FTSEMIB40 Index

The FTSE MIB 40 index follows the 40 most active stocks on the Borsa Italiana, which is the Italian stock market. People also call this index the Italian 40 Index. The 40 stocks in this index come from the most traded stocks in the Italian economy's most successful areas.

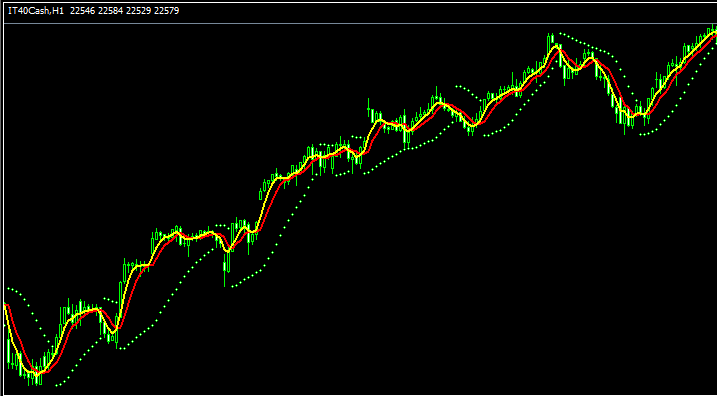

The FTSE MIB 40 Stock Index Trade Chart

FTSEMIB40 Index trading chart is shown and shown above. On the above illustration this financial instrument is named IT 40CASH. You want to find a broker who offers FTSE MIB 40 Stock Index chart so that as you can begin to trade it. The example Which is shown above is that one of FTSEMIB 40 Stock Index on the MT4 Forex Software Platform.

Other Info about FTSE MIB 40 Index

Official Index Symbol - FTSE MIB:IND

The FTSE MIB 40 Stock Index is composed of 40 equity components selected from the most profitable corporations operating within Italy. These specific shares/stocks are also drawn from the most financially robust sectors across the Italian national economy.

Strategy to Trading FTSE MIB 40 Index

FTSE MIB 40 index in general moves upwards over longterm because the stocks choosen represent best sectors in the Italian economy thenceforth in general this index will keep heading up over time - because these sectors will be doing booming business.

As a participant interested in trading this specific Index, your trading bias should generally lean towards the upward trajectory of this Stock Index.

If the index is advancing, your intent is to maintain a buying bias. Given that the Italian economy frequently exhibits strength, this upward market momentum is highly likely to persist. A sound strategy for index trading in such conditions would be to purchase during temporary price dips.

During Economic SlowDown and Recession

During periods of economic downturn and recession, companies start to report diminished profits and reduced growth forecasts. Consequently, traders begin to divest stocks of businesses that are announcing and recording lower earnings, leading to a downward movement in the Index that tracks these specific shares.

Because of this, market trends at these times are more than likely going to be moving downwards, so as a trader, you should change your plan to match the downward trends of the index you are trading.

Contracts & Details

Margin Required Per 1 Contract - € 250

Value per Pips - € 1

The pip value for IT 40CASH is set at €1, which can be compared to the pip values of other indices like Germany DAX and EUROSTOXX 50 that have a pip value of €0.1 per lot. However, the average pip movement for this index tends to be considerably lower when compared to other indices like DAX30 and EURO STOXX.

NB: Even though general trend is in general move upward, as a trader you've to consider and factor in the daily market price volatility, on some of the days the Indices may & might move in a range or even retrace and pull back, market pullback/retracement move may also be a large one at times & therefore you as a trader you need to time your entry precisely using this trading strategy: Stock strategy & at same time use the proper and appropriate money management methods & guidelines just in case there's unexpected market trend volatility. About money management principles and guidelines in stock indices trading lessons: What's Stock index money management guidelines/rules and money management techniques.

Explore Further Manuals & Training: