Comprehensive Analysis of the McClellan Oscillator and Its Resulting Technical Signals

Developed & Created by McClellan.

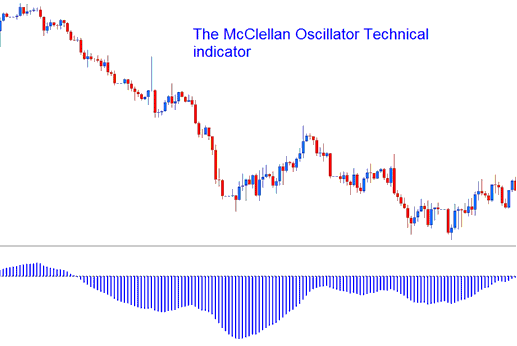

The McClellan Oscillator, an indicator whose calculation involves smoothing the gap between the count of advancing and declining candlesticks, bears a visual resemblance to the well-known MACD technical indicator.

McClellan Oscillator Indicator

FX Analysis and How to Generate Trading Signals

This Oscillator functions as a momentum indicator and can be utilized for trading in a manner similar to the MACD. There are three distinct techniques or methods by which the McClellan Oscillator indicator can be employed to generate trade signals.

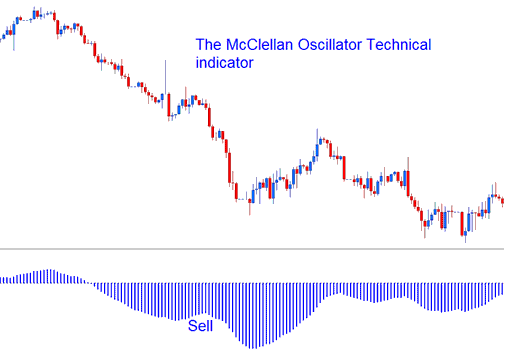

Zero Center Line Cross-over Signals:

Bullish Signals - A buy trade signal is generated when the oscillator crosses above the zero center-line.

Bearish Signals - A sell trade signal is triggered when the oscillator falls below the zero center-line.

Analysis in FX Trading

Divergence Trading Setup Signals:

Looking for divergences between the McClellan Oscillator & price can prove to be very effective in spotting the potential reversal and/or trend continuation points in price movement.

There are several types of divergence-setups:

Classic Divergence (Regular Forex Divergence)

- Bullish Divergence: Lower lows in price action & higher lows on the McClellan Oscillator.

- Bearish Divergence: Higher highs in price & lower highs on the McClellan Oscillator Indicator.

Hidden Forex Divergence

- Bullish Divergence: Higher lows in price action and lower lows on the McClellan Oscillator.

- Bearish Divergence: Lower highs in price action & higher highs on the McClellan Oscillator Indicator.

Over-bought/Oversold Levels in Trading Indicator

The McClellan Oscillator spots possible overbought or oversold spots in price moves. It signals these when it hits far levels on one side and turns back. In a strong trend, it can hang there a while. Avoid using overbought or oversold for trade signals. Go with center-line crossovers instead for better entries.

Get More Courses:

- Gann Swing Indicator: A Guide to Forex Buy and Sell Signals

- Method for Drawing Channels Directly onto Charts within the MT4 Platform

- Learn XAUUSD Tutorials and Gold Training Course Training Course Tutorials

- Technical indicator bull power FX technical indicators MetaTrader 4 Software

- USDRUB Spread Overview

- Analyzing the Impact of Fundamental Economic Data Reports on the Forex Market.