UKX100 Index

UKX100 - Financial Times Stock Exchange Market, the UKX100 stock index represents the Indices of the top 100 largest firms in UK which are shown in London Stocks Market. The calculation of this index incorporates stocks which are determined quarterly. These shares included in UKX 100 Stock Index represent 80% of total market value of London Stock Exchange displayed firms.

Because the UKX100 Stock Index tracks 100 corporations the index will be more volatile as when compared to an index like Germany DAX30 which only monitors 30 companies.

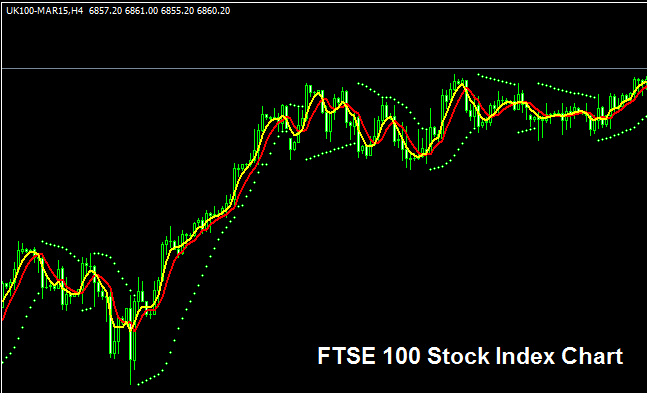

UKX100 Trading Chart

UKX100 chart is displayed & shown above. On above example the index is named UKX100CASH. You want to find an online broker who offers UKX100 Stock Index chart so that as you as a trader can begin to tradeit. The example Which is illustrated & shown above is the one of UKX100 Stock Index on MT4.

Other Data about UKX 100 Stock Index

Official Index Symbol - UKX:IND

The 100 component stocks that constitute UKX100 Stock Index are selected from top performing United Kingdom(UK) corporations. The UKX100 share index is closely followed as an indicator of the performance of UK businesses. The components that make up this stock index are revised quarterly. The calculation of this stock index is a simple formula based on the market capitalization.

Strategy for Trading UKX100 Index

UKX100 Stock Index represents relative trend movement of the top 100 shares in UK. In general the share value of the top 100 corporations will keep moving upwards, hence this stock index also will over time keep heading upwards. Should a company not meet required business expansion targets, the corporate will be removed from the index and replaced with an alternative company that has better business growth prospects.

As a trader wanting to trade this Stock Index, the over-all general market direction sentiment at any one particular time will likely be bullish than bearish. This is because as long as the 100 corporations being tracked and monitored are doing booming business, then their share value will keep moving & heading upwards, & hence this stock index will also keep moving & heading in an upward trend.

As a stock index trader you want to be biased and keep on buying as the index heads & moves upwards. When UK economy is performing good (most times it is performing well) this upwards trend is much more likely to be in place. A good stock index trading strategy would be to keep buying and buy the dips.

During Economic Slow-Down & Recession

During economic slowdown & recession periods, companies begin to report slower profits and lowers growth projections. It's due to this reason that traders begin to sell shares of firms that are announcing lower profits and hence Indices tracking these specified stocks/shares will also start and begin to move downwards.

Hence, during these times, market trends are more likely to be going & moving downwards and you as a trader should also adjust your strategy accordingly to fit the prevailing downward trends of the index which you as a trader are trading.

Contract Specs

Margin Requirement per 1 Lot - £ 70

Value per Pips - £ 0.1

Note: Even though general and overall trend is generally move upward, as a trader you've to consider and factor on daily market price volatility, on some of the days the Indices might move in a range or even retrace and pull back, the market pullback move may also be a big one at times & therefore you as the trader you need to time your trade entry strictly using this trading strategy: Stock strategy & at the same time use the proper & suitable money management principles & guidelines just in case there is unexpected volatility in the market trend. About money management strategies in stock indices courses: What's stock index money management strategies/guidelines and index funds management methods.

Study More Lessons and Topics:

- Technical Analysis of Kurtosis Indicator

- Bulls Power Trading FX Bot EA EA

- How to Use MT4 Ultimate Oscillator Indicator

- How to Draw Fib Extension Levels in MT4 Trade Platform

- Linear Regression Acceleration XAUUSD Indicator Analysis

- How Can I Add Gold to MT4 Platform?

- How to Use MT4 Aroon Oscillator Indicator in MT4 Platform

- How to Trade DAX 30 Stock Index for Beginner Index Traders

- Where is AEX in MT5 Platform?

- How Do I Open a XAU USD Chart on MT4 Platform Software?