T3 MA Analysis and T3 MA Signals

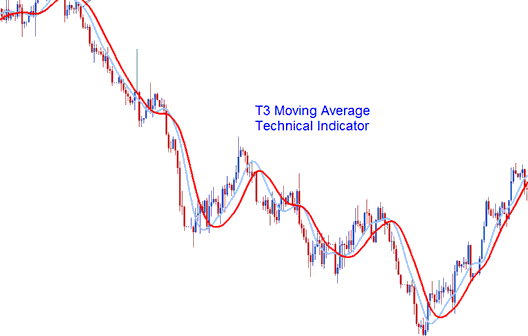

T3 uses a method called a Smoothing factor to create trading signals that are like moving averages, but T3 signals are more precise than the Moving Average (MA) signals. The T3 method changes how the original MA is calculated, resulting in a smoother line that doesn't fall behind the market as much as the MA does. This indicator watches price movements and adjusts to follow where prices are going.

Forex Analysis and How to Generate Signals

The T3 Moving Average (MA) bears a resemblance to the standard, initial Moving Average, and consequently, it can be traded and utilized in a manner consistent with the original MA indicator.

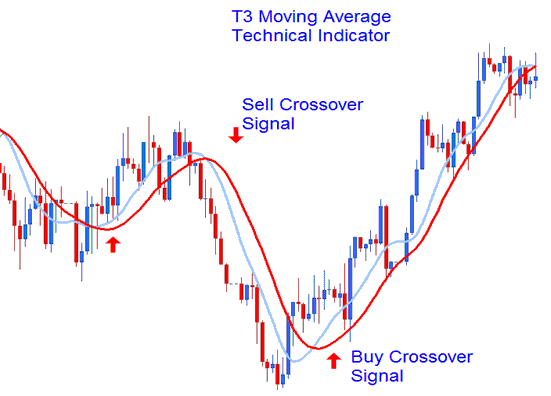

Moving Average Cross-over Signal

This Method involves using two T3 MA & generating trade signals when the two cross each either upwards generating an upward trend signal or cross downward generating a downward trend Signal.

Cross over Signal

Cross over Signal

Bullish Trend - Prices stay bullish if they hold above the key indicator. This suggests prices will keep rising.

Bearish Trend - Prices are considered bearish as long as the price action remains below the T3 Average. When the price is below this indicator, it suggests that the price is likely to continue trending downward.

Whipsaws - This particular indicator is smoothed, rendering it resistant to generating false breakouts (whipsaws). Its smoothed nature translates to diminished responsiveness to sudden price spikes: therefore, a sharp rise in price will not distort the data utilized for its calculation and plotting.

Get More Topics: