Williams Percent R - how should you analyze it, and what are its trading signals?

Williams Percent R Indicator Developed by Larry William

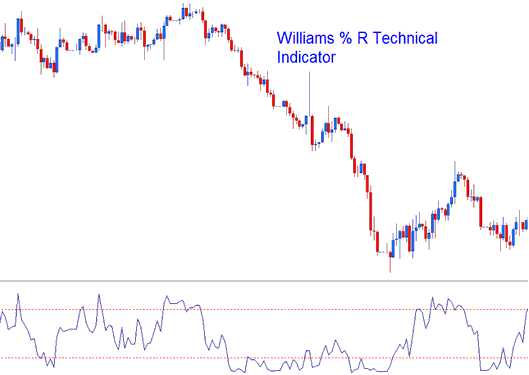

The Williams %R indicator measures momentum. Traders use it to spot overbought or oversold conditions.

Williams Percent R trading resembles the Stochastic oscillator. But it plots upside down on a scale from 0 to -100. It skips any smoothing step.

Williams Percent R, Percentage R Indicator - Indicators

The Williams Percent R tool looks at how closing prices connect with the highest and lowest prices over a set and picked number of candles, which we call n.

- The closer the closing price of a candlestick is to the highest high of the range selected the closer to zero the Percent R reading and value will be.

- The closer the closing price of a candlestick is to the lowest low of the range chosen the closer to -100 the Percent R value will be.

When performing technical analysis, currency traders should disregard the negative sign (-) preceding a value, such as in -40: this sign should be ignored, just remember that indicator readings are often presented inverted.

- At zero: If the closing price of the candle is equivalent to the highest high of the range the William % R reading and value will be 0.

- At -100: if the closing price of the candle is equal to the lowest low of the range the Williams % R reading and value will be -100.

Analysis of William's Percent R Indicator

Over-bought/Oversold Levels in Indicator

- Overbought- William's % R values from 0 to -20 are considered and regarded over-bought while

- Oversold - Williams % R values from -80 to -100 are regarded and considered oversold.

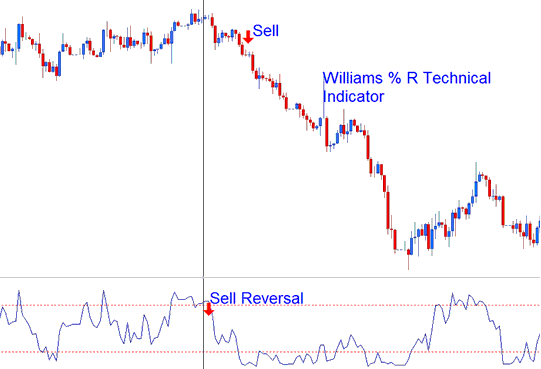

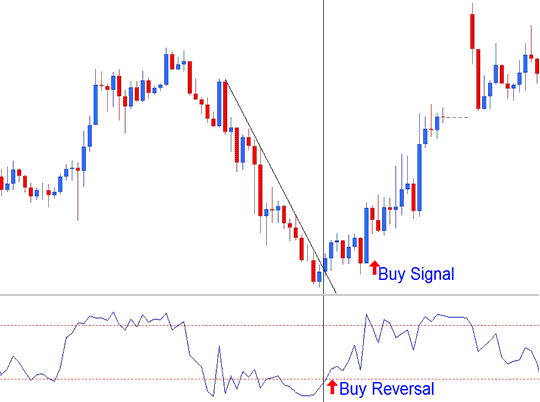

When looking at levels where something is too bought or sold, it's better to wait for a currency pair to change direction before using a signal that goes against the current trend. For instance, if a forex pair is oversold, it's best to wait for the trend to turn around and start going up before you buy the forex pair.

Trend Reversal Signals

The Williams %R trading indicator signals a potential market trend reversal when trading currency pairs. It predicts reversals by consistently applying its unique method.

The Williams Percent R indicator can serve as a bearish reversal trading signal, forming a peak and then declining a few days before the market trend peaks and reverses. The example provided shows Percent R signaling a reversal ahead of a price decline, marking the start of a downward trend.

Bearish Reversal Signal after an Upward Trend

The bullish reversal signal via William's %R indicator occurs when the indicator forms a trough and begins turning upward days before the underlying market bottoms.

Bullish Reversal Signal after a Downward Trend

Explore Further Subject Areas and Programs: