S & P 500 Index - Standard and Poor's 500 Index

The Standard & Poor's 500 Index tracks the capitalization of 500 key stocks that represent various major industries within the U.S. economy. These stocks are listed on major exchanges such as NYSE and NASDAQ.

The S&P 500 index, very much like the Dow Jones Industry Average Index, exhibits considerably higher volatility than many other premier Stock Indices. The S&P 500 index typically trends upward over the long run, but it is prone to greater price pullbacks and consolidation phases than its counterparts. Traders who are already accustomed to the more striking and resilient trends found in other top stock indices might prefer engaging with those other indices instead.

One of the reason this stock index has more oscillations than other indexes is because it has more component stocks than other indexes. This Index also has got a weighting constituent in its calculation which contributes to making the index more volatile.

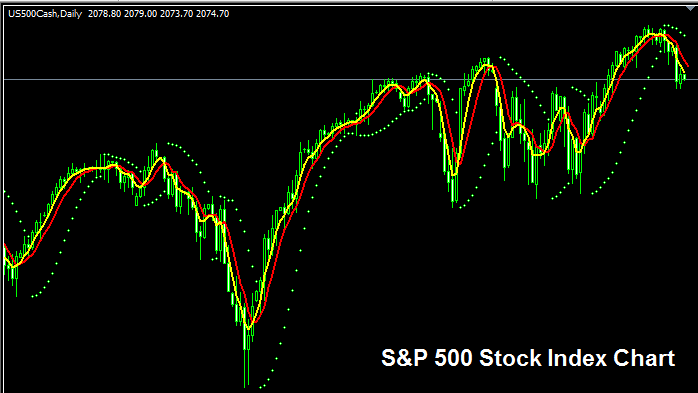

The S & P 500 Index Chart

The S&P 500 chart is displayed and shown above. On the above example illustration this financial and trading instrument is named US 500CASH. You want to look for & find a broker that offers S&P 500 chart so that you can start to trade it. Example displayed and illustrated above is of S&P 500 Indices on MT4 Forex Platform Software.

Other Details about S & P 500 Index

Official Symbol - SPX:IND

The S&P 500 Index includes 500 stocks from major US industries. Its calculation differs from other indexes. It weights the prices of those stocks, which makes it more volatile.

Strategy for Trading/Transacting S & P 500 Stock Index

The S&P 500 Index approach of calculation makes it more volatile & therefore there are much wider swings(more volatile swings) in price movement of this stock index. Although this stock index in general moves upward over long-term because US economy also shows strong growth & is also the biggest economy in the world.

As a trader wanting to trade this index, be prepared for wider price swing & a little more volatility.

If you trade stock indexes, you probably want to lean towards continuously buying as the index rises and goes higher. When the US economy is doing well (which it usually is), this upward movement is very likely to keep going. A smart way to trade stock indices is to buy when prices temporarily drop.

During Economic Slow-Down & Recession

When the economy slows down or is in a recession, companies start saying they are earning less, making less profit, and forecasting less growth. This is why traders begin to sell stocks of companies that are reporting smaller profits, and as a result, the Index that tracks these particular stocks also starts to decrease.

Consequently, during these periods, market trajectory is significantly more prone to a downturn, and as a trader, you must concurrently modify your approach to align with the prevailing downward movement of the index you are actively trading.

Contracts & Specifications

Margin Requirement Per 1 Contract - $ 12 dollars

Value per Pip - $0.1

Note: The big trend often heads up. But as a trader, think about daily price swings. Some days, indices stay flat or pull back. Pullbacks can run deep sometimes. Time your entry tight with this strategy for indices. Use good money rules too. They help with surprise market shifts. Check tutorials on equity money methods for indices. Learn stock index money tips, strategies, and ways to handle funds.

Study More Guides and Courses:

- Stock Index Trade Guide Tutorial for Beginner Traders

- Forex Stop Losses Setting Summary: Important Things To Remember When Deciding on Forex Stop Losses.

- How do I add gold to the MT4 platform?

- Trading with Signal Methods

- AS51 Stock Indices Trading Method How to Create Stock Indices Strategy for AS51

- Trading Strategy Signals for DJ30

- Forex Ehlers Fisher Transform: Technical Analysis