Stochastic Trading Strategies

- Three Diverse Categories of Stochastic Oscillator Indicators

- How does the stochastic trading indicator work?

- Understanding Overbought and Oversold Oscillator Levels

- Studying How the Stochastic Oscillator Can Be a Useful Tool

- Signals from Stochastic Crossover

- Signals for Stochastic Divergence Setups

- Stochastic Trading Systems

Stochastic Oscillator Trading Strategy

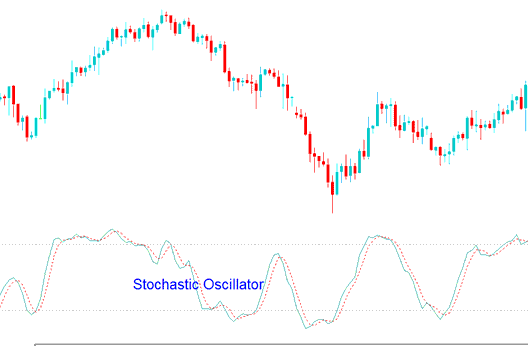

The Stochastic Oscillator Functions as a Momentum Indicator Gauging an Asset's Underlying Strength.

The Stochastic Oscillator operates on the premise that during an uptrend, price action generally settles near the high of the respective price candle, whereas in a downtrend, price action typically concludes near the low of the price candle.

The Stochastic Oscillator serves to map out the momentum of current market trends and clearly identifies areas categorized as oversold or overbought.

The Stochastic Oscillator is a popular technical tool. Many traders follow its signals, so they often come true on their own.

Stochastic Oscillator is used to identify certain patterns, like divergences.

The Stochastic Oscillator possesses the capability to provide early indications regarding potential future price movements, classifying it as a Leading indicator.

The Stochastic Oscillator creates more signals than other key momentum tools. Pair it with additional technical indicators for best results.

Stochastic Oscillator is comprised of 2 lines one called the fast-line and the other slow line. These 2 lines move in the direction of the price trend.

Stochastic - Stochastic Oscillator Strategy

More Tutorials and Guides & Lessons: