Trading Strategy

Stock indices follow the performance of top stocks in a given market. These indices monitor the most active and liquid shares from leading companies in key sectors of an economy. Over time, the value of these choice stocks tends to climb. As a result, the index that tracks them rises too.

One common belief among traders is that markets tend to rise over time. Historical evidence consistently supports this concept, and the recommended strategy will be based on this principle.

Our plan for stocks is to only start buy trades when we are dealing with the stock market averages. We will start the trade positions when the average level goes down a bit.

Strategy

- Wait for price pullback

- Open a buy position

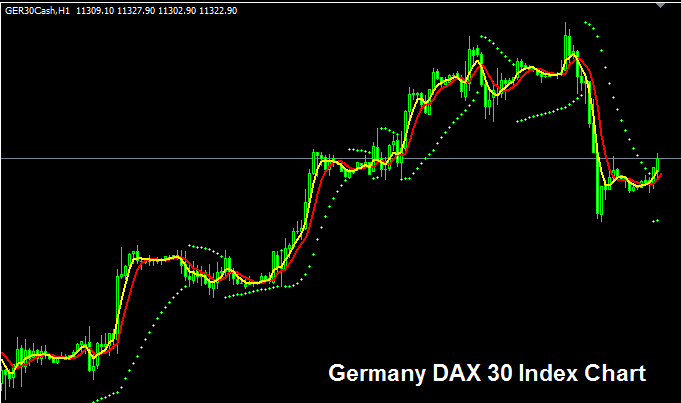

The Pull Back Setup is Displayed Below - Retracement

As a stock index trader, wait for a pullback before entering a trade. The example below shows what a price pullback looks like.

This moment represents the optimal point for a stock index trader to execute a buy order. Utilizing this setup offers the most favorable risk-to-reward ratio, which is essential for ensuring continuous strategy profitability.

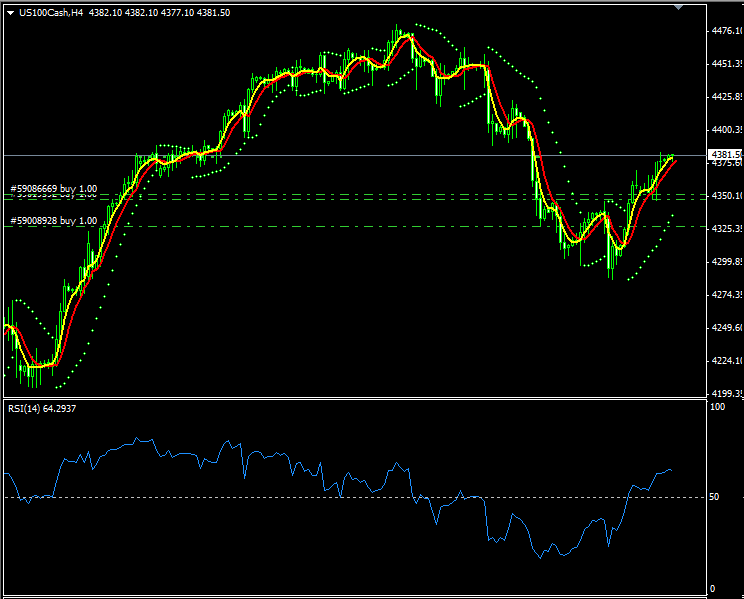

Example Trade Positions Using This Strategy

The subsequent example provides a demonstration of several trade executions that were initiated based on this particular trading methodology.

This example shows that even though the trend is in general moves upward, there's always a price pull back that traders can use to enter a buy position. Best thing about waiting for pull back is that you as a trader reduce your drawdown to a minimum and thus chances of you strategy becoming more profitable are increased.

In the above exemplification the first trade transaction opened after the pull-back was opened at 4325 level, second trade was placed at 4350 level. The index value then went up to 4381 level where it's now. One that waited for the pull back to buy this index is already in profit as compared to another that bought near the top & are now in draw-down & they now have to wait for price to go back to break even.

