How Stochastics Oscillator Technical Works

The Stochastic oscillator uses periods for fast and slow lines. %K and %D depend on the trader's goal with this forex tool.

- A trader using the Stochastic oscillator indicator in combination with a trend indicator to see overbought & oversold levels, one can use periods 10 periods.

- The default period used by the stochastics technical indicator is 12.

Forex traders should temper their decision-making by avoiding sole reliance on the stochastic indicator: instead, it should be used in conjunction with other supplementary technical indicators.

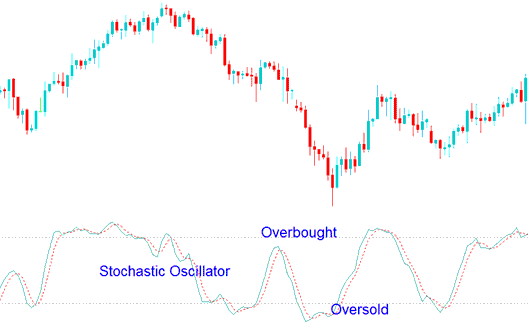

In ranging markets this Stochastic oscillator technical technical indicator can be used to illustrate oversold/overbought levels as potential profit booking points when trading the market.

Oversold & over-bought levels by default are 20 and 80, but other traders use 30 and 70.

To look for 'overbought' region at the indicator's 80% stochastic forex oscillator mark is used

To look for 'oversold' region 20% stochastic forex oscillator mark is use.

The overbought and oversold areas are shown as dotted lines on the stochastic oscillator trading indicator. These areas can also be changed to the 30 and 70 levels.

Overbought and Over-sold Levels on Stochastic Indicator

More Lessons and Tutorials and Courses:

- How do you trade an XAU/USD chart if you're a beginner?

- How to Get MT4 EURUSD Chart

- Overview of Gold Market Session Overlaps and the Three Primary Trading Sessions

- How to Analyze and Trade Based on Overbought and Over-sold Levels for Indices.

- How Can I Set GBPHKD Chart to MT4 Software/Platform?

- Analyzing and Interpreting Trade Charts Using Indicators

- Establishing a Suitable XAUUSD Leverage Ratio for Traders New to the Market

- Guide to Positioning the Recursive Moving Trend Average Indicator on Your Chart

- How to Choose & Select Best Linear Regression Acceleration Trading Method

- Setting up new gold orders in the tools menu on the MetaTrader 4 platform.