NASDAQ 100 Index

The NASDAQ100 tracks 100 of the biggest non-financial companies listed on the NASDAQ exchange. It's calculated by weighting each company based on its market capitalization. The index updates its list of companies every quarter.

The 100 corporations used to calculate this index are not necessarily based in the USA: foreign international companies are also included as long as they are listed in the NASDAQ Bourse.

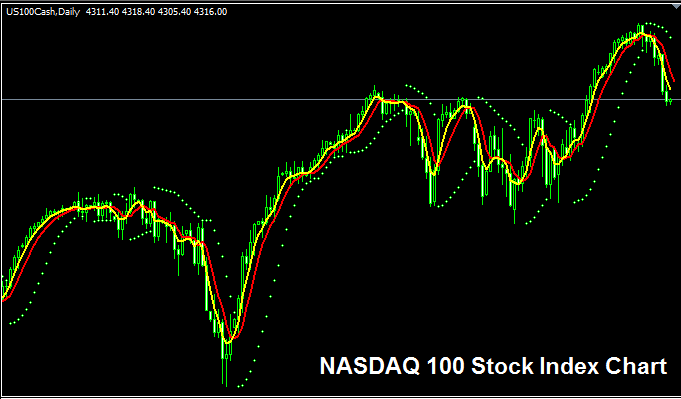

The NASDAQ100 Index Chart

The NASDAQ 100 Index chart is shown above. On the illustration put on display above this stock index is named as US100CASH . As a forex trader you want to search and find a broker who offers the this The NASDAQ 100 Index chart so that you can start to trade it. The example above is of NASDAQ100 Index on the MT4 FX & Indices Software Platform .

Other Data about NASDAQ 100 Index

Official Symbol - QQQ:IND

The NASDAQ 100 Index comprises 100 component stocks calculated using weighted values for each stock. These components and their respective weights are reviewed and adjusted on a quarterly basis.

Strategy for Trading NASDAQ100 Index

The NASDAQ 100 Index is pretty volatile because of the way it's calculated. Each stock in the index gets its own weighting, which causes bigger swings in the price. Even so, this index usually trends up over time, thanks to the strong growth of the U.S. economy.

As an index trader, your preference should lean towards a buying bias, accumulating positions as the stock index climbs. During periods of US economic strength, the equities composing the NASDAQ 100 index tend to appreciate, making an upward trend highly probable for this index. A sound strategy for trading this Stock Index would involve buying on dips.

Contracts and Specifications

Margin Required Per 1 Lot/Contract - $ 30

Value of 1 Pip(Point) - $ 0.1 dollars

Note: Even though the overall trend is in general upwards, as a forex trader you have got to factor in the daily price volatility, on some days the stock might oscillate or even retrace, the retracement might also be substantial some times and thence as a currency trader you need to time your trade entry accurately using this strategy: Indices trading strategy & at the same time use suitable & proper/suitable money management principles & guidelines in case there's unexpected price market trend volatility. About money management rules topics: What's money management and money management techniques.

Review More Lessons, Tutorials, and Courses