Germany DAX30 Index

The DAX 30 is Germany's Market Index, which includes the country's top Blue Chip Stocks. This Index includes the Top 30 Stocks that are most frequently traded on the Frankfurt Stock Market. Because Germany's economy is the biggest in the Euro Zone, the DAX30 Index is a popular Index that traders like to trade.

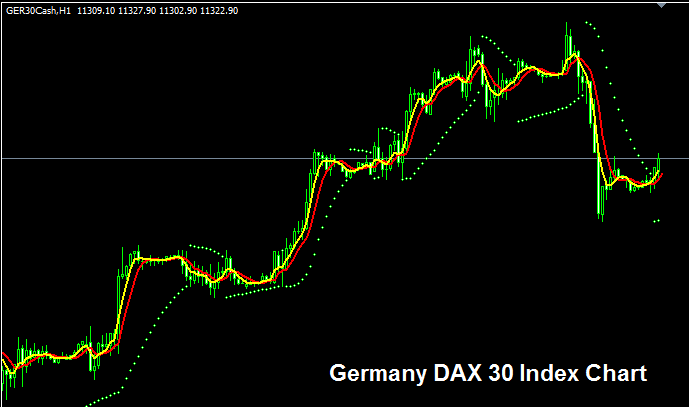

Similar to currency pairs, the Germany DAX30 Index also has a graphical representation that can be analyzed and traded by market participants. Traders retain the option to place buy or sell orders for this index using standard contract sizes/lots.

The Germany DAX30 Index Chart

The Germany DAX30 Index chart is shown above. In the image, it's named GER30CASH. As an FX trader, find a broker that offers the Germany DAX30 Index chart so you can trade it. The example is from the MT4 FX and indices platform.

Other Info about Germany DAX30 Index

Official Symbol - DAX:IND or GDAXI

The 30 component stocks that make up the Germany DAX30 Index are re-evaluated a few times a year to determine if to change this composition or not. Stocks which aren't doing & performing well and good might be replaced with other stocks which are doing well and good.

Strategy for Trading Germany DAX30 Index

The Germany DAX30 Index is composed of blue chip stocks that trade in the Frankfurt Stock Exchange picked from the top performing sectors in Germany: therefore a good strategy to trade the Germany DAX30 Index is to trade long most of the times. This is because in general the best stocks in Frankfurt Stock Market will in general keep moving up and up because the corporations behind these stocks/shares are the best and most lucrative corporations in Germany.

The Germany DAX30 Index gets updates a few times each year. A weak stock drops out. A strong blue chip takes its place. This keeps the index rising most of the time.

As an index trader, it is advantageous to maintain a bullish bias, continuously buying as the stock index exhibits upward momentum. Given the generally strong performance of the German economy, this upward trajectory is frequently the dominant market condition. A prudent strategy here involves buying during any minor price declines (buying the dips).

Contracts and Specifications

Margin Required Per 1 Lot/Contract - € 85

Value per 1 Pip(Point) - € 0.1

Note: The main trend heads up in general. As a forex trader, consider daily volatility. Some days, stocks could wobble or drop back. Those drops might run deep now and then. Time entries sharp with this indices strategy. Pair it with solid money management for surprise swings in the trend. For equity management lessons: What is money management and fund techniques.

More Tutorials and Topics:

- Kauffman Efficiency Ratio as an Indicator

- Types of Stock Index Analysis

- Trading Strategy for MACD Stock Indices

- Spotting RSI trend lines and index trends on trading charts

- Spotting Divergence on XAUUSD Charts for Trades

- SPX500 Trading System

- Determining the Margin Requirement for XAU/USD Trades Utilizing 1:50 Leverage on Gold

- XAU/USD Indicator: Ehler MESA Adaptive Moving Average (MA)

- Clarification of DeMarker Analysis

- Technical Indicator Aroon Oscillator Technical Indicator MetaTrader 4 Platform