RSI XAUUSD Technical Analysis and RSI Signals

Developed by J. Welles Wilder, this was illustrated in the book "New Concepts in Technical Trading Systems".

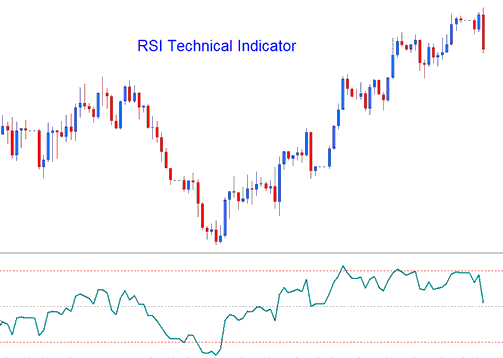

The Relative Strength Index (RSI) is a highly favored technical indicator functioning as both a momentum oscillator and a trend-following tool. RSI achieves this by comparing and contrasting the magnitude of recent upward price movements against the magnitude of recent downward price movements, plotting this comparison on a scale ranging from 0 to 100.

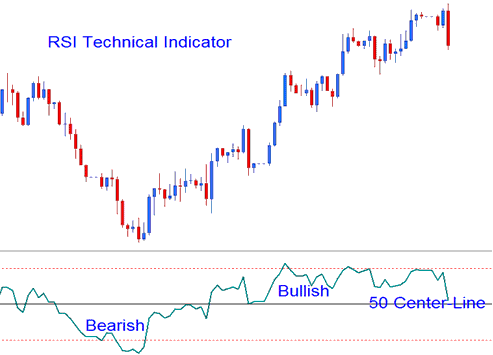

The Relative Strength Index quantifies the momentum of a financial instrument: readings exceeding 50 suggest upward market impulse, whereas values below the 50 center-line indicate downward market impulse.

- RSI is drawn as a green line

- Horizontal dashed lines are drawn to identifying over bought and oversold levels are - 70/30 levels respectively.

XAU/USD Technical Analysis and How to Generate Trading Signals

There are various techniques used to trade, these are:

50-level Crossover Signals

- Buy signal - when the technical indicator crosses above the 50 a buy/bullish signal is given/generated.

- Sell Signal - when the technical indicator crosses below the 50 mark a sell/bearish signal is given/generated.

RSI Gold Setup Patterns

Chartists have the capability to overlay trend lines and map out chart formations directly onto the RSI indicator display. The Relative Strength Index frequently produces XAUUSD patterns, such as a Head and Shoulders formation, that might not be distinctly visible on the primary price chart.

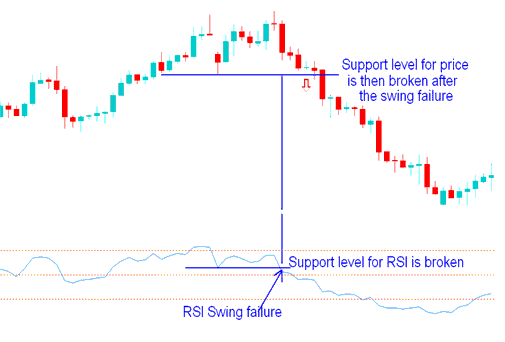

Gold Support/Resistance Break outs

RSI is a leading indicator and helps predict support or resistance breakouts before the price actually breaks those levels. RSI uses swing failure signals to spot when price is about to break through support or resistance zones.

Swing Failure - Support and Resistance Break out

Over-bought/Oversold Conditions in Trading Indicator

- Overbought levels above 80

- Oversold - levels below 20

These levels can give signals, like when RSI goes up from below 20 after being too low, buy, and sell when RSI goes below 80 after being too high, sell. These signals are not good for trading because they often give false alarms.

Divergence Setups

Divergence trading spots trend reversals. Four types exist. This indicator covers them. Check the divergence guide on this site.

Study More Topics and Guides: