Divergence Plays - Bearish and Bullish Trades Explained

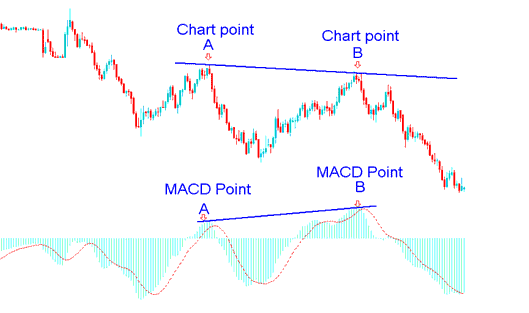

Divergence Explained: Divergence is recognized as one of the trading patterns utilized by market participants. It involves comparing the readings of a price chart against a secondary trading indicator. For this illustration, we will employ the MACD.

To identify this divergence pattern, locate two points on the chart where the price establishes a new peak (swing high) or a new trough (swing low), but the MACD indicator fails to do so, signaling a discrepancy between price action and momentum.

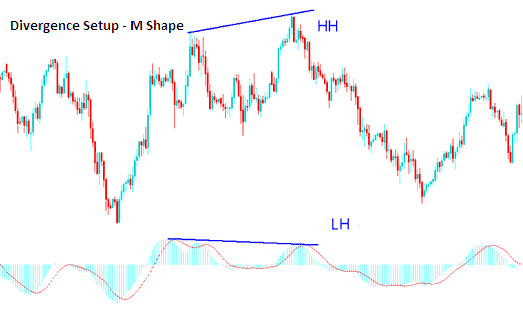

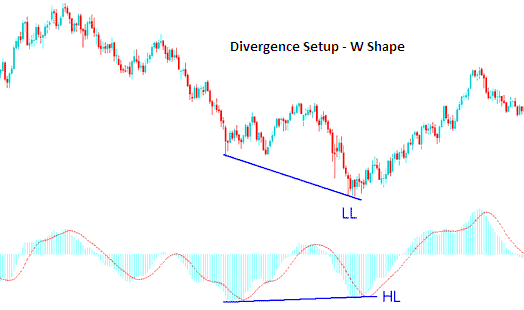

To search for divergence setup we look for 2 points, 2 highs which form an M-shape on the chart or 2 lows that form a W Shape on the trading chart. Then look for same M-shape or W-Shape on indicator which you use to trade - for examples RSI or MACD.

Explanation of a Divergence Trading Setup:

In the EUR/USD chart below, we see two points: A and B, both swing highs. They create an M-shape on the price chart.

Using MACD, traders analyze the highs indicated by MACD, specifically those situated just below chart points A and B.

We then draw one line on the chart & another line on the MACD.

Techniques for Drawing Divergence Lines: Applications in Bearish and Bullish Forex Divergence Trading

The chart illustration above showcases an example of one of the four recognized divergence configurations. The specific divergence configuration displayed is termed hidden bearish divergence, considered among the most favorable types for active trading as it generates signals that align with the current prevailing market trend. The various types of divergence arrangements will be explored in detail in the subsequent instructional lesson.

How to Identify Divergence Setups

In order to spot & identify divergence signal we look for following:

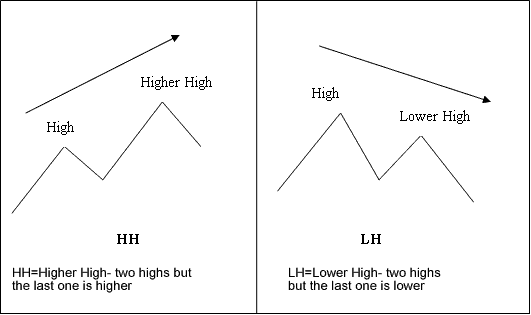

- HH = Higher High - two highs but the last one is higher

- LH = Lower High - 2 highs but the last one is lower

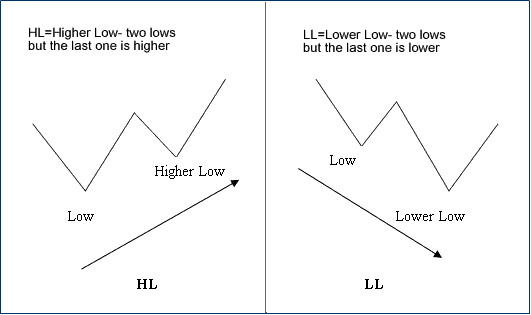

- HL = Higher Low - two lows but the last one is higher

- LL = Lower Low - 2 lows but the last one is lower

First let us look at the explanations of these divergence trading terms:

M-shapes on charts dealing with price Highs

W Shapes on charts dealing with price lows

Explanation of M-shapes on fx Charts

Examples of W Shapes on fx Charts

Having grasped the terminology used to describe different divergence conditions, we will now examine the two primary categories of currency divergences and the appropriate charting techniques for trading these divergence setups.

There two divergence types which are:

- Classic Divergence

- Hidden Divergence Trading Setup

These two divergence setups - classic divergence and hidden divergence are explained on the following learn guides in the next lessons - divergence definition lessons.

Learn More Topics and Courses: