Reversal Patterns: Analyzing Head & Shoulders and Inverse Head and Shoulders

Head and Shoulders Pattern

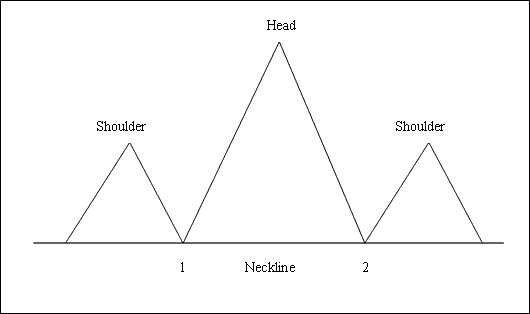

The Head & Shoulders pattern is a reversal formation that typically emerges after a prolonged upward trend. It consists of three peaks: a left shoulder, a head, and a right shoulder, separated by two moderate troughs between the shoulders.

When price breaks below the neck-line, which is drawn by connecting the two troughs between the shoulders, this Head & Shoulders chart arrangement is deemed complete.

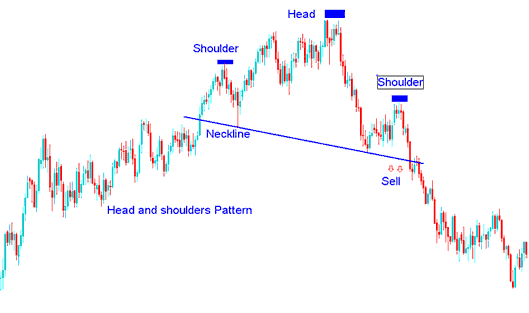

To execute a short sale, Forex traders are advised to place their pending sell-stop orders marginally beneath the neckline of a confirmed Head & Shoulders chart formation.

Summary of Head and Shoulder Chart Setup:

- Head & Shoulders chart setup forms after an extended upwards trend move

- This Head & Shoulders pattern formation indicates that there will be a reversal in market

- This reversal pattern setup formation resembles head with shoulders thus its title.

- To draw the neckline of this reversal chart setup we use chart point 1 & point 2 as shown and explained below. We also extend this line in both directions.

- We sell when price breaks out below neckline: see the trading chart below for an explanation.

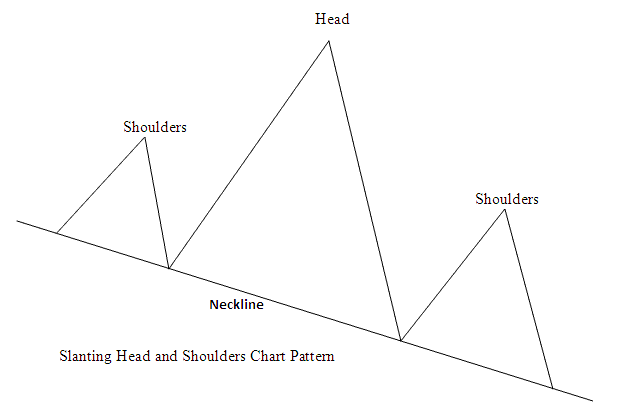

Or the head and shoulders chart pattern neckline can also form on a slanting neckline, like on the trading example:

Example of Head and Shoulder Chart Setup on Chart

Head & Shoulders Setup - Head & Shoulders Setup Explained

This Head & Shoulders chart setup can also be formed on a sloping neckline, like the one above, the neckline on this reversal head and shoulders chart pattern does not have to be necessarily horizontal.

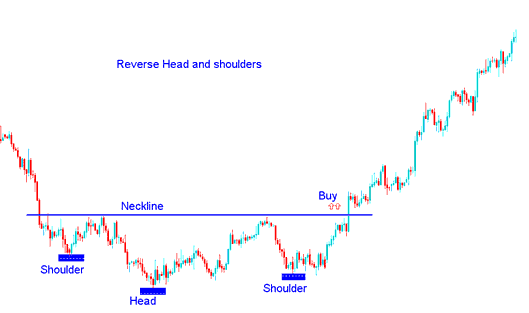

Reverse Head and Shoulders Pattern

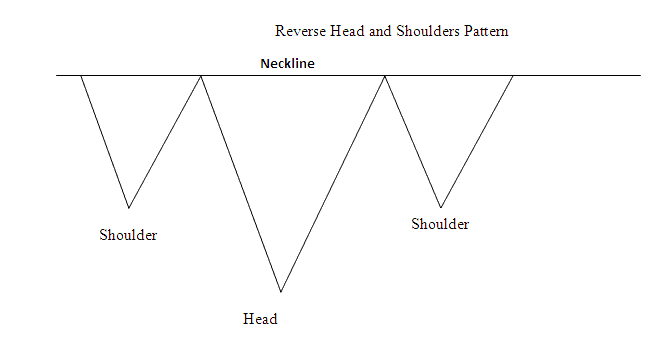

This inverse head and shoulders forms after a long Forex drop. It looks like an upside-down regular one. It signals the reverse of the standard head and shoulders pattern.

The Inverse Head and Shoulders chart pattern is deemed complete when the price breaks above the neckline, which is drawn by connecting the two peaks situated between the reversed shoulder formations.

To assume a long position, buyers are instructed to place their pending buy stop orders just above the horizontal line marking the neckline of the Reverse/Inverse Head & Shoulders chart configuration.

Summary of Reverse Head & Shoulders Setup:

- Reverse Head & Shoulders chart setup forms after an extended downwards trend move

- This Reverse/Inverse Head & Shoulders pattern formation shows that there'll be a reversal in market

- Reverse Head & Shoulders chart pattern formation resembles an upside-down Head & Shoulders chart pattern, thus its name Reverse/Inverse Head and Shoulders pattern.

- We buy when the price breaks-out above neckline: see the trading chart below for an explanation.

Example of Inverse Head and Shoulder Chart Setup on a Trading Chart

Illustration of the Inverse Head and Shoulder Setup - Explanation of How the Inverse Head & Shoulders Forms

More Courses: