INDICES TRADING PLAN - EXAMPLE OF TRADING PLAN TEMPLATE

Illustrated below is a sample plan that a stock index trader can adapt as a foundation for creating their own personalized strategy.

JUSTIFICATION FOR PLAN

Principle 1: Treating Trading as a Business; Successful Ventures Require Defined Roadmaps

- Businesses which are successful always begin with a plan.

- Successful business plan will lesson you to success, think of your trade plan as a map - it's a constant reminder of how you'll consistently pull trading profits from the Index market .

- Difference between a successful Indices trader and a losing trader is the plan.

2. TO KEEP ME IN THE RIGHT DIRECTION

Maintaining consistency within one's established routine is a crucial metric for assessing trading effectiveness.

Keep you on target, read it every day & stick to it.

SUCCESS IS GUARANTEED IF YOU POSSESS A SOUND TRADING STRATEGY AND THE DISCIPLINE TO ADHERE TO IT RIGIDLY.

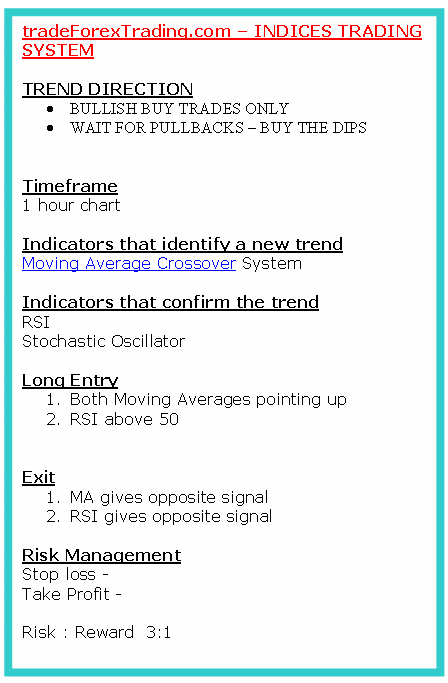

INDICES STRATEGY

Our strategy will only open bullish trades, this is because Indices moves are based on the principle that prices always move up over time, therefore the Stock Index that track these prices movement will over time move in a general upward direction. To open a buy trade we shall wait out for a price pull back and buy these dips.

TREND DIRECTION

BULLISH BUY TRADES ONLY

WAIT FOR RETREATS - PURCHASE THE DIPS.

TRADING SYSTEM

GOALS OF THE SYSTEM

- Ability to IDENTIFY A TREND AS EARLIEST AS POSSIBLE.

- Ability to AVOID WHIPSAWS.

A Trade System should find a reasonable middle ground between the 2 Goals,

Find a way to spot a trend as early as possible but also find ways to help you as a trader distinguish the fake signals from the real ones.

THE PURPOSE OF EVERY GAUGE

MA - Identify a new trend as early as possible.

RSI - Confirm the start & begin of a new trend.

TIMEFRAMES

- Main time-frame is the 1H.

- Signals are generated on the 1 Hour timeframe.

1H

- 5 & 7 L MA

- RSI (14)

RULES

LONG ENTRY

1H Chart

- Both Moving Averages are moving UP

- RSI greater and higher than 50

LONG EXIT

- Moving Average gives and generates in the opposite market trend signal

TRADE ROUTINE

- Signals are generated using 1 Hour timeframe.

- Trading Signals to be executed immediately the trading rules are met ( Not Before ).

- Entry signals should be executed during day-time.

- Close all trade positions at the end of the trading day.

TIME OF DAY TO WATCH MARKET

Watch market during day-time

MONEY MANAGEMENT

Day trading - Low risk High return trading method

Trade when I have a high risk : reward ratio 3:1 or more

Never trade more than 10 percentage of account total account balance

Never risk more than two percent on a single trade

MINDSET and PSYCHOLOGY

- Trade without Emotions (greed, fear, anticipation, impulse, bias, overexcitement)

- I trade what my eyes see & not what I feel.

- I'll be patient.

My job is not to be the system!

It isn't to decide which trade positions looks promising.

That's what my FX system is for. It gives me a rulebook to follow - no making up strategies on the fly or getting distracted by price action. Stick to your rules.

MY JOB ROLE IS

The discipline involves waiting patiently until my system signals an appropriate entry or exit point. Then, acting with maximum focus and concentration, I proceed to execute the trade position according to the established plan.

Making trades not shown by the system, doubting the system and skipping suggested trades, waiting too long & joining late, guessing & joining early are normal and come from not trusting the system and not focusing on doing things exactly right.

OBJECTIVE: To achieve absolute, unwavering determination in flawlessly implementing my Index methodology.

As a trader enhances their skill in taking a step back from market activities and calmly observing the market while waiting for trading signals, it becomes easier to manage emotional swings and avoid being influenced by them, preventing disruptions to their strategy.

WEAKNESS

- I am greedy.

- I overtrade

- Make a listing of all your weaknesses which are interfering with your trading. This is the first strategy toward helping you as a trader overcome these weak-nesses. Use trading psychology to help you as a trader overcome them.

Tip: As you trade, you'll start to identify your flaws by writing them down. After you do this, you'll begin to avoid them, and your trading will get better.

GOALS

- To focus on exit just as much as I do on entry.

- Always protect my account using stop loss, equity management methods, trading with the trend and always following the trade rules of my system & plan.

- Never second guess or go against my system. To always keep up my trading discipline.

- Follow all the rules of my system and never break them.

- Trade fewer times & execute all my trades rightly. Trade what I see, what the strategy + charts are telling me.

- Sit patiently and wait for signals from my system.

- Achieve consistent profitable trading results.

Write down goals & focus on achieving these goals on your trading

FOLLOW THE TRADING SYSTEM RULES

This is the most crucial and important part of creating the system.

Always follow the trade rules

Stick with the trade rules

Be controlled & wait patiently

JOURNAL

I will meticulously log all executed trade activities in a dedicated journal to monitor my advancement.

More Guides & Topics:

- Forex NKY 225 Index NKY 225 Name in FX

- Bollinger Bands Price Action on Upwards Gold and Downwards Gold Trends

- Where to Trade GER30 Indices

- Learn the Basics of FX Trading Strategies in the Forex Market

- How Do I Trade GDAXI 30 Index?

- FX Strategies Tips

- McClellan Oscillator Methods for Generating Buy and Sell Signals

- AUD NZD Trade Spread

- How Do I Set S&P in MT5 App?

- Chandes Momentum Oscillator