Money Management in Indices

Money management in index trading ensures long-term gains.

To gain proficiency in money management, a trader must first comprehend the ensuing core concepts.

Drawdown

Drawdown is the amount of money you can lose on a single trade in indices trading.

Example of Drawdown:

With $10,000 in your account, a $1,000 loss on one trade means a 10% drawdown.

Drawdown Equals $1,000 Divided by $10,000 Times 100, or 10% of Account

Maximum Drawdown

Maximum draw-down represents the total cumulative loss experienced in your trading account before you transition into a profitable state.

Example of Maximum Drawdown:

As an example, if you have a $10,000 trading account, experience three consecutive losing trades totaling $3,000, and then recover with four winning trades earning $4,000, your maximum drawdown would be $3,000.

Maximum Draw-down = $3,000/$10,000100 = 30% of your account

Effective money management involves minimizing drawdowns per trade. Limiting drawdown to around 2% per trade is recommended. This approach helps traders manage risk effectively and reduce overall exposure.

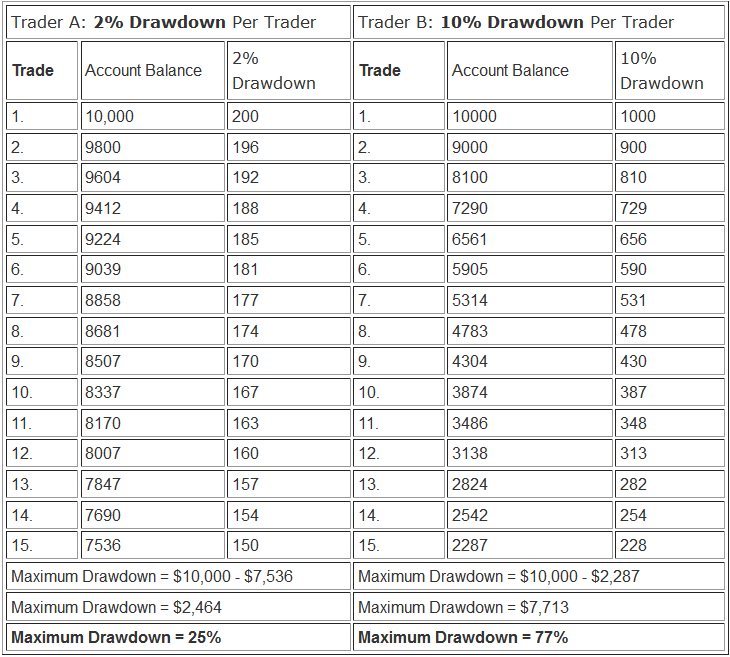

For instance, consider two traders: one risking 2% of capital per trade, and the other risking 10% per trade position: should both encounter a sequence of 15 consecutive losing trades, the resulting status of the two accounts would be as demonstrated beneath:

A trader who loses 15 trades in a row with a 2% drawdown would still have 75% of their money, but a trader with a 10% drawdown would only have 23%.

This illustration although it is nearly not possible to have a losing streak of 15 consecutive trades in a row, shows that using 2 % drawdown will preserve your capital and help keep you in this trading game for longer & you'll be more likely to make profits in the long-term.

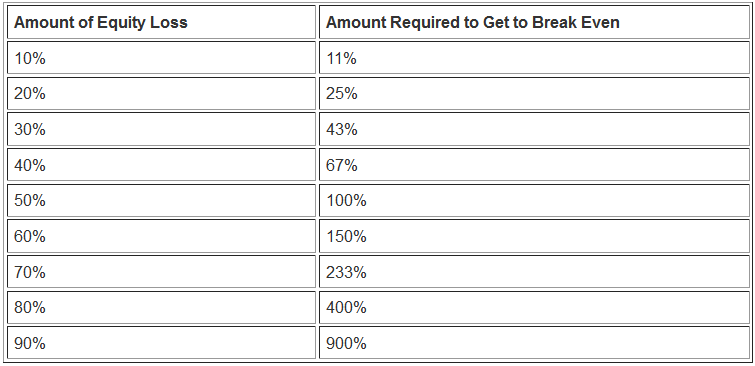

It's just easier to break even if you only risk a small part of your capital, rather than most of it, as you can see below.

Break-Even Calculation in Percent Works This Way

A 10% loss on $10,000 leaves $9,000. You need $1,000 gain to recover.

Therefore, 1,000 divided by 9,000 multiplied by 100 equals 11 %

A 30% loss on a $10,000 capital reduces it to $7,000, requiring you to recover $3,000 to reach break-even.

Therefore $3000/$7,000*100 = 43%

A 70% loss on $10,000 leaves $3,000: you need $7,000 to recover.

Thus, 7000 divided by 3,000 multiplied by 100 equals 233%.

From these examples above the more the maximum drawdown the harder it is to get back to break even and to make profits.

This underscores the prudence of limiting risk drawdown to 2% to maintain both your current floating loss and maximum drawdown at their lowest possible levels, thereby maximizing potential market profitability.

More Guides and Courses: