Bollinger Bands Technical Indicator Strategy

The Bollinger Bands indicator functions as a gauge for measuring price fluctuation or market uncertainty. It is classified as a price overlay indicator.

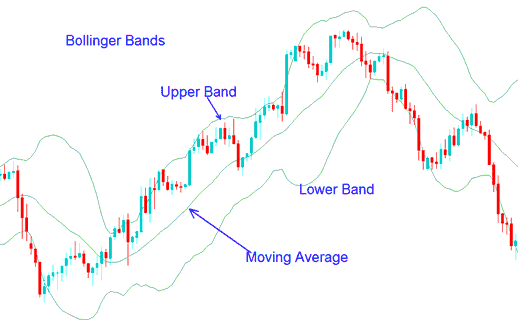

The Bollinger Bands indicator comprises three lines: the middle band (a moving average), an upper band, and a lower band. These bands encase the price, with market movements occurring within their boundaries.

Bollinger Bands are indicators that create upper and lower bands surrounding a moving average, with the default being the 20-period Simple Moving Average (SMA). These bands are calculated using the standard deviation formula to determine their positions.

The example of Bollinger Bands indicator is shown below.

Understanding the Bollinger Bands Indicator - A Strategy Guide for Trading Indices with Bollinger Bands

Because standard deviation measures how much prices change and the market's changes are always happening, the bollinger bands always change how wide they are. When prices change a lot, standard deviation is higher, and the bands get wider. When prices don't change much, the standard deviation is lower, and the bollinger bands get closer together.

Bollinger Bands forex indicator use price action to give a large amount of the price action movement information data. The price info given by this bollinger bands indicator includes:

- Periods of low volatility - consolidation phase of the market.

- Periods of high market volatility - extended trends, trending markets.

- Support & resistance levels of the price.

- Buy and Sell points of price.

Learn More Guides & Guides:

- Procedure for Opening a New Chart within the MT4 Platform Trading Software

- Pick XAUUSD Brokers: Key Factors for New Gold Traders

- Using the McClellan Oscillator Indicator in MetaTrader 5

- MetaTrader SMI20 Index: Stock Indices Trading with MT5 Software

- Bollinger Bands Price Action in Ranging Sideways Forex Markets

- How to Find and Get US 100 on MT4 PC

- Beginner's Guide: MT4 Chart Interpretation

- Trading the EU 50 Indices Trade Chart