How Do You Interpret/Analyze When a Market Trend is Beginning?

How Do You Trade When a Trend is Starting?

Steps to Identify a Beginning Trend

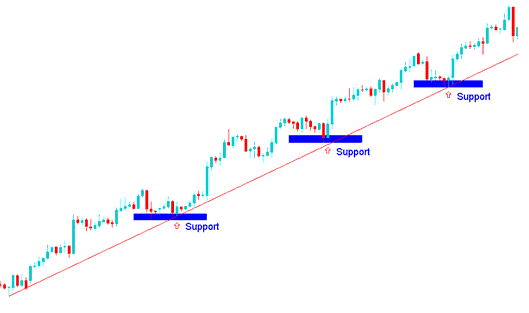

When Does a Upwards Trend Start?

Lesson Module: Determining the Start of an Ascending Price Trend - Identifying When an Upward Movement Commences

Example of How Do You Know When a Upwards Trend is Starting

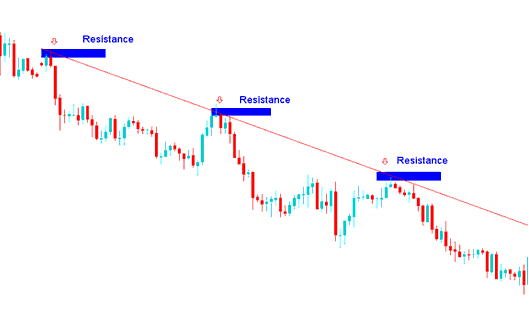

When Does a Downwards Trend Start?

Instructional Module: Identifying the Onset of a Declining Price Trend - Determining the Commencement of a Downward Trajectory

Example of How Do You Know When a Down Trend is Starting

The current trend is your friend and is a common saying among traders because you should never trade against the trend when trading foreign exchange. This is a very reliable way to trade Forex because when prices begin to head in a specific direction, they might continue that way for a while. So, using this trending technique allows for chances to gain profits.

Principles of How Can You Draw Forex Trendlines?

Use candle charts to draw trendlines

- The areas used to draw the trend-line - up-ward trend line are along the lows of price bars in a bullish market. An upwards bullish trend is defined by higher highs & higher lows.

- The points used to draw the trend-line - downwards trend-line are along the highs of the price bars in a bearish market. A downwards bearish trend is defined by lower highs and lower lows.

- The points used to draw the trend lines are extremes points - the high or the low price. These extreme price areas are critical because a price close beyond these extremes tells traders the trend of instrument might & may be changing. This is an entry or an exit signal.

- The more often a trendline is hit but not broken, the more powerful its market signal.

How Do You Analyze When a Trend is Starting?

Study More Lessons and Tutorials and Courses: