Indices Trade Strategy

Stock indices serve to track the price movement of the leading equities within a designated stock exchange. Given that the stocks comprising these market indices are typically the most actively traded and highly liquid instruments, selected from top-tier companies spanning leading economic sectors and segments, their nominal value generally exhibits an upward trajectory over time. Consequently, the stock indices that monitor and reflect the aggregated performance of these shares tend to follow this sustained upward movement.

In stock market trading, there's general agreement that prices increase consistently over time. Historical evidence supports this notion, forming the foundation of many proven trading strategies.

When trading the indices, our stocks indices trading plan is to only execute buy trades. The trades will be initiated if the stock index level drops.

Strategy

- Wait for the price pull back

- Open a buy position

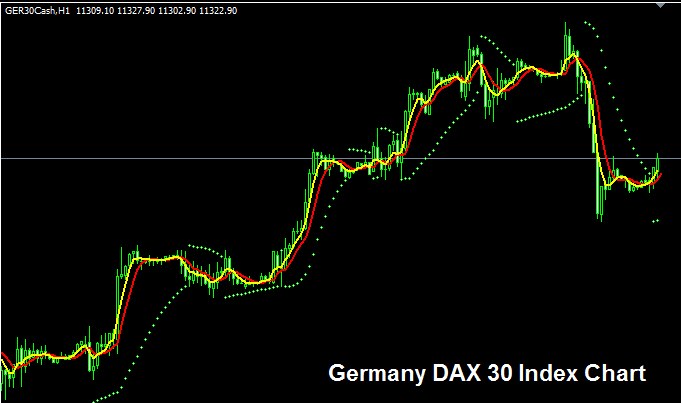

The Pull Back Setup is Displayed Below - Retracement

As a trader even before opening a position, you want to wait for a pull back, but how does a pull back look like - The price retracement is illustrated and shown below.

This precise juncture is when a trader should initiate a purchase order. Employing this specific setup typically yields the optimal risk-to-reward ratio, contributing to the profitability of your overall strategy.

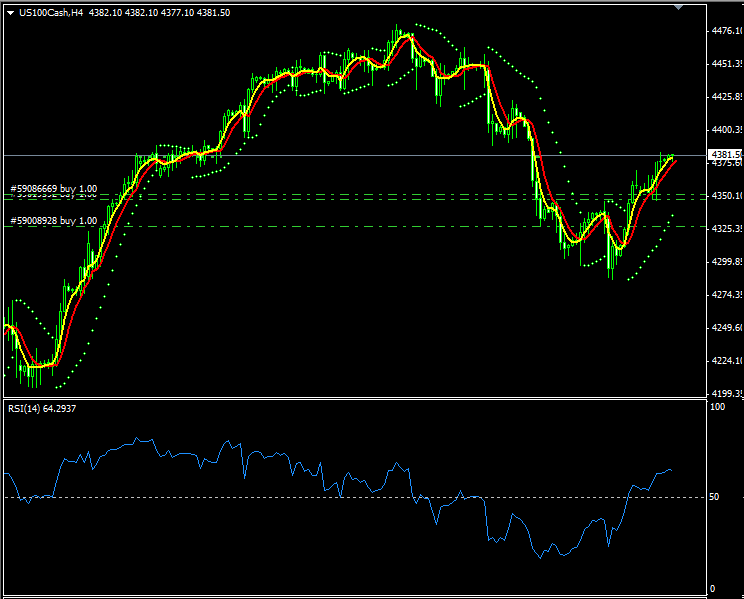

Example Trade Positions Using This Trading Strategy

The exemplification laid-out below shows a few trade transactions that were opened using this trading strategy.

This illustration demonstrates that despite the overall upward trend of the stock index, there is always a price retracement that forex traders may use to initiate a buy trade. Waiting for a pullback is the best thing since it reduces your drawdown to a minimum as a trader, increasing the likelihood that your plan will be successful.

Based on the preceding illustration, the first purchase order, placed after a price dip, was executed at the 4325 level: the second buy order followed at 4350. The index has since climbed to 4381, its current position. A trader who elected to wait for the pullback before buying is currently realizing gains, unlike a counterpart who bought closer to the peak and is now facing unrealized losses, necessitating a wait for the price to recover to their entry point.

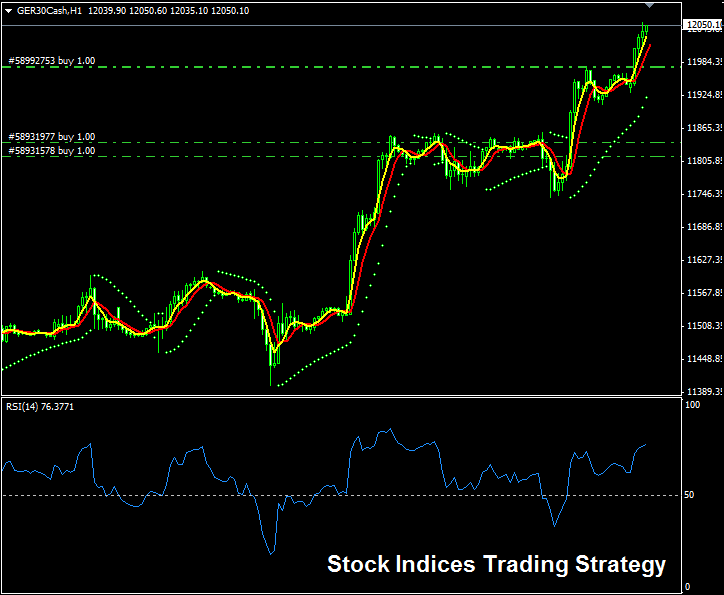

Where to Take Profit

On the example below - there are a few open orders that are already in profit. These orders are illustrated below. Many traders would want to keep their trades open and scheme more profits from the market and they might be right - the market may still have more room to go up - but also it is very important for a trader to know when to take profit and you don't take profit once the market begins to retrace, no - you take-profit when the market is headed way up such as shown below.

Open trades. Take profit now while the market rises.

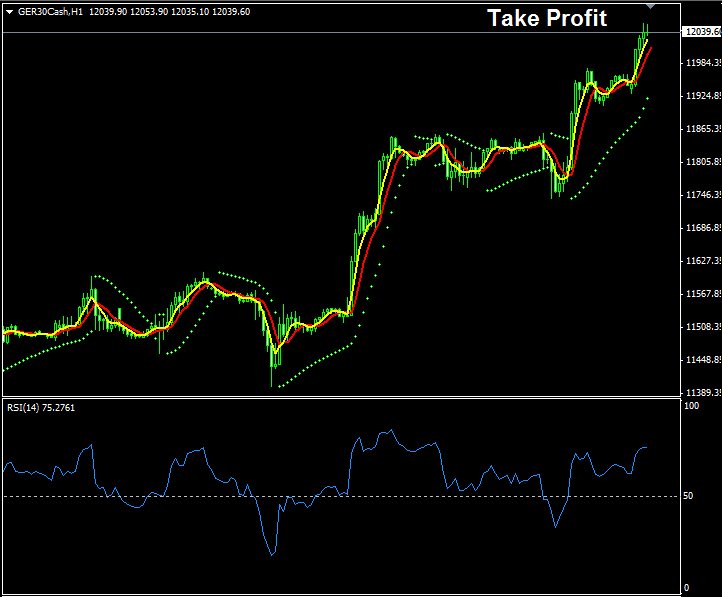

Trades Closed - Take-Profit executed and profits booked

When you are trading stock indices, you want to follow the above strategy as you reduce the drawdown and you spend less time to make profits because you do not have to wait for the retracements with open trades. Instead, you wait for the retracements outside the market, enter when the pull back momentum has faded and the market trend is going up again.

If you trade indices, don't mess with the pullbacks. Pullbacks go against the main trend, and trading against the trend is usually a losing game. Sure, you might get lucky once, but most of the time, you'll end up on the wrong side.

It is best to wait out the retracements and open buy trades after these pullbacks. Remember stock indices keep moving up because these indices track the best shares from the world leading economies. Hence, because individuals in these top world economies have money to invest and they keep buying the stocks - with the most preferred stocks/shares being these top stock tracked by these indices. This fact that the stocks tracked by these indices are the most sought after stock and most traded and most profitable, meaning that their value is likely to keep going upward means that the indices that track these stocks are also likely to keep going up and up and maintain this upward trend.

To make your chances of earning as a indices trader better, it is best to trade which way the market is trending, and that is the upward direction. Also, always wait for a pullback prior to beginning a trade, and end your trades when the index level has gone up a good number of points for you, such as what is shown in the example given above.

Strategy 2: Diversify the Index in Your Portfolio

Another good idea to use with the one above is to spread out your investments and find these chances among the 14 most common stock indices, so if one index doesn't look good for trading, you can check another to see if it's better, and then trade the top 3, 4, or 5 indices that have the best chances for the day.

More Courses and Topics: