Ehler Fisher Transform Trading Analysis Signals

John Ehler's creation and development,

First Used for Stocks and Commodities Trading.

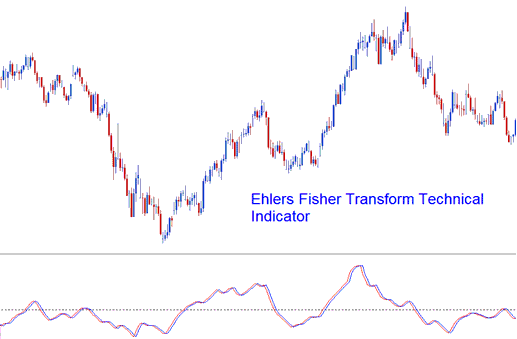

The Ehler Fisher Transform has two lines, the Fisher Transform line and the signal line: signals happen when these two lines cross, which is like how the stochastic oscillator trading tool works.

It was designed to define major price reversals using the rapid response time and sharp, distinct turning points making it a leading technical indicator.

This tool assumes prices don't follow a bell curve. But normalize them with the Fisher Transform. That makes the lines look like a normal bell shape.

Ehler Fisher Transform

Forex Technical Analysis and How to Generate Trading Signals

Use crossovers of the Fisher Transform and its signal line. They create trading signals with exact aim.

The Ehler Fisher Transform lacks precision like other leading indicators. It sends false signals and fake-outs often. Use it with other indicators for better trades.

Explore Further Programs and Programs:

- Stochastic Overbought Levels and Oversold Levels XAU/USD Signals

- How can new traders trade NASDAQ 100 Indices?

- Morning Star, Evening Star, Bullish and Bearish Engulfing Patterns

- Divergence Trade Forex: How to Spot Divergence & Trade Divergence in Trade

- A Detailed Guide to Day Strategy for Stock Indices

- Transforming Your Forex Psychology and Mindset When Trade Forex

- Relative Strength Index RSI XAU/USD Indicators

- Bullish and Bearish Divergence Strategies for Forex

- Participants of FX Market Retail Forex Traders

- Comparative Study: Classic Bullish Divergence Versus Classic Bearish Trading Divergence