TIPS: MAXIMIZING PROFITS OF FOREX SYSTEMS

1. Define Simple Rules and Follow the Market Trend

It's better to have a system that is easy to understand. If the trading system is too hard to follow, it will be very difficult to stick to the rules. Complex systems also cause a lot of confusion. It's easier to stick to the rules with a simple strategy.

2. Eliminate Risk Quickly and Let Profits Run

Minimizing risk is far more important than making money when trading the trading market. Our first objective in forex is to make the trade less risky. We do and achieve this by entering only the high probability trade setups, setting stop loss orders, cutting losses quick & never average down, and letting the profitable trade positions run for sometime, just long enough, but not very long, so as to increase profits. Profitable trade positions are only held open as long as the strategy shows the trend is in place, these trade transactions should be closed immediately once your exit trading signal criteria is generated and given by the trading system.

3. Select & Choose the Right Forex Currency Pairs

Once you as a trader have your trading system, you'll want to start & begin testing it on a demo account. Currencies have their own characteristics different from others. EURUSD, GBPUSD USDJPY, USDCHF are ideal. A system will give different results for each forex currency pair.

To get the most out of your plan, find the times when the market is busiest for a currency pair and only trade when it is busiest.

4. Use Funds Management Trading Strategies

Always limit your risk to less than 2% per trade. With compounding effects, you'll be amazed at how rapidly your trading account can grow when operating under a profitable system.

5. Keep a Journal

Keep a log of all your trades. It'll make you better - seriously. A trading journal helps you stick to your system's rules, track your wins and losses, and dig into why certain trades worked and others didn't.

6. Add take Profit Targets

Set profit goals for daily, weekly, and monthly trades. Hit the target, then close positions. This cuts overtrading and protects gains. Aim for a 3:1 reward-to-risk ratio. Trade only when wins could triple your risk.

Example illustrations of signals derived & generated by our trading system

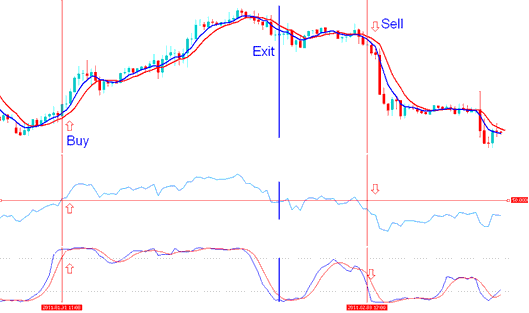

Example 1: Buy Trading Signal & Sell Signal Generated By Method – See how this method produces buy and sell signals.

A buy signal is generated by the indicator-based trading system: an exit signal is then generated prior to the derivation or generation of the very next contrasting sell trade signal appearing on this chart.

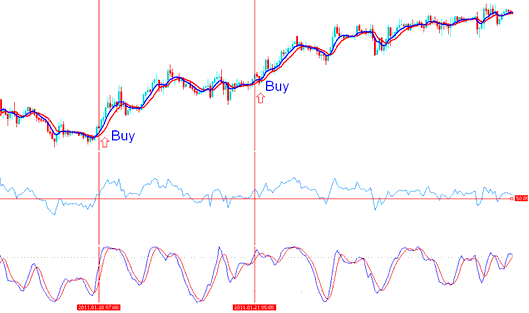

Example 2: 2 buy signals generated by Strategy

Two buy signals are created and shown during a market that is trending upward - How to Use System Rules to Create Signals

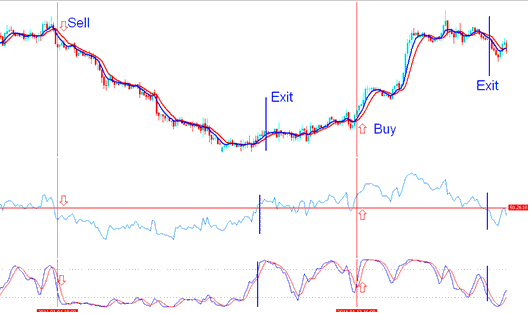

Example 3: System-Generated Exit Signal from Trade Rules

Examples of Signals Derived and Generated by a System - System Rules Signals

Other Tips

Learn Education Training Tutorial

First, learn the market through lessons. Traders who skip guides won't get better, no matter the tips. Without study, they repeat beginner errors blindly. Forex covers a lot, so learn basics to make profits.

