Pivot Points Analysis & Pivot Points Signals

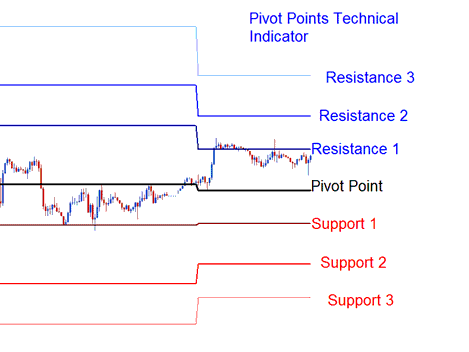

This specific indicator incorporates a central pivot around which are situated three resistance boundaries above and three support thresholds below.

Initially, these points were utilized by floor traders to analyze and interpret equities and futures exchange markets. This indicator is deemed a leading indicator rather than a lagging one.

Pivot points let traders spot the market's broad direction for the trading day. Basic math helps draw support and resistance lines.

To calculate these points and levels for the coming day is the previous day's

- high,

- low, and

- closing prices are used

The foreign exchange day concludes at 5:00 P.M. EST: this specific daily closing marker is when the trading indicator is refreshed.

This technical indicator uses a complex formula to figure out the 24-hour cycle. Then, it calculates the central pivot point, which gives you the support and resistance levels.

Resistance 3

Resistance 2

Resistance 1

Pivot Point

Support 1

Support 2

Support 3

Forex Analysis and How to Generate Signals

This signal that tells you what to do can be used in various ways to make Forex signals. Here are the most typical ways to use it:

Trend Identification Trading Signals

Traders utilize the central pivot point as a gauge for determining the overall direction of the price trend. Trades that are entered and executed will exclusively align with the established direction of the market price trend.

- Buy signal - price is above the central pivots point

- Sell trading signal - price is below the central pivot point

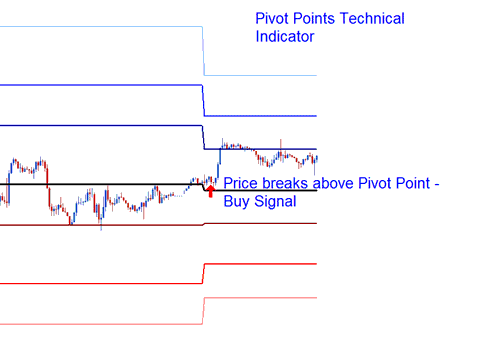

Price Break Out Signals

Price breakout trade signals are derived and generated as follows

- Buy signal - is generated/derived when the price breaks-out upwards through the central point.

- Sell signal - is derived & generated when price breaks-out downward through the central point.

Price Breakout

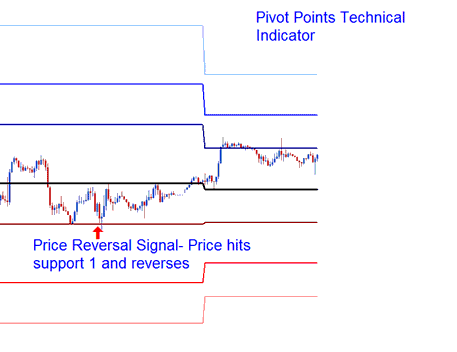

Price Reversal Signal

Price reversals are derived and generated as follows

Buy when price drops to a support level. It touches or dips below slightly, then bounces up fast.

Sell Signal - This occurs when the market price ascends toward a designated resistance ceiling, makes contact with or slightly breaches it, and then rapidly reverses its course to move lower.

Price Reversal Signal

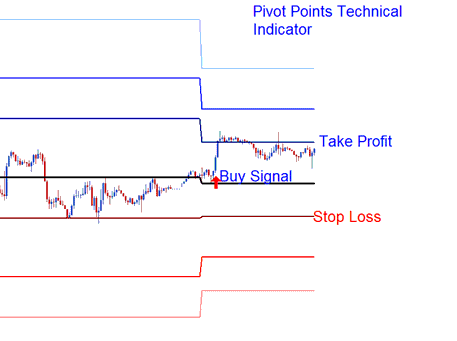

Setting Stop loss & Limit Profit Values

The center pivot & the other support & resistance areas are used by the traders to identify suitable stop loss & limit profit levels.

Setting Stoploss and Limit Profit

If a buy signal is placed above the central point the Resistance 1 or Resistance 2 can be used to set takeprofit level, & the Support 1 can be set as a Stop Loss Level for the trade position.

To download Pivot Points Leves Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

Once you download it. Open it with the MQL4 Language MetaEditor, Then Compile the indicator by clicking Compile Button and it will be added to your MT4 Trading Software.

NB: Add it to your MT4 setup as a trader. The tool adds MidPoints lines. To drop them, launch MQL4 MetaEditor with F4 key. Edit line 16 from:

Extern bool mid-pivots = true:

To

Extern bool mid-pivots = false:

Press the Compile Button again, and it will display as illustrated on this website.

Learn More Lessons and Tutorials and Topics:

- Trading Strategy for HangSeng50 Index

- NZDCHF Pip Calculator for Forex

- Best Time for Transacting XAU USD EST

- Linear Regression Automated Forex Strategy

- Learning a Stochastic XAU/USD Strategy to Start XAU/USD Trades

- Calculation Method for Pip Profit in Forex Trading Corresponding to 100 Pips on a 1 Micro Lot?

- GER 30 Indicator and How to Use it on MT4

- What's USD CHF Bid Ask Spreads?

- List of Technical XAUUSD Technical Indicators for Gold

- Setting new FX orders through the tools menu in MT4