Kase Peak Oscillator and DevStop 2 Signals

Conceived and Constructed by Cynthia Kase

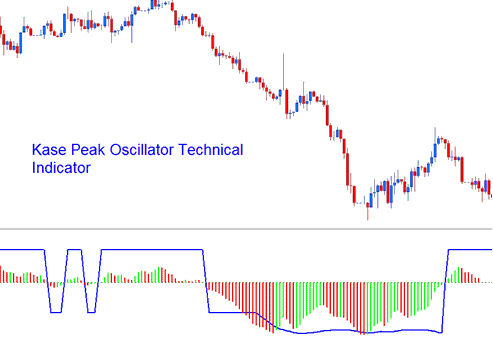

The Kase Peak Oscillator technical indicator is used in same way as other traditional oscillators indicators, but the oscillator is derived from a statistical evaluation of the trend: this statistical evaluation analyzes over 50 different trend lengths. The oscillator is capable of automatically adapting itself to the cycle length & volatility changes of the trend.

Kase Peak Momentum Gauge

Bars under the middle line mean downtrends. Those above signal uptrends. Crosses mark spots to enter or leave trades.

Kase DevStop 2 Indicator

Developed by Cynthia Kase

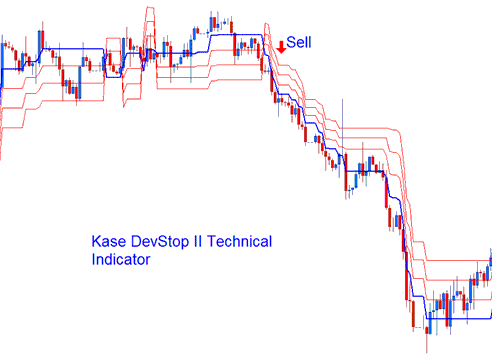

The Kase DevStop 2 calculates an average measure of recent price fluctuation, combined with three standard deviations derived from that average movement.

XAU USD Analysis of the Kase DevStop II Indicator

This Indicator is used to determine realistic points to exit trade positions based on volatility, variance of the volatility & the volatility skew. This indicator draws 4 lines. 4 lines are described as a Warning Line and 3 Standard Deviation Lines of 1, 2 and 3. These lines allow traders to take profit order or cut losses at levels where probability of a position remaining profitable is very low, at the same time without taking and incurring more of a loss or cutting profit at any time sooner than it is necessary.

Kase DevStop 2

Traders use the 3 red lines to set where they will exit trades or place stop loss levels. The DevStop II shows the price trend.

Review More Lessons, Tutorials, and Courses