Identifying Setups for RSI Hidden Bullish Divergence and Hidden Bearish Divergence

Hidden divergence signals a trend that may keep going. It forms when price pulls back to test a past high or low.

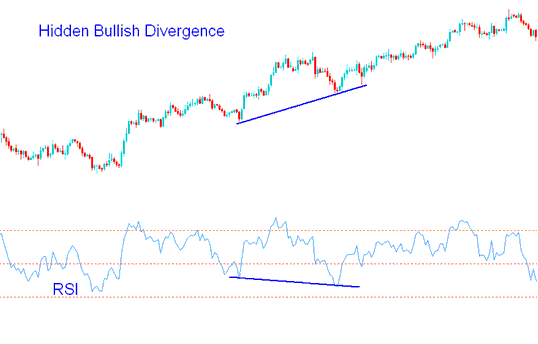

Hidden RSI Bullish Divergence

Hidden RSI Stock Index bullish divergence happens when the price makes a higher low, but the oscillator shows a lower low to traders.

Hidden bullish divergence setup occurs when there is a retracement in a uptrend.

RSI Hidden Bullish Divergence - Hidden Divergence Setup

Hidden divergence signals an end to market pullback. It points to strength in an ongoing uptrend.

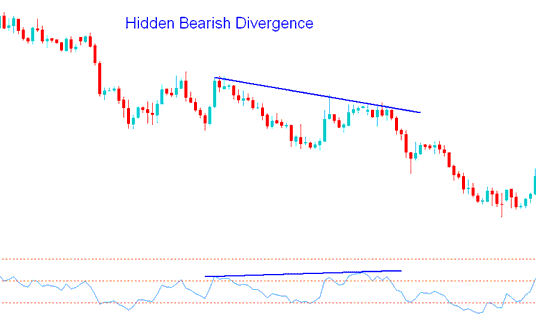

Hidden RSI Bearish Divergence

Hidden RSI Indices bearish divergence setups forms when price is forming/making a lower high (LH), but the oscillator technical is showing a higher high (HH).

Hidden bearish divergence setup occurs when there is a retracement in a downtrend.

Identifying Hidden Bearish Divergence - Setting Up and Trading the Hidden Bearish Index Divergence Scenario

This hidden bearish RSI means a price move is done. This divergence shows the strength of a downwards trend in the market.

Get More Guides: