Medium-Term Trade Strategy

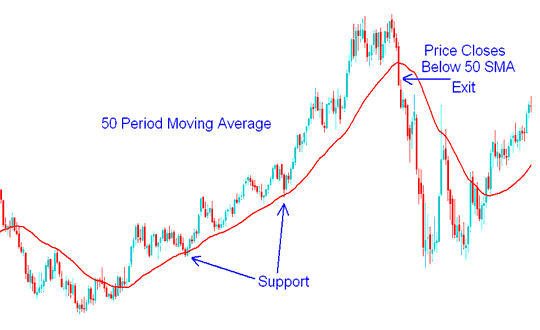

Medium-term MA trading strategy will use the 50 period MA.

The 50 period MA acts as support resistance level for the Indices price.

In an upward trend for stock indices, the 50-period moving average (MA) often acts as a support level. Prices typically bounce upwards upon touching this MA, while closing below it may signal an exit point.

50 Moving Average Period Support - Indices Trade Strategy Examples

In a down Stock Index trend the 50 period MA will act as a resistance, Indices price should always go down after touching the moving average. If the Indices market closes above the indicator then this is an exit signal.

Utilizing a 50 Moving Average Period for Resistance in Indices Trading Strategy Examples

50 Day Moving Average(MA) Indices Trade Analysis

Watch the 50-day index moving average as the trend climbs. Staying above it sends a positive sign. A drop below on high volume warns of trouble. It might mean a trend reversal coming soon.

A 50-day moving average for indices uses 10 weeks of data to plot the average. It updates daily. The line reveals the trend: up, down, or flat.

You normally should only buy when Stock Index prices are above their 50 day Indices MA. This tells you the prevailing market direction is trending upward. You always want to trade with the Indices trend, & not against it. Many traders only open orders in the direction of price trend.

Usually index values will find repeated support at this 50-day level. Average indices motion. Mutual funds, pension funds, and hedge funds among other big and large investment firms pay great attention to this level. These large volume companies see it as a chance, to increase to, or create and start a fresh trade position at a reasonable level, when they spot a trend dropping to its 50-day line.

If the price falls and breaks below its 50-day line on high volume, it's a clear sell signal. Big institutions are likely selling shares. This can lead to a sharp drop, even if basics seem fine. But if it dips just below on low volume, watch the next few days. Act if needed.

Learn More Guides and Lessons: