How to add Choppiness Index indicator to MT4 charts.

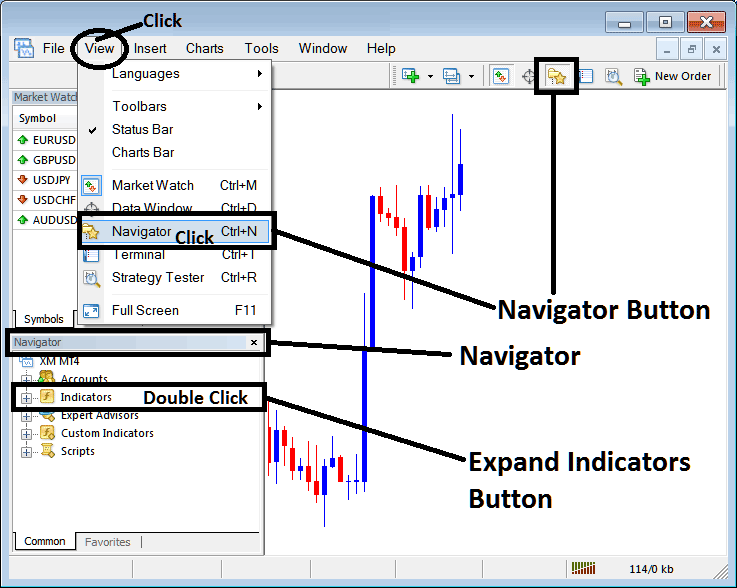

Step 1: Access the Navigator Window in the Trading Software Platform

Open the Navigator window just as shown below: Go to 'View' menu (press on it), then select 'Navigator' window (click), or From Standard ToolBar click the 'Navigator' button or press key board short-cut keys 'Ctrl+N'

On Navigator panel, choose 'Indicators', (DoublePress)

How to Implement the Choppiness Index Indicator Configuration on MT4 - MT4 Choppiness Index Technical Tool

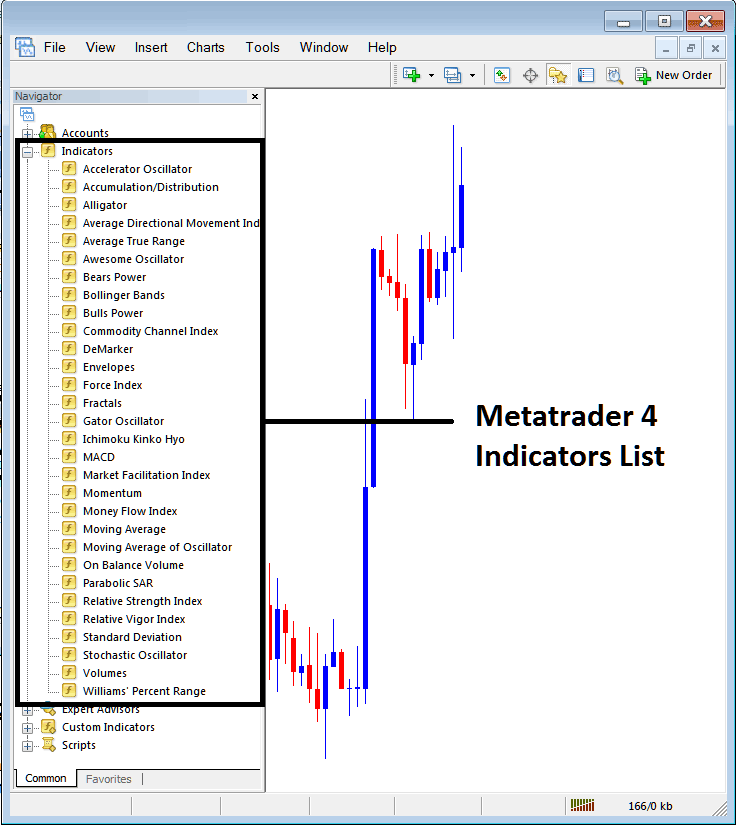

Step 2: Open the indicators menu in Navigator. How to add Choppiness Index to MT4.

You can expand the menu by either clicking the protractor button or double-clicking the indicators menu. This will transform the button's appearance to signal the list of trading indicators below. From this list, select the Choppiness Index to add it to your chart.

How to Add Choppiness Index - From the window shown Above, you can then add the Choppiness Index that you, as a trader, want.

How to Set Custom Choppiness Index to MT4

If the indicator you want to add is a custom technical indicator - for example if the Choppiness Index you as a trader want to add is a custom indicator you'll need to first add this custom Choppiness Index on the MetaTrader 4 software and then compile the custom Choppiness Index so that as the newly added Choppiness Index custom indicator pops up on the list of the custom indicators in MetaTrader 4 software.

Guidance on adding Choppiness Index indicators to MT4, integrating the Choppiness Index window into MT4, and incorporating the Choppiness Index custom technical indicator onto the MetaTrader 4 Platform – A guide on adding a personalized Choppiness Index within the MT4 Software.

About Choppiness Index Lesson

Choppiness Index Explained: Technical Analysis and Trading Signals

Developed & Created by E.W. Dreiss

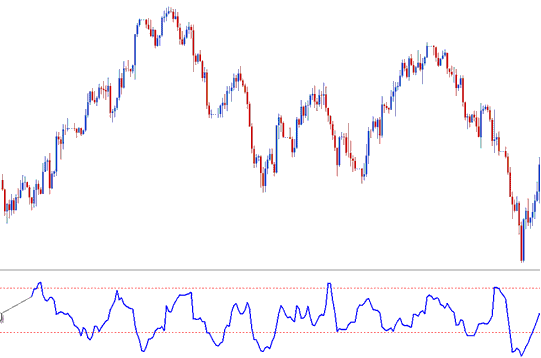

The Choppiness Index was made as a simple and useful tool to help traders know if prices are following a trend or staying in a tight range.

The purpose of this indicator, like that of ADX, is to assess the strength or momentum of a trend and ascertain whether the market is trending or consolidating.

The Choppiness Index measures market conditions on a scale from 0 to 100, often utilizing bands set at 61.8 and 38.2 for reference points.

This indicator is plotted by first calculating the true range for each period & then adding the values of n-periods.

Next, the highest and lowest values over a specified period are determined and their difference is calculated.

Third, it divides the sum of the true ranges and calculates the base-10 logarithm of this value.

Finally, this figure is divided by the base-10 logarithm of the specified number of periods (n), and the result is then multiplied by 100.

Technical Analysis & Generating Signals

Furthermore, a key consideration is the class of account you intend to establish, which will depend on the initial capital you plan to commit:

The core idea behind it is simple. A strong market trend across the past n price periods pulls the Choppiness Index near zero. When the market consolidates hard and moves sideways in a choppy or ranging way over those n periods, the index gets close to 100.

Readings above 61.8% show the market is in a range or choppy phase. Prices move side to side and consolidate.

Higher values happen during/after a strong consolidation phase. Higher values could also be interpreted & analyzed as a trade signal of a potential upcoming breakout after a substantial consolidation has taken place.

Choppiness Index values of below 38.2 indicate the market is trending.

Lower values occur during or after strong trends. They can signal upcoming consolidation and choppy action following a trend.

More Courses:

- Stochastic Momentum Index: MT5 Analysis

- How to Get MT4 XAGUSD Chart

- Calculation of the Value/Size of 1 Pip for FTSE100 Index

- What technique is used for trading GDAXI 30 Index?

- Add Nikkei225 to MT4 Trading App

- How Can I Add the SPX500 Index to MT5?

- Bullish Divergence RSI Index Trading and Bearish Trade Divergence RSI Index Trading Details.

- Trading Gold Using MT5 WebTrader Features

- How Can I Use Indicator Signals To Trade?