Get a Strategy

A trade strategy is a must for every trader, a system is used to determine what decision to take. A trading strategy generates a trader an edge over others who don't have a trading plan. A good plan is one that is back-tested & proven to produce profitable trade positions. After coming up with your system you should backtest it on a Practice Account.

Learn Money Management

Familiarize yourself with The Various Capital Management Tutorials: refrain from engaging in the online trading market unless you have established money management protocols. The two crucial management guides for any forex trader to master are:

What Constitutes Sound Money Management?

Techniques for Managing Capital in Foreign Exchange (FX)

Learn about Leverage and Margin

If you don't know what is leverage and how it works and how it can affect your margin, then you'll not make any money in the currency market and you'll most likely lose your money in the market.

Have a Written Down Plan

A trading plan will use all of the forex trading tips mentioned and put them together in one document that you can use when trading in the online market.

In General

The first goal should be taking your time to really determine what your trading goals are and how much money you wish to make. Once this is determined then the following 3 suggestions will help you on your way to begin & start Trading. It is essential to keep all the 3 goals in mind when executing all of your trade positions but at the same time this is not a black & white tutorial to trading success.

The first thing to keep in mind is that you really need to focus on short-term trading positions until you become profitable and know how to properly keep track of these trading transactions. You should trade short-term because, as a forex trader, this allows you to monitor your open positions and quickly close any position where the trading signal changes direction. To benefit from the strategy, you need to be willing to put in the effort to watch the market and see how long you, as a forex trader, can keep your money invested in the online trading market. Making short-term investments will help you monitor your trades and manage the risks: don't leave orders open when you're away from your computer or when you go to sleep: close all trades and only open/execute trade orders when you can watch them.

While it is crucial to elevate the volume of trade operations during your trading engagements, it is essential to adhere to certain forex trading principles. A widely accepted guideline for managing funds is to avoid risking more than 2 percent of your overall account balance in any single trade. This advice is practical when your account holds substantial funds, but what if your total is merely in the hundreds? For instance, 2 percent of a $10,000 account amounts to $200. Although following this principle is generally safer, it does not seem as logical for smaller trading accounts. In Forex trading, the application of leverage can make a significant impact in such scenarios. Typically, having more forex capital to allocate improves equity management.

A final idea is to take some time to be sure that you have all your information right before you start any trade, as this will be the best way to do things. Keeping things simple makes sense on the Forex market just like it does everywhere else. Even though it might take more time and effort to make money trading, it will save you money over time.

Trying to maintain your thinking as clear as possible will make your studying trading journey much easier but knowing when to breakaway from the norm also is important. Moving towards the right path will make success that much more easier to obtain and by studying all of the steps and logic you'll be able to continue to make profits. Forex is not hard to learn but a lot of traders lose money quickly because of not taking the proper steps in preparation & learning.

Get More Topics and Tutorials:

- What is the Value of a Forex Pip on a Regular Forex Account?

- Dow Jones 30 Index: Making Sense of the Trade Chart

- How do I use the Aroon Oscillator indicator?

- Using the Relative Strength Index (RSI) for XAU/USD

- RSI XAUUSD Bullish and Bearish Divergence Signals

- Interpreting and Analyzing Trading Charts by Utilizing Trends

- A Beginner's Guide to Starting Forex Trading with a Lesson

- USDSEK Open Hours & USDSEK Closing Time

- Overview of Awesome Oscillator Indicator

- Best Method to Trade the DAX 30 Index