Analysis of Moving Average(MA) Indicator

Trend Identification

A moving average indicator for stock indices can serve as a tool for generating trading signals. A buy signal occurs when the price moves above the moving average, while a sell signal is triggered when it moves below.

If the moving average is sloping upward, it indicates that the general trend in the indices market is positive.

If the moving average trends downward diagonally, it suggests that the general market trend for indices is bearish.

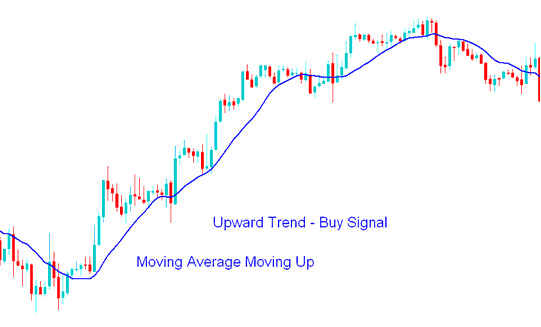

Upward Indices Trend/Bullish Trend

If the Moving Average is going up, then the Indices trend is going up, and the signal that comes from it is a buy/bullish signal.

As long as the price of an index remains above the moving average, the upward trend is sustained. The moving average serves as a "support level," meaning the index's price action on the chart should not close below this indicator.

Buy Signal

A Buy Stock Indices signal triggers when indices prices surpass the moving average and close above this level.

Traders seeking confirmation of an index signal should wait for the Moving Average (MA) line to shift upwards, signaling an uptrend. Waiting for this confirmation helps minimize potential whipsaw risks and ensures more accurate signal execution.

Upward Indices Trend - How Do You Intraday Trade Indices: A Detailed Guide to Intraday Trading Strategies

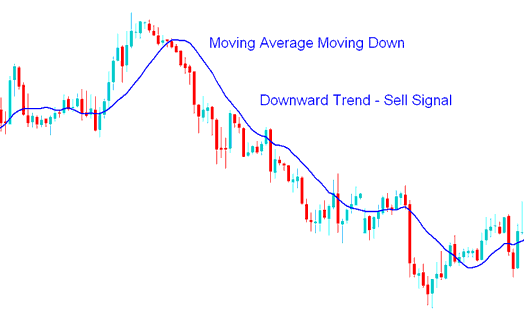

Downward Indices Trend/Bearish Market

If the MA is going down, then the Indices trend is down, and the sign is to sell/short Indices.

If an index's price remains below its Moving Average (MA), the trend is considered bearish. The MA acts as a resistance level, preventing candle price actions from closing above it.

Sell Signal

A sell signal for Indices is triggered when the price moves below the Moving Average (MA) and closes beneath that average.

To confirm an indices signal, traders should wait for the Moving Average (MA) line to turn and head downward, reducing the risk of acting on a false signal.

Prices Trending Downward - How You Trade Indices Each Day: A Complete Guide to Trading Strategies for a Single Day

Indices Range Market signals

Moving Average Indicators Can Also Be Employed to Pinpoint Trading Opportunities in Range-Bound Index Markets.

MA Cross over Method Stock Index Trading Strategy

Traders often prefer the moving average crossover method for generating signals over the earlier index approach. It stands as the easiest type of index system that online traders commonly use. People pair this moving average technique with other tools to create more detailed index systems and plans.

Discover more subjects and courses: