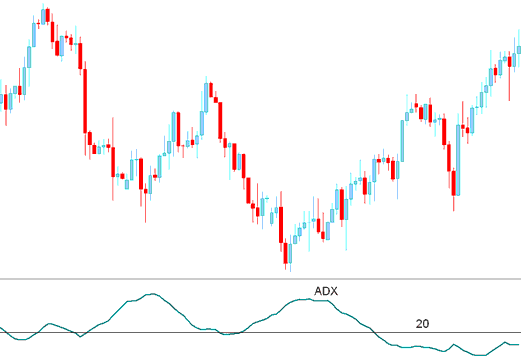

ADX Analysis and ADX Signals

Built and Made by J. Welles Wilder

This a momentum indicator used to measure the momentum of a price trend: it is derived from DMI - Directional Movement Index which has two lines.

+DI - Positive Direction Movement Index

–DI - Minus Direction Movement Index

ADX is calculated by subtracting these two values and applying a smoothing function.

The ADX serves not as an indicator of market direction but measures the intensity or strength of the prevailing trend, operating on a scale from 0 to 100.

Higher the trading indicator reading the stronger the market trend.

A value of below 20 reflects that the market is not trending but heading in a range.

A reading exceeding 20 validates a signal for either buying or selling, indicating the commencement of a new market direction.

Readings Over 30 Point to a Strong Trend.

ADX falling from over 30 means the trend is weakening.

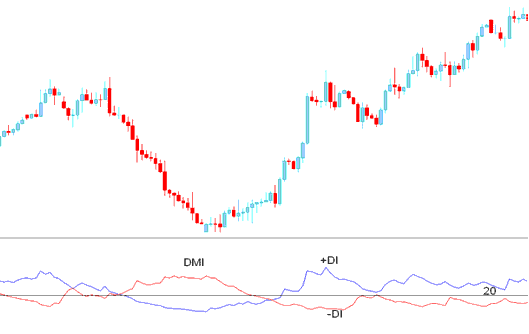

ADX with DMI Combined - Understanding the Directional Movement Index Indicator

Because ADX does not show direction on its own, it is used with the DMI index to find out which way a currency pair is moving.

DMI

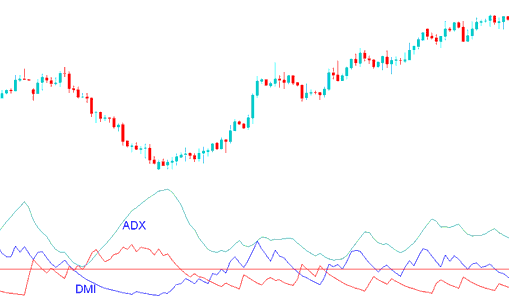

ADX & DMI Index

When combined with the DMI index, ADX can help identify both market direction and trend strength. This indicator offers valuable insights into current price momentum and energy.

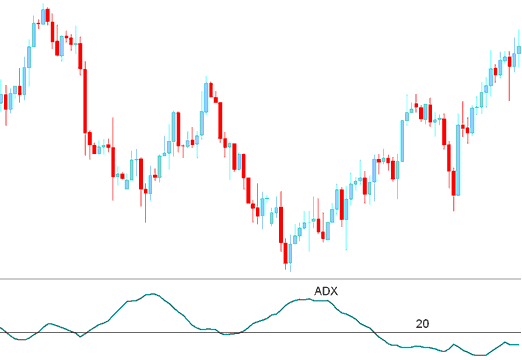

Forex Analysis and How to Generate Trading Signals

Buy FX Signal

A buy signal is generated when +DI exceeds –DI, and the ADX trading indicator is above 20.

Exit signal is derived/generated when indicator turns downwards from above 30.

Buy Signal

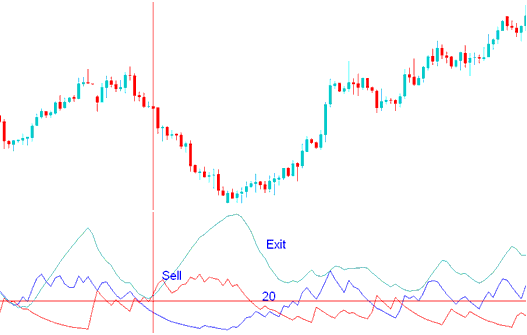

Sell Trade Signal

A short selling indicator signal is realized when the –DI reading surpasses the +DI reading, and the ADX registers above 20.

The signal to exit a trade position is generated when the chosen technical indicator declines from a level exceeding 30.

Sell Signal

Acquire Additional Training and Themes:

- Transforming Your Forex Psychology and Mindset When Trade Forex

- How to Add XAU USD Indicators in XAUUSD Charts in MetaTrader 4 Platform

- What is the Process for Putting the T3 Moving Average MA Tool on a Graph?

- Best Time to Trade EUR/PLN EST

- How Can You Place FTSE MIB40 in MT4 Android App?

- How Do I Draw Upward Channel on MetaTrader 4 Trade Charts?

- How to Analyze/Interpret Pips in GBP/USD How to Count Pips on GBPUSD

- FTSE100 System

- How Do I Trade Upwards Trend in Charts?

- How Do I Trade SX50 Lesson Guide Strategies Listing?