pips?

- How to Place Zigzag Indicator in Gold Chart on MetaTrader 4 Platform

- How Much is 0.01 Lot in FX Trade?

- S&P500 Indices Strategy

- How Can I Add AEX in MT4 AEX Phone App?

- Medium-term Index Trade with Moving Averages MAs Moving Averages Moving Averages MAs

- Islamic Swap Free XAUUSD Account