Forex Money Management Rules and Styles - Manage Your Forex Trading Account

The best approach for a forex trader to practice good equity management is to limit their losses to be less than their gains. This is known as the risk-reward ratio.

High Risk to Reward Ratio - Account Management Methods

This risk-reward approach boosts strategy profits. Trade only if wins could top losses by three times or more.

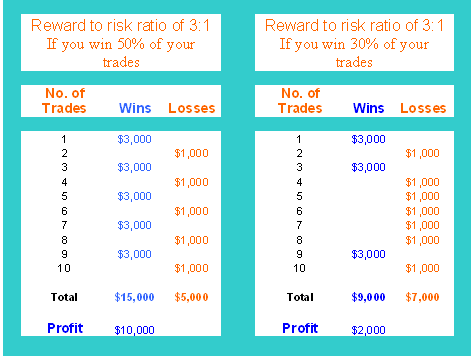

If you invest using a high risk-reward ratio of 3:1 or more, you greatly increase your chances of becoming profitable in the long run. Chart below indicates to you how:

The first example shows that even if you only won 50% of your transactions in your trading account, you would still have a $10,000 profit.

Even if your success rate dipped to around 30%, maintaining profitability would still be achievable – this aligns with the principle of Account Management within Money Management.

Keep in mind that anytime you secure a favorable risk-to-reward ratio, your probability of achieving consistent profitability as a trader is significantly enhanced, even if the win rate for your chosen strategy is relatively modest.

A sensible risk-reward ratio is essential in Forex trading. It's irrational to risk significantly more (e.g., $1,000) for a return of far less (e.g., $100).

The necessity arises because you need ten successful trades to recover the single loss and still net the $1,000 profit. A currency trader suffering just one loss must relinquish all accumulated profits from their preceding ten transactions.

Engaging in this type of investment approach is inherently counterproductive and will result in financial depletion over an extended timeframe.

Percentage Risk Method - Account Management Methods

The percent risk method risks the same account percentage per trade. It is one of the account management methods.

The percentage risk-based money management method states that a certain percentage of your equity balance is at risk per trade. To calculate the percent risk for each forex transaction, you need to know two things: the percentage risk you've chosen and the lot size of an open forex order. With the known risk percent, you can determine the position size for the trading order in the market.

Example

If you as trader have an account balance of $50,000 in your account and the risk percent you use is 2%

So 2 percent equals $1,000

When three investors trade EURUSD with differing stop-loss levels - 20 pips, 40 points, and 50 points - each will have a distinct position size based on their chosen stop-loss value.

Example 1:

Stop Loss = 20 pips

Risk percent = 2 % = $1,000 dollars

20 pips = $1,000 dollars

1 point =1,000/20= $50

Position size is 5 lots (for 5 lots 1 point movement =$ 50)

Example 2:

Stoploss = 40 pips

2 % = $1,000

40 pips = $1,000

1 point =1,000/40= $25

Position size is 2.5 lots (for 2.5 lots 1 point movement = $25)

Example 3:

Stop Loss = 50 pips

2 percent = $1,000

50 pips = $1,000

1 point =1,000/50= $20

Position size is 2 lots (for 2 lots 1 point movement =$20)

Illustrative Scenario: Calculating Annual Income from a Trading Strategy for an Investor with $50,000 Capital

Annual Profit Projection: Assuming your algorithmic system achieves a 70% win rate, maintains a 3:1 risk-to-reward ratio, utilizes a 30-pip stop loss and a 90-pip take profit, and executes 20 standard lot Forex transactions monthly, your maximum annual earning potential will approximate:

For 1 standard lot profit per 1 pip is $10

20 transactions*12 months = 240 transactions

Wins and Profit

70% win : 70% of 240 = 168 profitable transactions

168 transactions * 90 pips = 15, 120 pips

15, 120 pips = $151,200

Losses

30% win : 30% of 240 = 72 losing trades

72 transactions * 30 pips = 2, 160 pips

2, 160 pips = $21,600

Net Profit = 15, 120 - 2, 160 = 12, 960 pips

Income: 12, 960 pips = $129,600

The above is just an example, the amount you'll make will depend on the risk: reward ratio of your system along with it's win percentage ratio.

Other factors & aspects to consider include:

Maximum Number of Open FX Trades

An essential consideration for traders is determining the maximum number of open forex positions they are comfortable managing at any time. This decision is crucial for effective capital management.

If e.g., you choose a 2 %, you might & may also say select to be in a maximum of 5 trades at any one specified time. If you open 4 trade positions & all four of those positions close out at a loss on the same trading day, then you'd have an 8% decrease in your trading account balances that day.

Invest with Sufficient Capital

One of the worst mistakes that people who trade forex can make is trying to start a trading account without enough money in it.

With little investment money, the forex trader will be anxious and constantly trying to reduce losses beyond what is realistic for trading, but they will also frequently be pulled out of trade operations before they can recognize and profit from their trading plan in any manner.

- Exercise Discipline

Discipline matters most if you want to be profitable. It's being able to plan your work and then actually stick to the plan.

Patience means letting a trade play out without pulling out too soon due to risk fears. Discipline means sticking to your FX trading plan rules at all times. Build the discipline you need to make profits in trading.

Basics of Managing Forex Account Capital - Fundamental Account Management Guidelines

Sound money management constitutes the bedrock of any successful trading methodology, enhancing an investor's prospects of profitability. This principle is critically important when engaging in the leveraged currency market, which, despite being one of the most fluid global trading arenas, simultaneously harbors significant inherent risks.

Success in market investing needs strong money rules in forex. Use them with trade leverage for orders. This covers basic account handling.

It is essential to meticulously calculate the difference between average profits and losses: ideally, the average profit should exceed the average loss when trading. If this is not the case, forex trading will not be profitable. Therefore, traders must establish their own forex account management rules, as the success of each trader is influenced by their individual character traits. As a result, every trader develops their own forex strategy and formulates their own money management rules based on these principles.

When you place orders, set stop losses to avoid big losses. You can also use stop loss orders to secure profits.

Aim for a 3:1 ratio where profit odds beat loss odds. Favor the side that wins more.

By adhering to forex rules and guidelines, FX traders can enhance their strategies' profitability and develop personalized trading approaches that may yield favorable results in practice.

Explore Additional Tutorials and Lessons:

- MT4 MetaEditor: How to Add EAs Expert Advisors(EAs) How to Make Expert Advisor EA for MT4 Software Platform

- Gold Analysis Live XAU USD Charts

- How Can I Use Choppiness Index in Forex Trading?

- An Overview of MT4 Forex Trading Software

- Learn Forex Principles of Trade Forex Psychology

- How to Calculate Forex Pips values for Mini Forex Accounts When Forex Mini Lots

- MA Analysis in Forex Trading

- How Can I Trade MetaTrader 4 Fibo Extension in MetaTrader 4 Platform Software?