FTSE 100 Index

FTSE100: Standing for the Financial Times Stocks Exchange Market, the FTSE 100 index reflects the collective stock value of the hundred largest corporations headquartered in the UK and listed on the London Stock Exchange Market. The composition of this stock index is recalculated via a quarterly review process. The stocks and shares included in the FTSE 100 Index collectively account for 80% of the total market capitalization of all companies listed on the London Stock Exchange.

The FTSE 100 stock index will be more volatile since it monitors 100 firms, unlike an index like the Germany DAX30, which only tracks 30 companies.

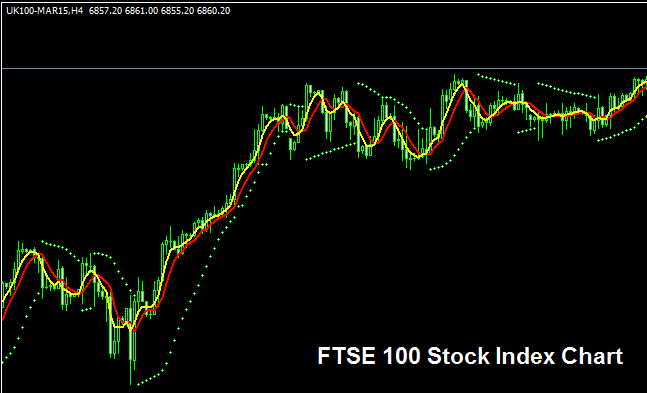

The FTSE 100 Index Chart

The FTSE 100 Index chart may be seen above. The index is referred to as UK100CASH in the example above. You need to locate an online broker that provides The FTSE 100 Index chart if you want to start trading it as a foreign exchange trader. The FTSE100 Index on the MT4 FX and Indices Software Platform is shown in the illustration above.

Other Info about FTSE 100 Index

Official Symbol - UKX:IND

The 100 stocks in the FTSE 100 Index are chosen from the biggest companies in the UK. People watch the FTSE 100 share index closely because it shows how well businesses in the United Kingdom (UK) are doing. The companies in this index are reviewed every three months. The index is calculated using a simple formula based on the value of the companies on the market.

Strategy for Trading FTSE-100 Index

The FTSE 100 Index shows the relative movement of the top 1 hundred stocks in the UK. In general share value of the top a hundred companies will keep moving upwards, therefore this index will also over time keep going upward. Should a company not meet the required business expansion targets, the company will be removed from the index and replaced with another company that has better business growth prospects.

For a currency trader aiming to trade this specific index, the prevailing directional bias at any given moment is expected to lean towards bullish sentiment rather than bearish. This expectation is founded on the premise that so long as the 100 constituent companies are performing well commercially, their corresponding stock valuations will continue their ascent, thus maintaining an upward trajectory for the index as a whole.

As a stock index trader, stay bullish and buy as the index climbs. The UK economy often does well, so upward trends hold. Buy the dips in that case.

Contracts & Specifications

Margin Required for 1 Lot/Contract - £ 70

Value per 1 Pip(Point) - £ 0.1

Note: The big trend points up overall. But as a forex trader, account for daily market swings. Some days, stocks might move side to side or pull back. Pullbacks can be big at times. So, time your entry with care using this indices strategy. Also, follow good money management rules for sudden price shifts in the trend. For lessons on money management: What is equity management and money methods.

Study More Lessons and Tutorials & Courses:

- How to Set US 100 in MetaTrader 5 Android App

- What is the Process for Trading Indices Using MetaTrader 5?

- Indicator Analysis of the Chandes Momentum Oscillator in Trading Contexts

- Analyzing the Gann Trend Oscillator in Market Trades

- What does gold margin level mean in MT4?

- Strategy for Stock Index Using Bollinger Bands

- Most Active Currency Pairs Right Now

- Trading Leverage Breakdown of 1:20 Ratio Defined

- DeMark's Range Projection Settings for Stock Indexes in MT4

- How do I analyze reversal setups if I'm a beginner trader?