Divergence Gold Setups

The Divergence Setup ranks as a key trading method for traders. It pairs a price chart with an extra indicator. In our cases, we pick the MACD indicator.

To identify this trading setup, locate two chart points where the price forms a new swing high or low while the MACD does not. This divergence between price and momentum indicates a potential trade signal.

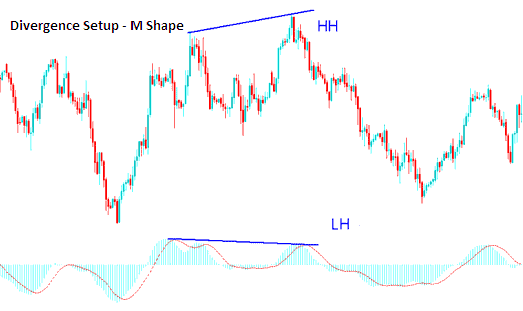

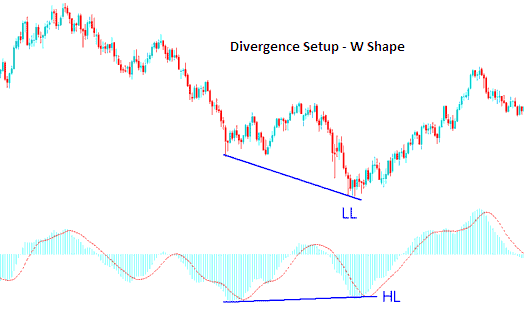

If you're hunting for a divergence setup, look for two points on the chart - two highs that make an M-shape, or two lows that form a W on the XAUUSD chart. Then check your indicator for the same pattern. That's your signal.

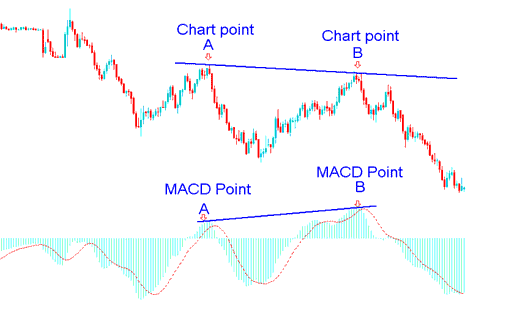

Example illustration of a Divergence Setup:

In the chart below, we spot two points, A and B, both swing highs. They create an M shape on the price chart.

Subsequently, employing the MACD, we examine the peaks registered by the indicator: these peaks consistently fall vertically underneath Chart points A and B.

We then draw one line on the Trading chart & another line on MACD indicator.

Drawing Divergence Lines

The chart displayed above illustrates an instance of one of the four recognized categories of divergences: the specific one shown is identified as hidden bearish divergence, which is often considered one of the superior types for trading. The various types of divergence configurations will be examined in the subsequent lesson.

How to identify divergence setup

To pinpoint a potential XAUUSD trading divergence setup signal, we look for the following evidence:

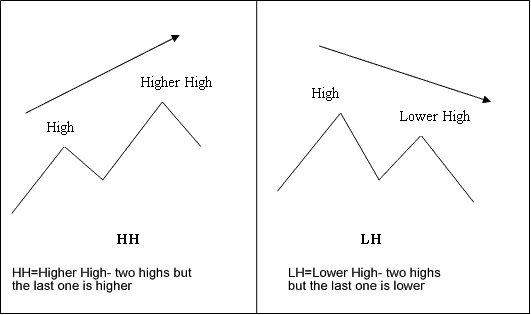

- HH = Higher High - 2 highs but last is higher

- LH = Lower High - two highs but last is lower

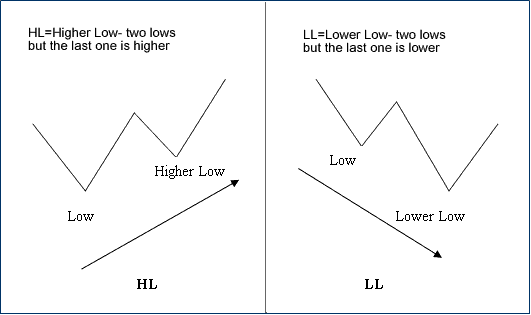

- HL = Higher Low : 2 lows but last is higher

- LL = Lower Low - 2 lows but last is lower

First let us look at the illustrations of these trading terms:

M-shapes dealing with price Highs

W Shapes dealing with price lows

Example illustration of M-Shapes

Examples of W-Shapes

Now that you've learned divergence terms used in setups, let's explore the two types of divergences and demonstrate how to effectively trade these chart patterns.

There two types are:

- Classic Divergence

- Hidden Trade Divergence

These two setups are explained on the following guides below

Study More Guides and Topics: