RSI Indicator Divergence Trading Setups

The divergence setup is one of the Stock Index setups that traders use: it means checking out a trade chart along with another measurement. We will use the RSI measurement.

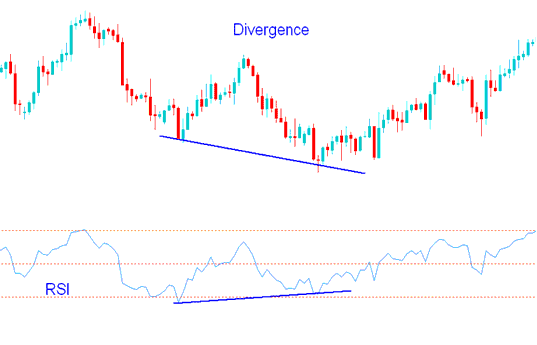

Identifying divergence setups requires spotting two points on an index chart where price forms a new swing high or low, but the RSI does not. This divergence reveals a mismatch between price movement and momentum.

RSI Divergence Example:

In the accompanying trade chart, we pinpoint two key locations on the Index trade chart, designated as point A and point B (representing swing highs).

Then using RSI we study the highs made and created by the RSI tool, these highs are right below the Trade Chart spots A and B.

We then draw one line on the trade chart & another line on the RSI indicator.

RSI Divergence Index Set Up - Divergence using RSI Indicator

How Do You spot divergence

In order to identify this divergence setup we check for the following:

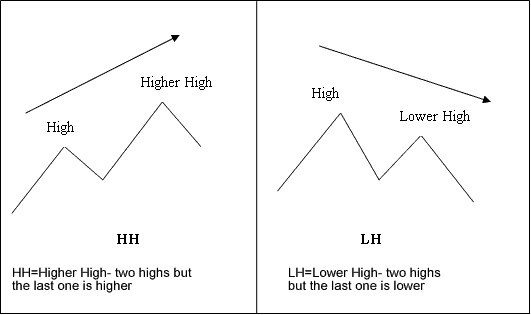

HH=Higher High- two highs but the last one is higher

LH= Lower High- two highs but the last one is lower

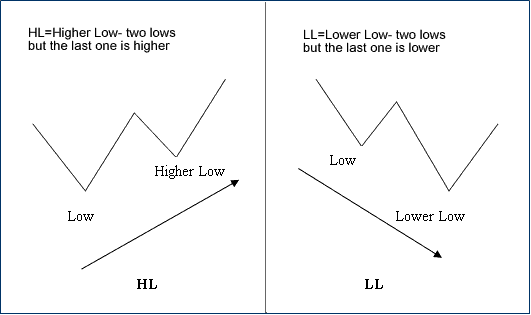

HL=Higher Low- 2 lows but the last one is higher

LL= Lower Low- 2 lows but the last one is lower

First let us look at the exemplifications of these terms

Divergence Terms Meaning

Divergence Terms Definition Examples

There are two types of divergence patterns:

- Classic Divergence

- Hidden Divergence Setup

More Guides:

- Set Accumulation Distribution Indicator on MT4 Charts for Beginners

- Trading with the MACD Fast Line and Signal Line

- Stochastics Oscillator Trade Buy Sell Signal

- Calculate the Size of 1 Pips of FTSE100 Index

- Forex Rules for Buy and Sell Signals

- Analysis of Forex Pivot Points for Trading

- Identifying Support and Resistance Levels through FX Trading Indicators

- FRA40 Trade Signal Strategy

- Calculate Size of 1 Pips of What's 1 Pip Equal to for DowJones 30 Stock Indices Pip

- Incorporating FTSE in the MetaTrader 5 FTSE App