Trading strategies for beginner traders step by step

Tips for Trading Strategies for Beginner Traders - Tips for Index Traders Strategies When Trading Online

1. Define Simple Indices Rules For Your Trading Strategy and Follow the Market Trend

The simpler the Method/Strategy is the better. If the Index Trading Strategy is too complex, it will be very difficult & hard to stick to the Indices strategy trading rules. Complicated Trading Strategies are also very confusing. A simple Method makes it easy to follow the trade rules.

2. Eliminate Risk Quickly and Let Profits Run

Minimizing risk is far more key than earning money. Our first objective in Stock Indices trading is to make the trade less risky. We will do and achieve this by only entering high probability trade set-ups, setting stop losses, cutting losses quick & never average down, letting the profitable trades run for a while, just long enough, but not very long, in order and so as to increase profits. Profitable Indices trade positions are only kept open as long as the strategy shows the trend is in place, these Index trade positions should be closed immediately once your exit trading signal criteria is generated and given by the Strategy.

3. Select and Choose the Right Stock Indices

Once you've your Stock Strategy, you will want to start testing it on a demo practice trade account. Index have their own particular characteristics different from others. A Index Trading Strategy will give different results for each Index.

- EUROSTOXX 50 Index

- DAX30 Stock Index

- Dow Jones Industry Average 30 Index

- FTSE 100 Stock Index

- Nikkei225 Index

- S&P ASX200 Index

- FTSE MIB 40 Stock Index

- S & P 500 Index

- NASDAQ 100 Index

- CAC 40 Index

- SMI20 Stock Index

- AEX25 Index

- HangSeng50 Index

- IBEX 35 Index

To maximize the profitability of your trading strategy find the most active Indices market hours for a chosen Stock Indices and trade during that market session only.

4. Use Funds Management Guidelines

Always risk less than 2% per trade position. With compounding, you'll be surprised to observe how quickly your account grows once you begin to trade with a profitable Strategy.

5. Keep a Journal

Keeping a log of all your positions will help you as a trader to become a better & better & will help you as a trader follow the trade rules of your Index Trading Strategy. A journal will also monitor your profitable Indices trade positions & losses & you can analyze and interpret why a trade setup was profitable & why it was not.

6. Place take Profit Targets

Establish a daily, weekly, monthly trading profit targets when trading the Indexes. Once you as a trader hit and achieve this target, stop trading & take a break from the market. This will stop you from over-& will also stop you giving back your trading profits to the market. Keep your risk:reward ratio high, a 3:1 risk:reward ratio is best. This means opening index trade positions only when you've got the probability of making and earning 3 times what you're risking.

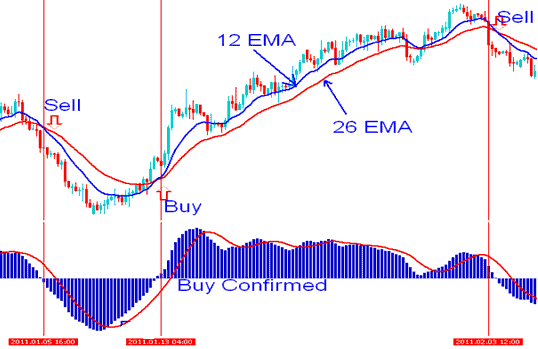

Example illustration of signals generated by our Index Strategy

Example 1: Buy Signal and Sell Signal Generated By Stock Indices Trading Strategy

Buy signal is derived and generated by the technical technical indicator based Method, then an exit trading signal is derived & generated before another reverse sell signal is generated on this trade chart

Example 2: Two buy signals generated by Stock Indices Trading Strategy

Two buy Index signals are generated during the upwards trending market

Example 3: Exit Signal Generated by Stock Indices Trading Strategy

Example of Signals Derived and Generated by a Trading Strategy

Study More Lessons & Topics: