Ehler MESA Adaptive MA Analysis and Ehler MESA Signals

Mesa Adaptive MAs was developed by John Ehler

Originally used to trade commodities and stocks.

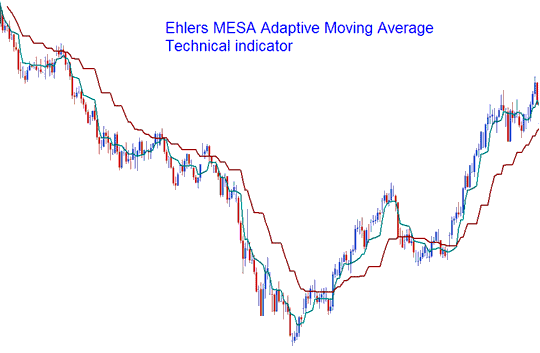

MESA Adaptive Average acts like two moving averages. But it steps up in lines, not smooth curves. The chart below shows it on price action.

Ehler MESA Adaptive Moving Average

The MESA Adaptive MA is a price trend following indicator that adapts to price action movement based on the rate of change of price as gauged by the Hilbert Transform Discriminator. This indicator will generate a signal when the two MAs cross one another. Trade Positions should be executed on the direction of the MESA averages.

This method involves both a swift moving average and a slower one, allowing the combined average to quickly adjust to price shifts and maintain its value until the closing of the next candle. Compared to traditional moving averages, this technical indicator is less susceptible to false signals due to the unique formula applied when computing changes in price.

Study More Courses and Guides: