Wall Street 30 Index or Dow 30 Average - Trading Wall Street 30

Wall Street 30 Industry Average Index, also known as the Dow 30 Stock Index, tracks 30 of the largest stocks in the United States. The shares included in this index are selected from the 30 largest corporations in the country.

WallStreet 30 is hands-down the most popular and most followed index out there. It used to track just industrial stocks, but now it covers all sorts of big sectors in the US economy. The main thing is, the index includes the largest US companies.

The WallStreet 30 Index tends to be more volatile compared to many other leading indices. While it is expected to trend upward over the long term, it typically experiences a higher frequency of price retracements and consolidations than other indices. Traders who are accustomed to more consistent trends often prefer other indices over the WallStreet 30 Industry Average.

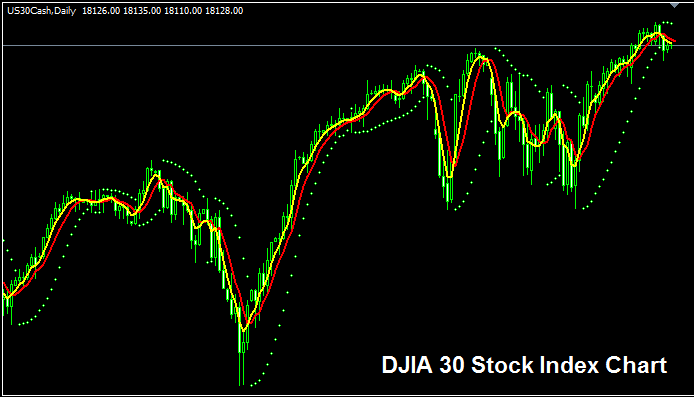

Wall Street 30 Chart

WallStreet 30 chart is illustrated and shown above. On the above example illustration this financial instrument is named WallStreet30CASH. The example Which is illustrated above is the one of WallStreet 30 Stock Indices on MetaTrader 4 FX and Index Software.

Other Info about WallStreet 30 Stock Index

Indices Symbol - DJI

The Wall Street 30 Index picks 30 top US company stocks. It calculates by dividing their prices by a set number. This setup makes the index jump more than others.

Strategy to Trading WallStreet 30 Index

The formula for calculating the WallStreet 30 Stock Index contributes to the increased volatility of the Dow 30 stock index, resulting in broader and more erratic price fluctuations. Despite this, the stock index generally trends upward over the long term, reflecting the robust growth of the U.S. economy, which is also the largest economy globally.

Those intending to trade this stock index should anticipate broader price fluctuations and somewhat heightened volatility.

As someone who trades stock indices, you should lean towards buying as the index goes up. When the USA economy is doing well (which is often), this rise is very likely to keep happening. A good way to trade this stock index would be to keep buying and to buy when prices drop a little.

During Economic Slow Down & Recession

When the economy slows down, companies start to show smaller profits and expect slower growth. This is why traders sell shares of companies with lower profits, making indexes that follow these stocks also go down.

During these periods, trends tend to head down more often. As a trader, adjust your strategy to match the current downward moves in the index you're trading.

Contracts and Specs

Margin Requirement Per 1 Contract - $150

Value per Pips - $ 0.5

Note: Even though general and overall trend is generally moves upwards, as a trader you've to consider and factor on daily market price volatility, on some of the days the Indices may & might move in a range or even retrace and pull back, the Indices market retracement/pullback move may also be a substantial one at times & therefore as a trader you need to time your trade entry strictly using this strategy: trading strategy & at the same time use suitable and proper and appropriate money management principles/guidelines just in case there's more unexpected market trend volatility. About money management guidelines/techniques in Indices lessons: What's Stock index money management guidelines and methods & Stock Index equity management methods/strategies.

More Guides and Topics:

- EURAUD Spread for Trades

- GDAXI 30 Strategy Courses

- Technique for Calculating the Pip Value for a Nano Account

- Want to trade an upward trend on charts? I'll show you the process.

- Counting HSI 50 Pips: How It Works

- Analysis of Trading Indicators for the IBEX 35 Index within MT4.

- How to Set Accelerator Oscillator on Trading Chart in MT4 Platform