What's Linear Regression Acceleration Indicator?

Linear Regression Acceleration - Linear Regression Acceleration indicators is a popular indicator which can be found in the - Indicators List on this site. Linear Regression Acceleration is used by the traders to forecast price movement depending on the chart price analysis done using this Linear Regression Acceleration indicator. Traders can use the Linear Regression Acceleration buy & Sell Trading Signals explained below to figure out when to open a buy or sell trade when using this Linear Regression Acceleration indicator. By using Linear Regression Acceleration and other indicators combinations traders can learn how to make decisions about market entry and market exit.

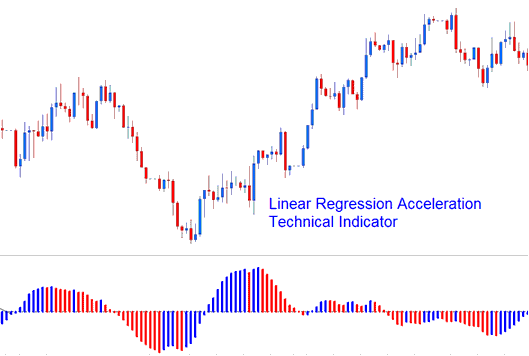

What is Linear Regression Acceleration Indicator? Linear Regression Acceleration Indicator

How Do You Combine Indicators with Linear Regression Acceleration? - Adding Linear Regression Acceleration in MT4 Platform

Which Indicator is the Best to Combine with Linear Regression Acceleration?

Which is the best Linear Regression Acceleration combination for forex trading?

Most popular indicators combined with Linear Regression Acceleration are:

- Relative Strength Index

- MAs Moving Averages Trading Indicator

- MACD

- Bollinger Band

- Stochastic Oscillator Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best Linear Regression Acceleration combination for Forex trading? - Linear Regression Acceleration MT4 indicators

What Indicators to Combine with Linear Regression Acceleration?

Get additional indicators in addition to Linear Regression Acceleration that will determine the trend of the price and also others that confirm the market trend. By combining forex indicators which determine trend and others that confirm the trend and combining these technical indicators with FX Linear Regression Acceleration a trader will come up with a Linear Regression Acceleration based system that they can test using a demo account on the MT4 software.

This Linear Regression Acceleration based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is Linear Regression Acceleration Based Trading? Indicator based system to analyze and interpret price and provide trade signals.

What's the Best Linear Regression Acceleration Forex Strategy?

How to Choose & Select the Best Linear Regression Acceleration Forex Strategy

For traders researching on What is the best Linear Regression Acceleration forex strategy - the following learn forex guides will help traders on the steps required to course them with coming up with the best strategy for forex market based on the Linear Regression Acceleration system.

How to Develop Linear Regression Acceleration Forex Systems Trading Strategies

- What is Linear Regression Acceleration Trading Strategy

- Making Linear Regression Acceleration Forex Strategy Template

- Writing Linear Regression Acceleration Forex Strategy Rules

- Generating Linear Regression Acceleration Forex Buy & Linear Regression Acceleration Sell Trading Signals

- Making Linear Regression Acceleration Trading System Tips

About Linear Regression Acceleration Described

Linear Regression Acceleration Technical Analysis and Signals

Linear Regression Acceleration calculates the change in the regression line's gradient on the current price bar from its gradient from the previous price bar. The value used in calculating the linear regression is referred to as the normalized acceleration reading which is plotted for each price bar formed on the price chart.

Linear Regression Acceleration

If normalized acceleration is 0.30, then regression line normalized slanting slope will be moving up at a rate of 0.30 per each price bar.

Similarly, a normalized slope of -0.40 would signal that the regression line normalized slope is declining/falling at rate of -0.40 per each price bar.

For example, if the current price bar normalized slope value is 0.40 & the previous price bar normalized slope value is 0.20, then the normalized acceleration of current bar would be calculated as 0.40 - 0.20 = 0.20.

Note: It is crucial to realize that a positive acceleration value does not equate to a positive slope value, it simply means the the slope's gradient is increasing. A negative acceleration reading does not equate to a negative slope value, it simply means that the the slope's gradient is decreasing.

Implementation of the Linear Acceleration Regression Trading Indicator

The Linear Regression Acceleration indicator allows for the following; price selection, regression periods, smoothing of raw price before applying the regression & selection of the smoothing out type.

Resulting regression slope is displayed as a bi-colored histogram that oscillates above and below 0.

reference line is set at 0 mark.

- A rising upward slope: (greater and higher than its previous value of one bar before) is displayed and illustrated in up slope color.

- A falling slope: (lesser than its previous value of one bar before) is revealed using the down slope colour.

More Courses: