Forex News Trading: A Fundamental Analysis Guide to Interpreting Forex Economic Reports

A trader has to first grasp Economic News Reports and know where to locate these Economic News Reports they will be using in their Fundamental Analysis Strategy before they may begin news trading. Economic Calendars will have the Economic News Reports. These Online Economic Calendars also let you see when these Economic Reports come out.

Economic news releases frequently cause significant changes in the currency market, giving break-out traders numerous possibilities for short-term trading, according to Forex News Trading.

However, not all financial news stories are useful for trading. Some news reports greatly affect the market, but others have no impact. By checking the forex calendar, traders can see how important upcoming news is and decide if it's worth trading on.

The Forex news announcements are marked in terms of significance. There are three levels of significance: RED, ORANGE, GREEN. Most significant news reports are marked & labeled in red: the least substantial ones are marked & tagged in green, while those marked and labeled in color orange are in between.

Two Main Ways to Trade Forex News Events

Trading the break-out channel

Forex traders place buy and sell stops on both ends of a price channel. When news hits, one order often triggers. This easy news plan has risks. The report might shake the market and hit both orders. Traders then lose on one or both sides.

By analyzing the news report

Forex traders can predict outcomes from economic news by reviewing forecast and previous values on an economic calendar. Comparing these figures against released data provides insights into present economic conditions.

Forex Traders watch the news report and pay attention to the actual numbers released. If the numbers come as a surprise meaning the news reports are not close to what was expected or forecasted, then fundamental analysts opening forex position according to the economic news reports. If the news report is better than expected then fundamental traders open Long positions. If the news reports are not favorable - traders open Short positions.

In forex fundamental analysis, grasp what the market expects from economic indicators. Analysts predict the likely data for an upcoming release. Traders position based on these forecasts, which affect the market. The real impact hits only if the actual report differs from expectations. Public data on economic news gets priced in by traders already.

Example of Forex Trading News

The most effective news approach is to plan the timing of news releases around the economic calendar in order to trade these foreign exchange economic data reports. Before and after the publication of economic data reports, a trader will maintain a schedule of these dates and plan out how to trade the information.

Check an economic calendar to see when key data releases happen. The forex version lists times for news reports on currency events. Experts in finance and economics build this calendar from global news and economy studies. It covers all upcoming announcements for the next 30 days.

By having this economic calendar a Trader can schedule when to trade these economic data reports well in advance. To get a copy of this calendar a trader can search for "Forex Calendar" and you'll find a couple of these forex calendars online hosted on various web sites.

An Economic Data Calendar will generally have 3 readings:

- Previous Reading

- Forecast

- Actual News

Previous Reading: This segment of economic data reveals the value recorded in the preceding economic news release. Most fundamental news reports are presented in either numerical figures or percentage units.

Forecast gives the expected value for the news report. Experts predict this number well before the release date. Economic analysts share their predicted figures.

- If the fore-cast number is better than the prior, Forex Traders will buy the currency associated with the good forecast

- If the fore-cast number is worse than the previous, Forex Traders will sell the currency associated with the bad forecast

Actual News Announcement

This Factor Decides Big Forex Moves or Flat Action.

If the actual reported economic data aligns exactly with prior forecasts, minimal market fluctuation is expected. This is because Forex traders had already anticipated this data and acted on it even before the official release of the economic figures.

If the actual news release is not the same as the fore-cast, this will come as a surprise to the FX traders, if the forecast & actual info release is not the same then, the traders will have to adjust their forex trades accordingly & this will cause a price reversal in the opposite trend market direction.

If the real news data beats forecasts by a lot, the forex market keeps pushing in its current path. It picks up even more speed that way. If the news comes in worse than expected, the price keeps moving as before. It gains extra push and heads farther in that direction.

Examples - Forex News Trading Example:

When new information is announced or made public, it only affects the market if it is different from what people thought it would be. If the news data is what people were expecting, it does not affect the price of a forex currency, because that information was already known and considered.

To use forex fundamental analysis, you should first know about economic market indicators, which are also called forex economic indicators. Economists create a forex economic data calendar that includes all the important economic indicators. Economists also use this calendar to guess what different news reports will say. Market analysts give these guesses. This can really change the market. Traders will pay attention to news that has a big effect on the financial markets.

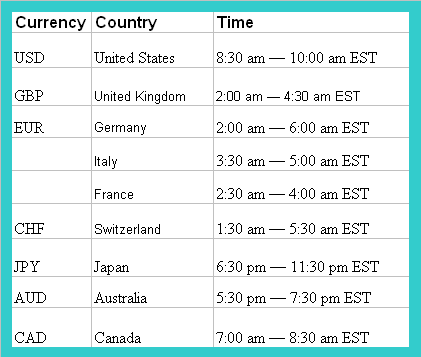

Economic News Times: Forex Trading Tips

Schedules for the release of Key Economic Data from major global economies and the primary currency pairs actively traded in the financial markets.

Courses and Courses to Learn More:

- MT4 Indicator RSI Technical Indicator

- Gold MT4 Online Trade Software Platform

- RSI Overbought and Oversold Levels: RSI 70 & RSI 30 Levels in Forex

- How to Effectively Utilize Trading Strategies in Conjunction with a Chart

- Kurtosis Analysis within MT5 Technical Trading

- Which are the Most Traded Forex Pairs in Trade Forex?

- SPAIN35 Trade System

- EURDKK System EURDKK Trade Strategy

- What's Kase Peak DevStop 2 Trading Indicator?