Reversal Setups

These reversal patterns are formed after the forex market has had an extended move up or down and the forex price reaches and gets to a strong and major resistance level or support level respectively.

Forex prices often form distinct patterns at critical points. Recognizing these recurring setups becomes easier with practice, and there are four main types of reversal patterns to be aware of.

- Double Tops

- Double Bottom

- Head and Shoulders

- Reverse Head and Shoulders

This guide on reversal chart patterns focuses only on double tops and bottoms. For the other two types, check this tutorial on head and shoulders plus reverse head and shoulders patterns.

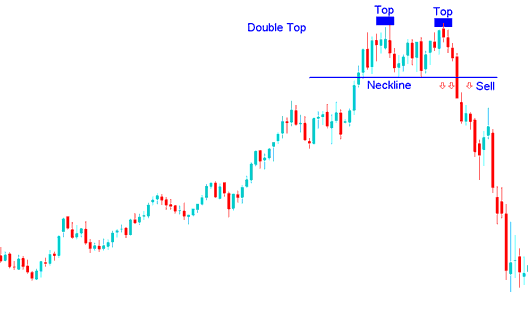

Double Top - Forex Double Tops Setup

The double tops pattern signals a reversal after an uptrend. It has two peaks at similar levels with a dip between them.

A double-top pattern is confirmed once the price forms a second peak and breaks through the lowest point between the two peaks, known as the neckline. A sell signal is generated when the price breaks below this neckline, completing the formation.

In Forex, the double top pattern is an early warning sign that the bullish trend is about to reverse. But it's only confirmed when the price breaks the neckline - that's the last support level on the chart. Once the market falls below it, the reversal is on.

Summary of Double Tops Setup:

- Double top pattern formation forms after an extended move upwards

- This double tops chart pattern indicates that there will be a reversal in the market trend

- We sell when price breaks below the neckline: see below for an explanation.

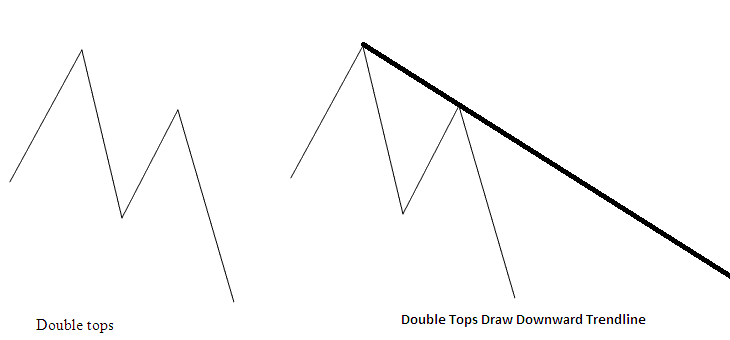

The double tops chart pattern look like an M-Shape, the best reversal signal for a double tops chart pattern is where the second top is lower and lesser than the first top like is shown below, this means that the double tops reversal setup can be confirmed by drawing a downwards trend-line just as illustrated and shown below. If a fx trader opens a sell trade signal the stoploss order will be placed just above this downward trend line.

M-Shaped Double Bottoms Reversal Chart Setup Patterns

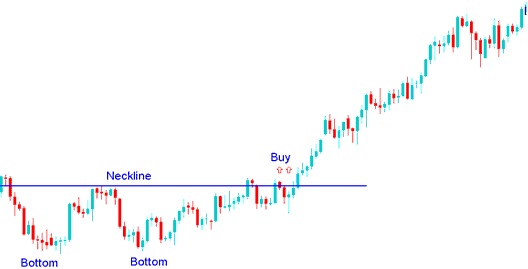

Double Bottoms

The double bottom formation represents a reversal setup that manifests following a prolonged downturn in the forex market. This trading pattern consists of two successive low points (troughs) that are approximately equal in level, separated by a distinct intermediate peak.

The double bottom pattern finishes when price hits a second low. Then it breaks above the high point between the lows, known as the neckline. A buy signal triggers when price rises above the neckline.

In FX trading, this double bottom look is an early sign that the falling market trend is about to change direction. It's only seen as done when the neckline is broken. In this double bottom chart look, the neck-line is where the forex price struggles to pass. Once this level is broken, the market will likely rise.

Summary of Double Bottoms Setup:

- Double bottoms pattern setup forms after an extended move downwards

- This double bottoms chart pattern shows that there will be a reversal in the market trend

- We buy when price breaks above the neck-line point: see below for an explanation.

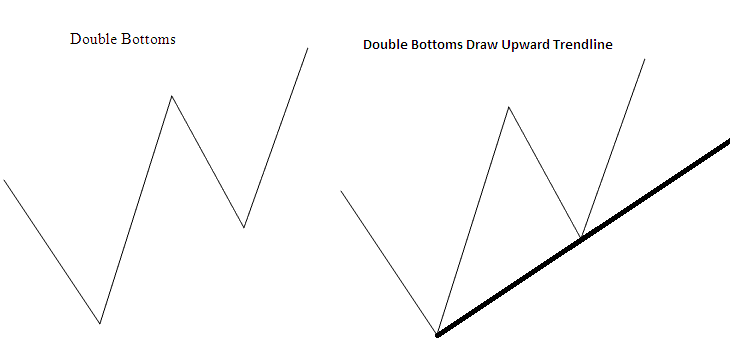

The double bottom pattern look like a W-Shape, the best double bottoms reversal signal is where the second bottoms is higher than the first one like as shown below, this means that the reversal setup can be confirmed by drawing an upwards trend-line like is illustrated and shown below. If a forex trader opens a buy signal the stoploss order will be placed just below this upwards trend-line.

W-Shaped Double Bottoms Reversal Chart Setups

More Instructions and Explanations: