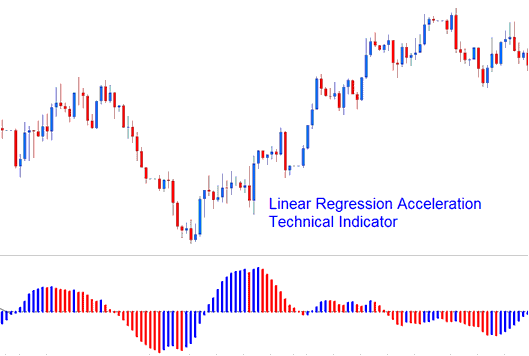

Linear Regression Acceleration Technical Analysis & Signals

The Linear Regression Acceleration indicator computes variations in the gradient/slope of the regression line on the current trading price bar compared to its gradient/slope from the preceding trading price candlestick. The value utilized in the calculation of the linear regression is referred to as the normalized acceleration value, which is represented for each trading price bar formed on the chart.

Linear Trajectory Rate of Change

If the adjusted acceleration is 0.30, then the regression line's adjusted slope will go up 0.30 for each price bar.

Analogously, a normalized slope value of -0.40 would signify that the normalized slope of the regression line is decreasing at a rate equivalent to 0.40 per price candlestick.

For example, say the current price bar's normalized slope is 0.40, and the previous one was 0.20. The normalized acceleration for the current bar is just 0.40 minus 0.20, so 0.20.

Important Note: It is crucial to grasp that a positive value for acceleration does not automatically imply a positive slope: it merely indicates that the steepness of the slope is increasing. Conversely, a negative acceleration value does not equate to a negative slope: it simply signifies that the gradient of the slope is diminishing.

Implementation of Linear Acceleration Regression Indicator

The Linear Regression Acceleration lets you do these things: pick a price, choose regression periods, smooth the starting price before using the regression, and pick the kind of smoothing.

The resulting regression slope appears as a bi-colored histogram that oscillates above and below zero.

The reference line is set at 0 level mark.

- A rising upward slope: (greater and higher than that of its previous/prior value of 1 bar before) is displayed and shown in up slope color.

- A declining/falling slope: (lower and lesser than that of its previous/prior value - of 1 bar before) is shown using the down slope colour.

Explore Additional Topics & Courses:

- Identifying Which Forex Pair Exhibits the Highest Activity Level in the Forex Market

- How Do You Use Darvas Box Indicator in FX?

- Regulated XAU USD Broker Data

- Using the data panel window in MetaTrader 4 for XAUUSD: a tutorial course.

- EUR/TRY Chart

- How to Add William % R Indicator in FX Chart

- Trade Strategies for NKY225 Stock Indices

- How Do You Use MT4 ATR Indicator?

- How You Can Put MACD on a Gold Chart in MetaTrader 4?

- Apps and How to Use Apps on Android, iPad or iPhone