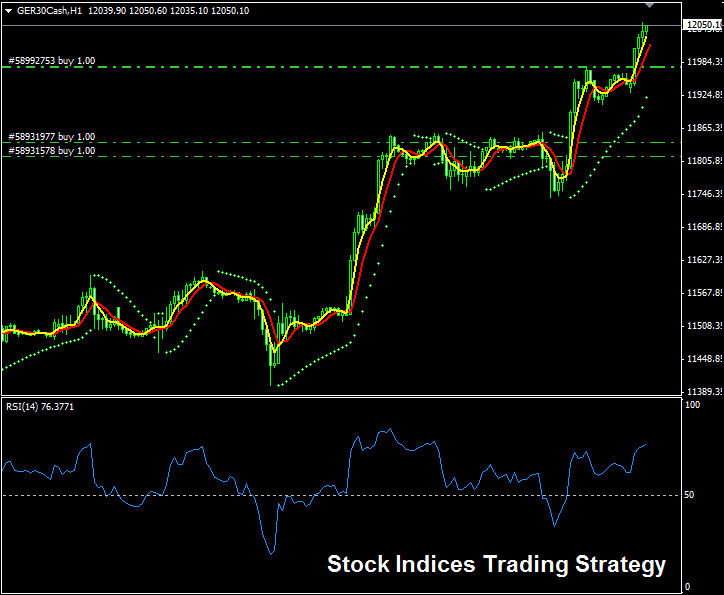

Where to Take Profit

On the example below - there are a few open trade orders that are already in profit. These orders are shown below. Many traders would want to keep their trade positions open and scheme more profits from the market & they might be right - but also it is very important for a trader to know when to take profit & you don't take profit once the market begins to retrace, no - you take profit when the market is headed way up just as is illustrated below.

Open Trades - Time to Take-Profit While the market is still heading upward

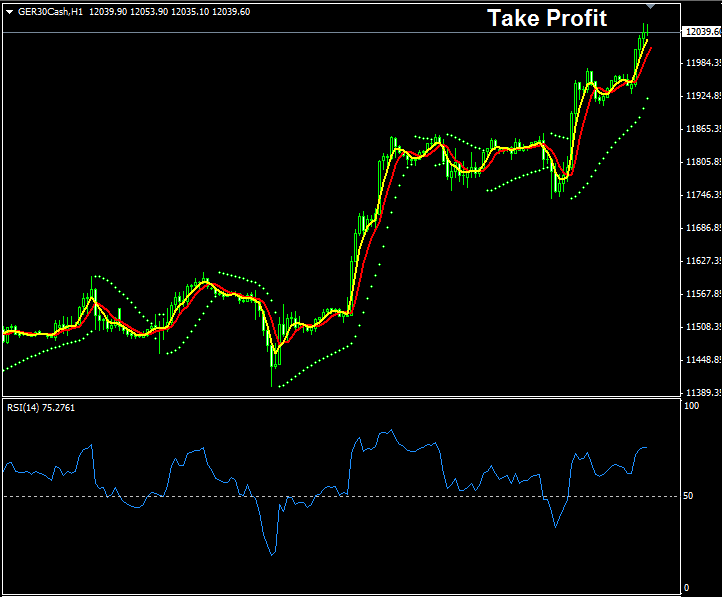

Trades Closed - Take-Profit executed & profits booked

Follow this index strategy to cut drawdowns and save time on profits. Skip waiting for retraces in trades. Stay out until the pullback ends and the uptrend restarts, then enter.

As an indices trader, avoid pullbacks. They go against the trend. Counter-trend trades rarely win. You might get one right, but most times you'll lose.

Wait for pullbacks to end, then start buy trades after them. Indexes keep rising because they follow top stocks from key world economies. People in those places have cash to spend and keep buying shares. The top picks are in these indexes. Since those stocks draw the most buyers and offer the best returns, their prices tend to climb. That pulls the whole index up and keeps the uptrend going.

To enhance your prospects of generating profits as a trader, it is advisable to trade in alignment with the market trend, specifically an upward trend. Concurrently, always await a pullback before initiating any trade, and exit your positions once the index value has moved a substantial number of points in your favor, as demonstrated in the preceding illustration.

Strategy 2: Diversify the Indices in Your Portfolio

A good second way to add to the first one is to spread out your investments and look for these setups among the 14 most well-known indexes, so if one index doesn't have a good setup, you can check another one to see if it does and then trade the top 3, 4, or 5 indexes that have the best setup for that day.

Check Out Extra Subjects and Lessons:

- Defining the WallStreet 30 Index (Wall Street 30)

- Chart Menu Templates in MT4 Software

- Understanding Double Tops and Bottoms: FX Reversal Patterns

- Login and Sign In to a MetaTrader 4 FX Account

- Support and Resistance Levels Buy Sell Signal

- What are AC Buy and Sell Forex Signals?

- MetaTrader FRA 40 Index FRA 40 MT4 FX Trade Software

- How to Trade with Trade Expert Advisors EAs Trade Robots

- How to Read Pips on GBPHKD And How to Count Them