What's GDAXI30 Strategy? - Course to Trade GDAXI30 Index

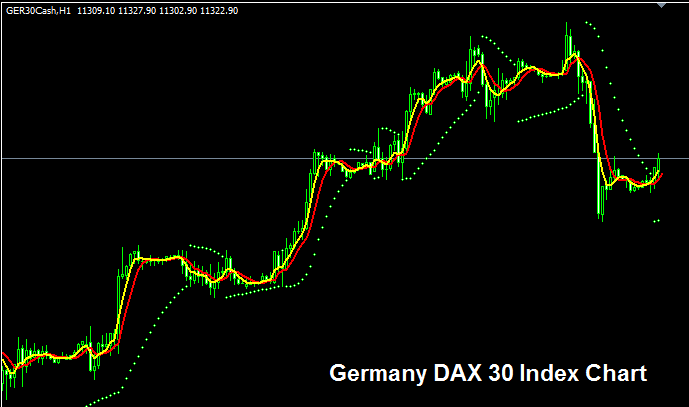

Germany GDAXI30 Chart

Germany GDAXI30 trading chart is shown above. On the above example illustration this financial instrument is named GDAXI30CASH. The Indices example illustrated above is that of Germany GDAXI30 Stock Indices on MetaTrader 4 FX and Index Software.

Strategy to Germany GDAXI30 Stock Index

The German GDAXI30 Stock Index is comprised of established blue-chip stocks traded on the Frankfurt Stock Exchange, chosen from Germany's top-performing sectors: therefore, a sound trading strategy for the Germany GDAXI30 Index often involves taking long positions the majority of the time. This is because the premier shares on the Frankfurt Stock Exchange generally maintain an upward trajectory, as the corporations underpinning these equities are among the most robust and profit-generating entities in Germany.

Germany GDAXI30 Indices is also re-evaluated a few times a year so that as if one Indices is not doing well then it is replaced with another blue chip Indices that is doing good. This ensures that most of the times Germany GDAXI30 Index will keep going upward.

As someone who trades stocks, you should want to favor buying and keep buying as the stock market goes up. If Germany's economy is doing well (which it usually is), this upward trend is very likely to continue. A good way to trade stocks would be to keep buying, especially when prices briefly go down.

During Economic Slow-Down and Recession

When the economy slows down or enters a recession, companies start to show slower sales, lower profits, and reduced growth expectations. Because of this, traders begin selling shares of companies with lower profits, which causes indices tracking these specific stocks to also move downward.

During periods of downward market trends, traders should adapt their strategies to align with prevailing conditions for the specific index they are trading to optimize results in such scenarios.

Contracts and Specs

Margin Requirement for 1 Contract - € 85

Value per Pips - € 0.1

The overall chart shows markets rise in the long run. But traders can't just coast through ups and downs. Daily action brings sharp turns. Indices might stall flat or drop fast and surprise you. Pullbacks hit hard sometimes. Stay alert on entry points. Follow your plan for timing trades. Keep money rules tight to guard against rough spots. Markets stay bumpy. Prep for any twist. About equity management techniques and guidelines in Indices lessons: What's Stock equity money management principles & guidelines & Indices equity management system/plan.

Get More Lessons and Courses:

- ROC, Rate of Change MT4 Trading Indicator in Forex Trade

- Ways to Trade GBPUSD Currency Pair Successfully

- Analyzing the Triple Exponential Average Indicator in XAU/USD

- Deploying Trade Signals via Moving Averages

- What about the IBEX 35 indicator? Any MT4 indicator tips?

- A Guide and Lesson Resource on Using Indicators for Swing Forex Trades

- Tutorial Courses on HSI 50 Strategies