Rate of Change Analysis & Rate of Change Signals

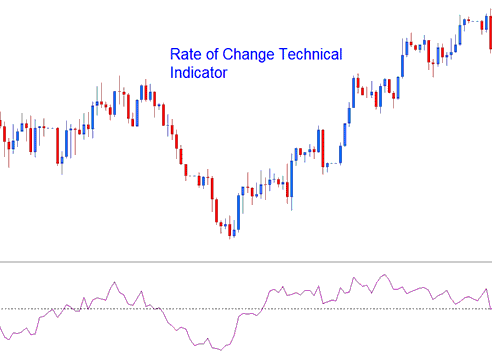

The Rate of Change (ROC) trading indicator measures the price change over a specified number of periods. It calculates the difference between the current price and the price from a certain number of previous candlesticks.

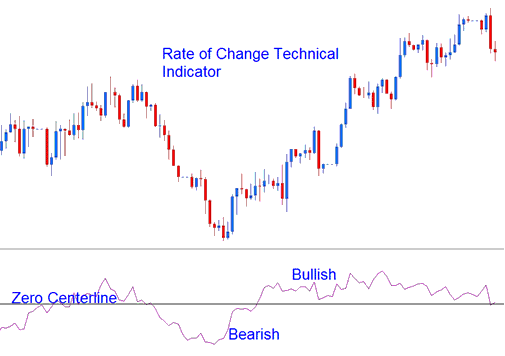

The gap can be worked out and shown using Points or Percentages. ROC goes up and down like a wave, going above and below a zero middle line. Levels above zero are good, while those under the zero middle line are not good.

The greater the changes are in the prices the greater the changes in the ROC Rate of Change.

FX Analysis & Generating Signals

The ROC (Rate of Change) indicator permits the creation of trading signals through several established methods, the most frequent of which are:

Forex Crossover Signals

Bullish Signal Indication: A buy trade signal is initiated when the ROC moves above the central zero line.

Bearish Signal - sell signal gets derived/generated when Rate of Change crosses below zero center line.

Overbought/Oversold Levels:

Overbought conditions occur when values rise beyond specified limits, indicating that a currency pair may be overbought and signaling a possible price correction is imminent.

Oversold - The lower the reading the more over-sold a forex pair is. Values below the oversold level imply that a currency is oversold and there's a pending price rally.

But, when markets are strongly trending, the price will stay in the Overbought/Over-sold Levels for a long time, and instead of the price changing direction, the price trend will keep going for quite a while. So, it's best to use the crossover signals as the official buy & sell signals.

Forex TrendLine Breaks

Trend Lines can be drawn on ROC technical indicator just the same way trend-lines can be drawn on price charts. Because The Rate of Change is a leading indicator, the trendlines on the indicator will be broken before those on price charts. A trendline break on the ROC is an indication of a bearish or bullish reversal setup.

- Bearish reversal- Rate of Change values/readings breaking above a downwards trend-line warns of a likely bullish reversal.

- Bearish reversal- Rate of Change values/readings breaking below an upward trendline warns of a likely bearish reversal.

Divergence Trading

The Rate of Change (ROC) indicator is crucial for spotting divergences and potential trend reversals. Common divergences include classic bullish/bearish and hidden bullish/bearish scenarios.

Learn More Lessons and Tutorials & Topics:

- What's a working EUR/SGD trading system or strategy?

- Trading Session Times: AUDNZD Opening and Closing Durations

- Darvas Box Automated System

- How do I use the Gann Swing Oscillator in trading?

- How can I incorporate gold into the MT4 software?

- Boost XAUUSD Trading Mindset with Simple Tips and Methods

- How to trade the DJ 30 index using MetaTrader 4

- Explanation of Bid and Ask Spreads for USDSGD

- How Do I Identify a Consolidation Pattern in?

- Setting Up a Stochastic Expert Advisor (EA) for Forex Trading