Stop Loss Explained: Important Things to Remember When Setting Stop Losses

When setting stop loss orders in Forex, it's important to avoid placing them too close, too far, or exactly on support resistance points.

Setting these stop loss orders is optimally achieved just a few pips (points) under the support area or above the resistance zone.

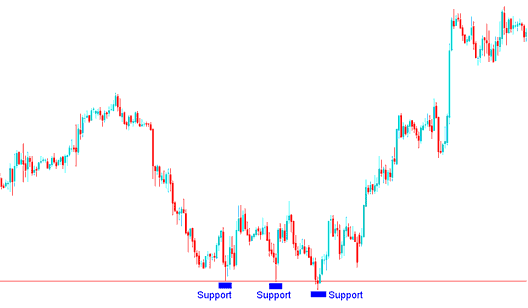

For a long position on a currency pair, find a support level below your entry. Set the stop loss 10 to 20 pips under that support. The image below shows where traders place stops just under the support on a chart.

Support Level for Putting Stop Loss Level for Buy Trade

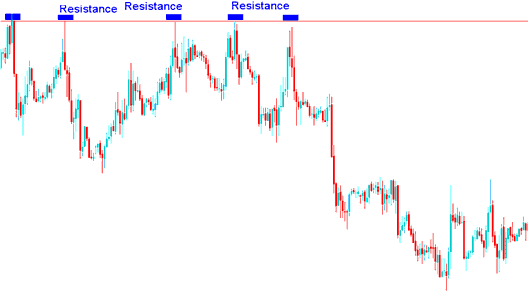

If you are going short (selling a currency pair), just look for a nearby resistance level that is above your entry point and set this stop loss order about 10 pips to 20 pips above that resistance level. The example illustration put on display below show the resistance level where a trader can set up their stops just above the resistance level on a chart.

Resistance Level for Setting StopLoss Level for Sell Trade

Use Stop Loss Orders to Secure Profits Too

A stop loss lets you skip daily market checks on forex. It's great when life keeps you from watching trades for a while. Or after a long trading day when you head to bed.

The downside is that a stop loss order can get triggered by a quick price swing. The trick is to pick a stop loss percentage that lets prices bounce around during the day but still protects you from big losses.

Stop-loss orders act as protective measures to reduce losses, but they can also secure profits when used as trailing stop-loss orders.

A trailing stop loss order is set at a certain percentage below the current price in the market. This stop loss level then changes as the trade goes on. Setting a trailing stop loss lets you keep making profits, but also makes sure you secure some profits if the market changes.

These stop loss orders can also be used to eliminate risk if a trade becomes profitable by moving the stop loss order to the level where the forex trade was opened. If a trade makes some justifiable gains then the stop loss order can be moved to break even point, the point at which you bought the trade, thereby ensuring that even if the trade transaction position moves against you, you'll not make any loss, and instead you'll break even on that position.

Trailing stop orders are a mechanism employed to maximize and safeguard profits as an asset's price appreciates, while simultaneously limiting potential losses if the price declines.

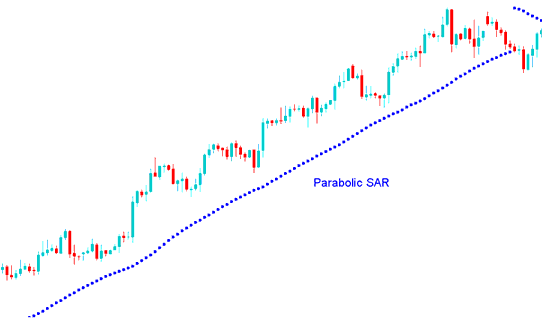

A good example is when you use the parabolic SAR Indicator & keep moving your stop loss order level to the Parabolic SAR level.

Parabolic SAR for Placing Trailing Stop-Loss Orders in Forex

An additional illustration involves a trader who adjusts their stop loss by a predetermined number of pips after specific intervals, perhaps every few hours, every hour, or every 15 minutes, depending on the timeframe chosen by the Forex trader for their activities.

In the earlier example of forex, the parabolic SAR, which was set at 2 and 0.02, was used as the moving stop for the forex chart shown. The trader would have continued to move the stop level higher after each Parabolic SAR was shown until the moment the Parabolic SAR was reached and the direction of the forex trend changed.

Stop orders are essential tools often underutilized by traders. Whether used to mitigate losses or secure profits, this simple feature lends itself well to diverse investing strategies.

Factors To Remember When Setting These Stop Orders

Here are several essential points to keep in mind:

- Be careful with the points where you set these stop loss orders. If a currency normally fluctuates 20 points, you don't want to set and place your stop order too close to that range else you'll be taken out by normal market price volatility

- StopLoss orders take the emotion out of a trading decisions and by setting one you set pre determined point of exiting & getting out of a losing position, meant to control losses.

- Traders can always use indicators to calculate where to set and place these stoploss order levels, or use the concepts of Resistance and Support Levels to identify where to set these stop loss orders. Another good indicator used to set these stop loss orders is the Bollinger bands where forex traders use the upper and lower band as the limits of price therefore placing these stop loss orders outside the Bollinger Bands.

Get More Courses & Tutorials at: